In 2022, Global EV Battery Usage Posted 517.9GWh, 71.8%

YoY Growth

- While K-trio M/S reaching 23.7%, LGES and BYD in fierce competition

for 2nd place

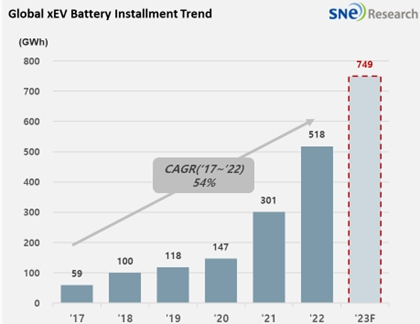

From January to December in 2022, the

amount of energy held by batteries for electric vehicles (EV, PHEV, HEV) registered

worldwide was 517.9GWh, a 71.8% YoY increase. The upward trend in the market

has continued since the 3rd quarter of 2020. According to the Global

Monthly EV & Battery Shipment Forecast based on the Tracker data provided

by SNE, the global EV battery usage in 2023 is

expected to reach approximately 749GWh.

(Source: Global Monthly EV

& Battery Shipment Forecast – January 2023, SNE Research)

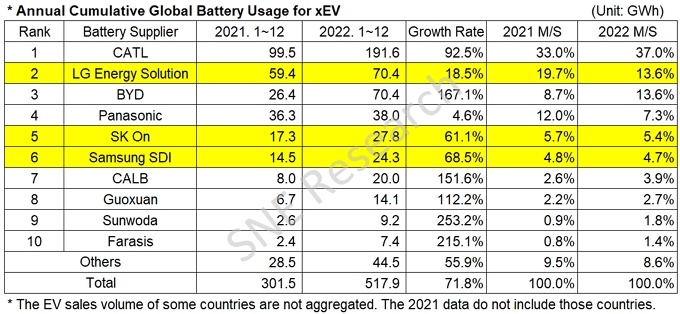

While

the battery usage by K-trio companies have been continuously increasing, their market

shares dropped by 6.5%p from 30.2% in the same period of last year to 23.7%. LG

Energy Solution recaptured the 2nd place in the ranking with 70.4GWh,

a 18.5% YoY increase. SK-On recorded 27.8GWh, a 61.1% increase, and Samsung SDI

posted 24.3 GWh, a 68.5% increase.

(Source: Global EV and Battery

Monthly Tracker – January 2023, SNE Research)

The

major driver behind the K-trio’s growth was sales of electric vehicle models

equipped with batteries of each company. SK-On found the sales of Hyundai Ionic

5, KIA EV, and Ford F-150 noticeably helpful for its battery sales. Samsung SDI’s

growth was led by steady sales of Audi E-Tron and BMW i4 and iX. The growth of

LG Energy Solution was based on solid sales of Volkswagen ID. 4, Tesla Model 3

and Y, and Ford Mustang Mach-E.

The Japanese

makers, however, have shown a relatively sluggish growth, with their market

shares also declined from the last year. Panasonic, for instance, registered a 4.6%

YoY growth, but seeing its market share dropping by 4.7%p. As one of the major battery

suppliers to Tesla, Panasonic managed to be on an upward track thanks to increases

in sales of Tesla models in the North American market and another fortunate

increase in sales of Toyota BZ4X.

On

the other hand, the Chinese makers including CATL and BYD have boasted an

explosive growth in the market. CATL’s remarkable growth was led by increases

in sales of Tesla Model 3 and Y, GAC’s Aion Y and Geely’s ZEEKR 001. High

growth of BYD was favorably affected by strong sales of BEV and PHEV including Yuan

(元),

Han (汉), and Qin PLUS EV in the Chinese

domestic market. Farasis, which newly entered the top 10 on the list with a

triple-digit growth, found itself rapidly expanding in the market last year, thanks

to solid sales of Mercedes EQ series sold to Europe. The Chinese maker is

expected to enjoy a steady growth in 2023.

(Source: Global EV and Battery Monthly Tracker

– January 2023, SNE Research)

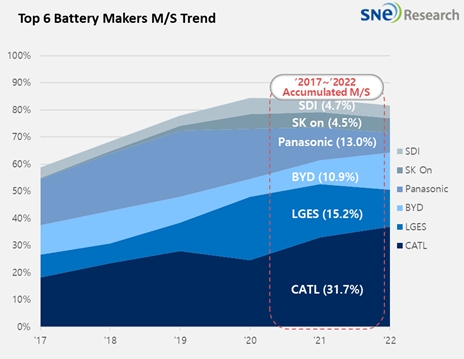

While

CATL is running far ahead of others, LG Energy Solution and BYD are in a fierce

competition for the 2nd place in the ranking. Since the

implementation of Inflation Reduction Act (IRA) by the US government, the

Chinese cell makers such as CATL, BYD, and CALB kickstarted to expand their

presences in the global markets like Europe and Asia, outside the Chinese

domestic market. Their competition for global marker shares with K-trio is

expected to be heating up more and more.

Forecast is updated every month in accordance

with the actual aggregated data of each month.