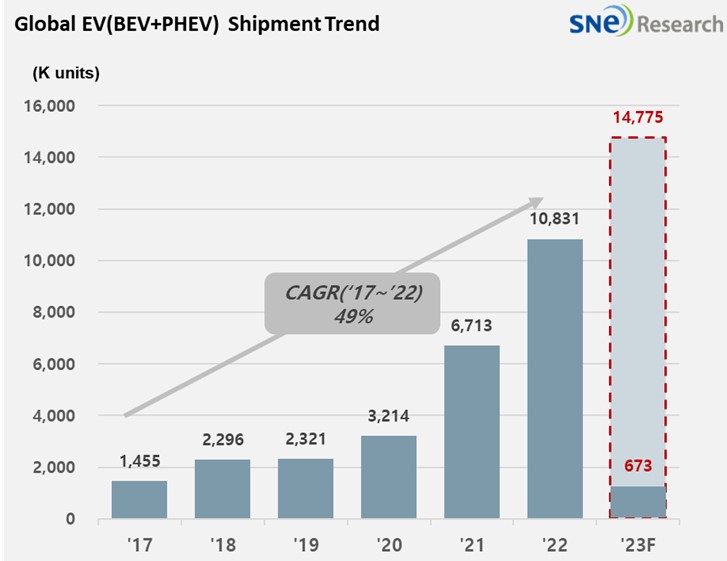

Global[1] Electric Vehicle Deliveries[2] Recorded 673,000 Units in Jan 2023, a 7.3% YoY Growth

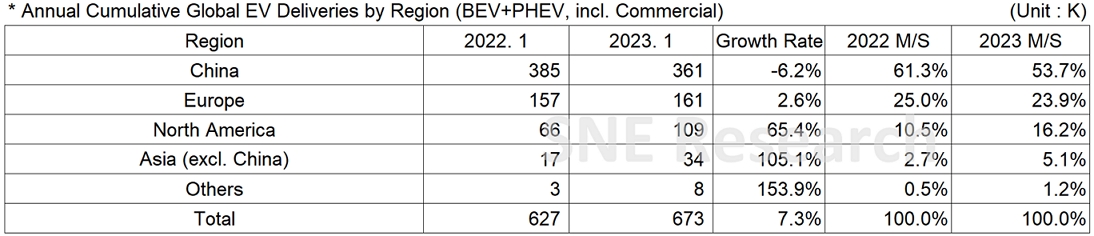

- After a 30-month long upward trend with a double-digit growth, China posted ‘degrowth,’ while BYD took No.1 position in the global ranking of EV sales

The total number of electric vehicles registered

in countries around the world in January 202 was approx. 673,000 units, a 7.3%

growth from the previous year. According to the Global Monthly EV & Battery

Shipment Forecast based on the Tracker data provided by SNE Research, the

global EV deliveries[3] in 2023 are expected

to reach approximately 14.78 million units.

(Source: Global Monthly EV & Battery Shipment Forecast – February 2023, SNE Research)

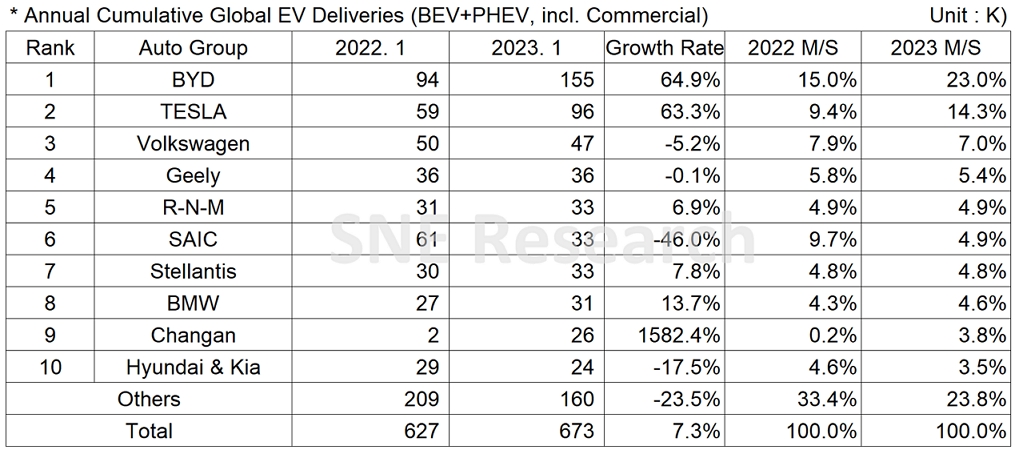

If we look at the EV sales in Jan 2023, BYD, who recorded over 200% of growth for two consecutive years in 2022, continued to grow with an explosive momentum, registering a 64.9% YoY growth and topping the list. Tesla, who recorded a 63.3% growth, ranked 2nd and was outpaced by BYD, who is fully equipped with BEV and PHEV line-ups. The 3rd place was taken by the Volkswagen Group who posted a 5.2% YoY degrowth due to a sharp drop in EV sales affected by the abolition of subsidy policy in the Chinese domestic market.

(Source: Global Monthly EV & Battery Shipment Forecast – February 2023, SNE Research)

[1] The xEV sales of 80 countries are aggregated.

[2] Based on electric vehicles (BEV+PHEV) delivered

to customers or registered during the relevant period.

[3] Forecast is updated every month in accordance with the actual aggregated data of each month.