In Jan 2023,

Global EV Battery Usage Posted 33.0 GWh, 18.1%

YoY Growth

- With K-trio M/S reaching 23.2%, BYD ranked 2nd and

LGES ranked 3rd

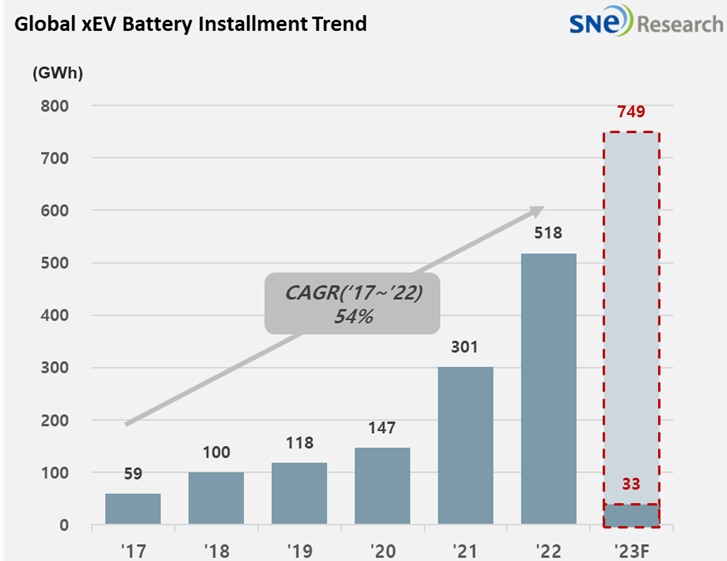

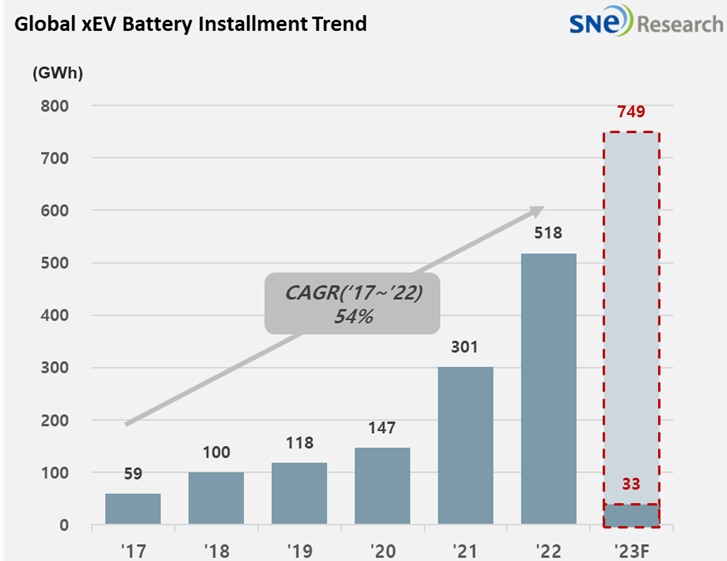

In January 2023, the amount of energy

held by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide

was 33.0GWh, a 18.1% YoY increase. The upward trend in the market has continued

since the 3rd quarter of 2020. Based on the Global EV & Battery Monthly

Tracker provided by SNE, the global EV battery usage in 2023 is

expected to reach approximately 749GWh.

(Source: Global Monthly EV & Battery

Shipment Forecast – February 2023, SNE Research)

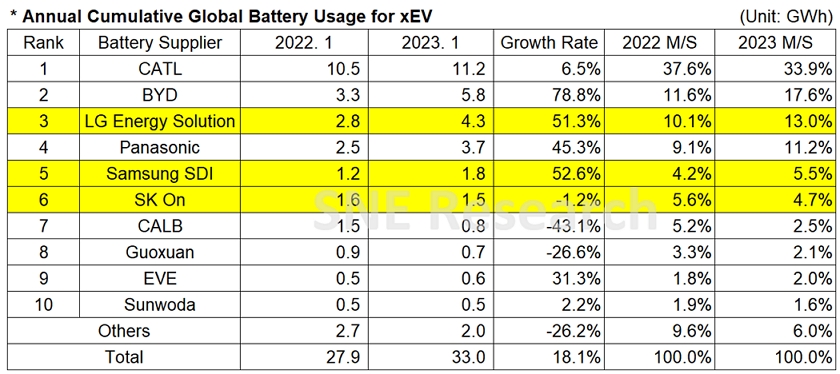

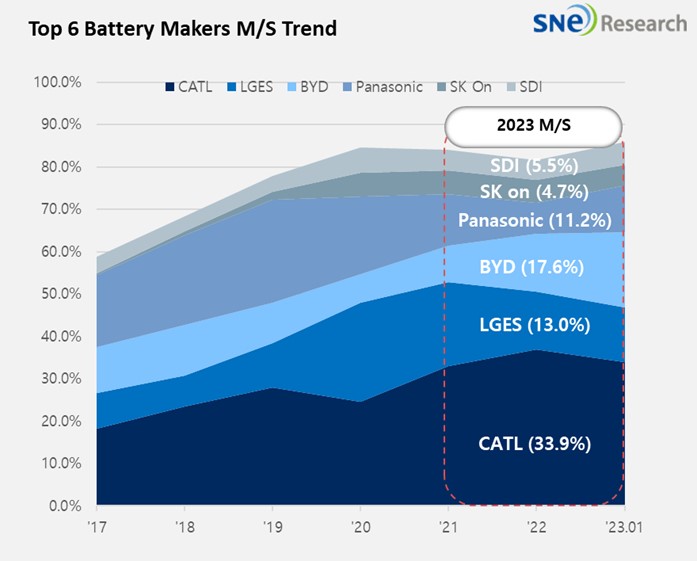

The market

shares of K-trio companies increased by 3.3%p from the same period of last year

to 23.2%. LG Energy Solution ranked 3rd with 4.3GWh, a 51.3% YoY

increase. SK-On recorded 1.5GWh, a 1.2% decline, and Samsung SDI posted 1.8

GWh, a 52.6% surge.

(Source: Global EV and Battery

Monthly Tracker – February 2023, SNE Research)

The upward

or downward trend in growth of battery cell makers was mainly affected by sales

of electric vehicle models equipped with batteries of each company. SK-On found

the sales of Hyundai Ionic 5, KIA EV6, and Ford F-150 noticeably helpful for

its battery sales but saw a decline in the sales of Kona BEV. Samsung SDI’s

growth was effectively led by steady sales of Audi E-Tron and BMW i4 and iX. A sudden

growth in sales of R1T, Rivian’s pick-up truck, also favorably affected Samsung

SDI. The growth of LG Energy Solution was based on solid sales of Tesla Model 3

and Y, Ford Mustang Mach-E, Chevrolet Bolt EUV, and Porsche Taycan EV.

Panasonic,

the only Japanese company in the top 10 on the list, posted 3.7GWh, a 45.3% YoY

growth, and witnessed its market share reviving by 2.1%p. As one of the major

battery suppliers to Tesla, Panasonic stayed on an upward track thanks to

increases in sales of Tesla models in the North American market and an increase

in sales of Toyota BZ4X.

Even

though CATL from China recorded a growth of 6.5%, below the market average, it

still occupied 33.9% of the entire market share, standing at the forefront of

the market as an unmatched leader. CATL’s continued growth was based on the

installation of CATL battery in Tesla Model 3 and Y, SAIC’s Mulan, Nio’s ET5,

and KIA’s Niro BEV. BYD, of which sales is mostly focused on the Chinese

domestic market, showed a high growth of 78.8% and took the 2nd

place on the list despite a decline in the EV sales in the Chinese market. Such

growth was achieved by selling a large number of BEV and PHEV from BYD who has

an advantage in cost competitiveness through in-house battery making and

vertical SCM integration.

(Source: Global EV and Battery Monthly Tracker – February 2023, SNE Research)

Although

the January EV (BEV+PHEV) sales in China has seen a 6.2% YoY decline due to the

termination of national subsidy policy in 2023, the market is still led by the

Chinese companies with CATL and BYD at the forefront. In February, the Ministry

of Industry and Information Technology of the People’s Republic of China announced

that it had a plan to accelerate the establishment of EV waste battery

recycling system. This announcement can be interpreted that China plans to

build a battery circulation system in the country as well as to prepare a solid

foundation for a stable take-off to the global stage. Amidst several

uncertainties in the market such as protectionist measures upheld by the US and

Europe and economic downturn, attentions should be drawn to counterstrategies

implemented by battery makers.

Forecast is updated every month in

accordance with the actual aggregated data of each month.