Global FCEV Market with 18.4% YoY Growth from January to December 2022

- NEXO from Hyundai Motor Group recorded accumulated sales of 11,179 units in 2022, remaining top on the global list for 4 consecutive years

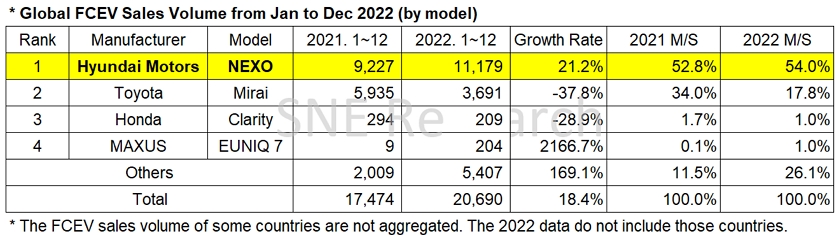

In the global FCEV market, NEXO from Hyundai Motors recorded the sale of 11,179 units in 2022. The Korean auto group has solidified its No.1 presence for 4 consecutive years, taking up more than half of the global market share. Toyota, on the other hand, aimed to reverse the trend in the FCEV market with its Mirai 2nd generation. However, its struggle turned out to be in vain due to lingering supply chain issues in Japan, especially those issues related to semiconductors and auto parts.

A total number of globally registered FCEVs sold in 2022 exceeded 20,000 units for the first time in its history, recording a 18.4% YoY growth. Increases in the sales of Hyundai’s NEXO and hydrogen commercial cars in China were found to be a driver behind the entire market growth.

By company, Hyundai Motors with a gradual sales increase in NEXO accounted for 54.0% of market share, closing the year 2022 as being No.1 in the global ranking. On the other hand, Toyota, who suffered from a sluggish sale of Mirai and was outrun by Hyundai Motor Group in 1Q 2022, had to see annually accumulated gaps between Hyundai and Toyota widen and eventually failed to recapture the 1st position. Since the termination of Clarity production, Honda also found it difficult to provide any sales record since last June. Same as Toyota, Honda posted a double-digit degrowth compared to the previous year.

(Source: Global FCEV Monthly Tracker – Jan 2023, SNE Research)

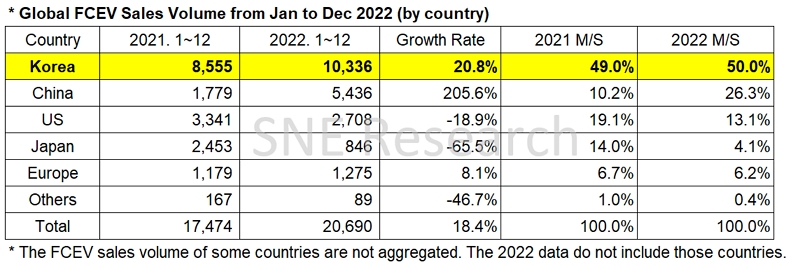

By country, Korea was the only country where more than 10,000 FCEV units were sold, keeping the top position in the global ranking. Next on the list, China posted a triple-digit growth, emerging as the most powerful competitor in the FCEV market. Such sharp growth was mainly driven by the hydrogen vehicle development and penetration policy implemented by the Chinese government to expand the use of hydrogen commercial vehicles. The hydrogen commercial vehicle market in China saw only 1,770 units registered in 2021, which jumped to 5,227 units in 2022.

Compared to battery used for electric vehicles, the hydrogen fuel cell system has benefits of lightweight and fast charging speed. This leads to a positive forecast on continuous expansion of FCEVs in the commercial vehicle market and a fiercer competition in consequence.

(Source: Global FCEV Monthly Tracker – Jan 2023, SNE Research)

The US and Japan, ranked 2nd and 3rd in 2021, were outperformed by China due to a sluggish sale of Toyota Mirai, recording a double-digit degrowth compared to the previous year.

As the global eco-friendly market has been focusing on electric vehicles in 2022, the FCEV market witnessed a temporary slowdown in growth last year. However, a gradual growth trend can be found each year, making it important to take a long-term approach towards the development of FCEV market. Similar to the fact that it took a long time for electric vehicles to finally achieve a rapid growth and locate itself at the center of the green car market, the FCEV market would need more time to grow and mature while addressing the issue of infrastructure expansion.