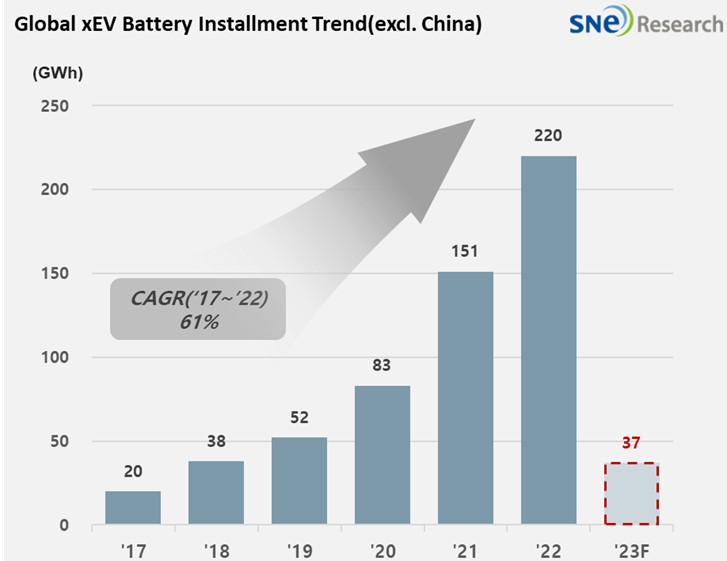

From Jan to Feb 2023, Non-Chinese Global[1] EV Battery Usage[2]

Posted 36.8GWh, a 50.1% YoY Growth

- The K-trio recorded 46.6% M/S combined, with LGES Staying on Top

Battery

installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese

market sold from January to February 2023 was approximately 36.8GWh, a 50.1% YoY

growth.

(Source: Global Monthly EV & Battery

Forecast – March 2023, SNE Research)

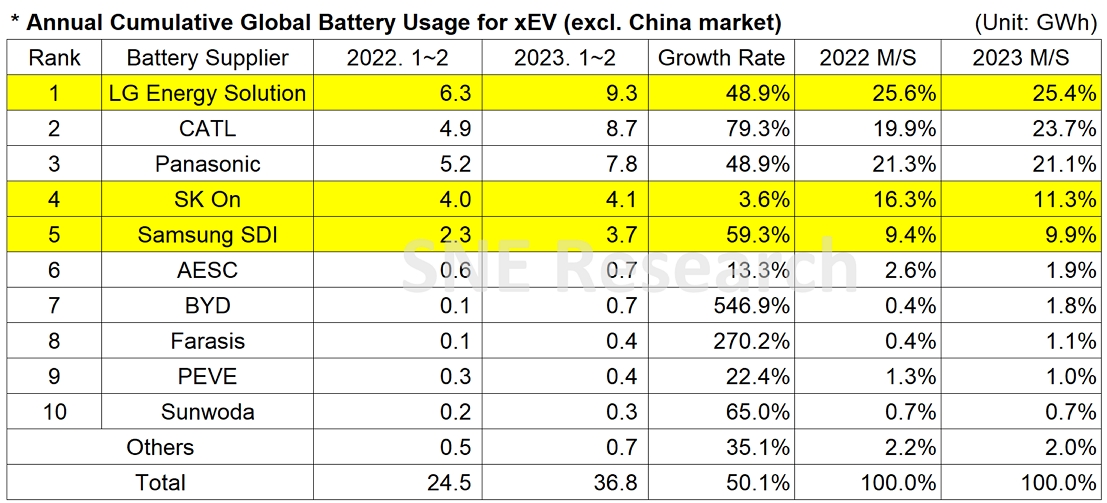

In the

ranking of battery usage for electric vehicles, the three Korean battery makers

all safely landed in top 5 on the list. LG Energy Solution kept No.1 position

with a 48.9% YoY growth (9.3GWh), while SK-On ranked 4th with a 3.6%

YoY Growth (4.1GWh) and Samsung SDI ranked 5th with a 59.3% (3.7GWh)

YoY Growth. CATL jumped to the 2nd place on the list, recording a

double-digit growth rate of 79.3%(8.7GWh) even in the non-Chinese market.

(Source:

Global EV and Battery Monthly Tracker – March 2023, SNE Research)

Although

the combined market shares of the K-trio recorded 46.6%, a 4.7% decline from

the previous year, the total usage of their battery was found to be in an

upward trend. Their growth trend was mainly affected by

strong sales of electric vehicle models equipped with batteries of each

company. LG Energy Solution continued to grow thanks to the increasing

sales of Tesla Model 3/Y, Volkswagen ID.3/4, and Ford Mustang Mach-E. SK-On

boasted a high growth propped up with a huge popularity of Hyundai IONIQ 5 and KIA EV6 in the global market.

Samsung SDI also kept its growth momentum based on the favorable sales of BMW

i4, iX, Audi E-Tron line-up, and Rivian R1T/S.

Panasonic,

as one of the major battery suppliers to Tesla, continued to see a double-digit

growth which was mainly led by the sales of Toyota BZ4X and Tesla in the North

American market.

Together

with CATL, some of the Chinese companies have also enjoyed a high growth in the

non-Chinese market, expanding their global market shares beyond the domestic

market in China. CATL took the 2nd place on the list based on strong

sales of Tesla Model 3 (made

in China and exported to Europe, North America, and Asia), Volvo C40/XC40 Recharge, Peugeot e-208/2008,

and MG ZS. As it has been known that CATL’s battery may be installed to a new

KONA model made by Hyundai, it is expected that CATL would further strengthen

its presence in the non-Chinese market. BYD, boasting the highest growth among

the top 10 companies, has enjoyed a great popularity in the domestic market of

China based on its price competitiveness gained from the establishment of vertical,

integrate supply chain management such as in-house battery supply and vehicle

manufacturing. Strongly equipped with its price competitiveness targeting the

Chinese domestic market as well as quite-decently-established product quality,

BYD is expected to see a rapid growth in its market share even in Europe and

Asia. Farasis has also continued a

steady growth in 2023 thanks to the favorable sales of Mercedes EQ line-up,

exported to Europe, which is highly sought after in the global market.

(Source:

Global EV and Battery Monthly Tracker – March 2023, SNE Research)

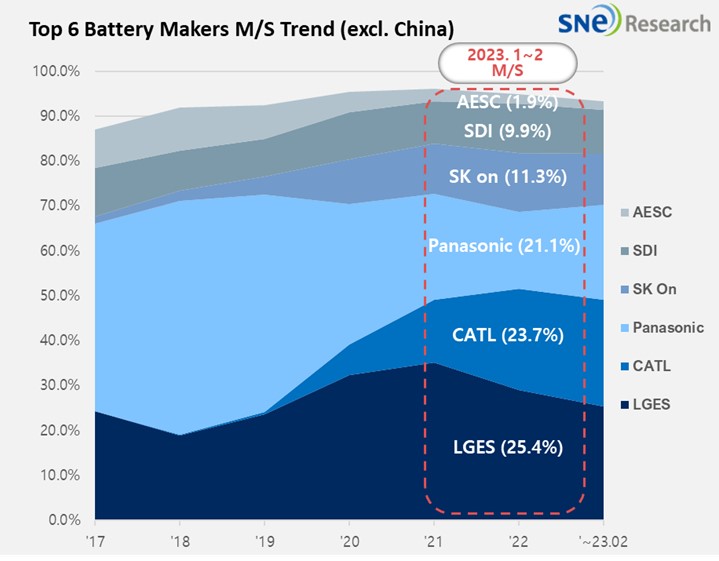

Following

2022, LG Energy Solution maintained No. 1 position in the non-Chinese market in

the early 2023, but continuous high growth of CATL has posed a threat to the

Korean battery maker. As the US Inflation Reduction Act (IRA) has been enacted

to reduce the dependence on China regarding key battery materials, frankly

speaking, the K-trio might be expected to be benefitting from the Act. However,

amidst detour methods cleverly taken by the Chinese companies like joint

investment projects and another looming unfavorable factor, CRMA in Europe, attentions

should be paid to how the global market shares of K-trio would change down the

road.

[2] Based on battery installation for xEV registered during the relevant period.