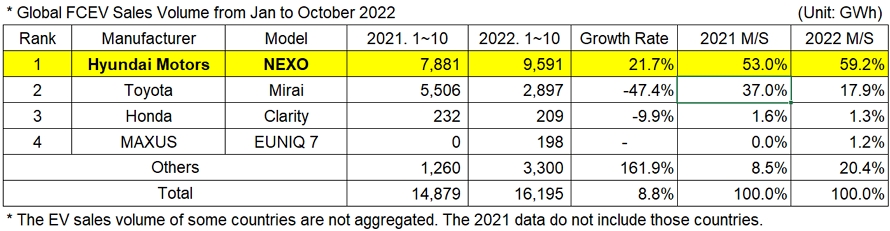

Global FCEV Market Saw 8.8 % YoY growth, with Hyundai Motors Staying Firm on Top from January to October 2022

- Hyundai Motors topped the list with a double-digit growth, while Toyota on the 2nd place saw a gradual recovery in sales of Mirai

Hyundai Motors stayed firm on top in the global FCEV sales ranking from January to October 2022. Despite the global eco-friendly vehicle market mostly focusing on electric vehicles and several unfavorable conditions such as supply issues related to semiconductors for vehicles, Hyundai Motors recorded a double-digit YoY growth thanks to steady sales of Nexo model.

A total number of globally registered FCEVs sold from January to October 2022 was 16,195 units, an increase of 1,316 units from 14,879 units sold in the same period of last year. While Hyundai’s Nexo showed a steady sales record in October 2022, Mirai 2nd generation from Toyota experienced a huge drop in sales compared to the same period of last year. This created a 41.3%p gap between the market shares of the two leading companies in the FCEV market. However, the sales of Mirai 2nd generation recorded 146 units in the US alone, showing a sign of slight recovery. Other than the US, its sales in Japan recorded 78 units and 30 units in Germany, exhibiting an increase from the last month and reaching 278 units in total.

Toyota was reported to import and sell Mirai 2nd generation in China at the end of this year and then plan to localize its manufacturing in China after the launch of its FCEV model in the Chinese market. Favorably affected by its plan, Toyota is expected to restore its market share in the global FCEV market. Hyundai Motors, who aimed to launch Nexo in the Chinese market at the end of this year, formally obtained the New Energy Vehicles (NEV) license from the transportation authorities in Beijing for the Chinese version of Nexo. It has been reported that the Chinese version of Nexo has its durability reinforced so that its battery performance would not deteriorate even in a low-temperature environment of the northern provinces in China. After monitoring customers’ response to the Chinese version of Nexo, it was reported that Hyundai Motors planned to consider the launch of Xcient, its hydrogen truck model, to the Chinese market. This may lead to create an opportunity for Hyundai Motors to take another leap forward in the Chinese FCEV market.

By company, Hyundai Motors stayed at the forefront in the FCEV market, propped up with its growth momentum. In Japan, Toyota and Honda have been continuously under distress from supply chain disruptions related to semiconductors and car parts. To be specific, Honda kept showing a poor performance since the manufacturing of Clarity was halted in August 2021. The EUNIQ 7 FCEV model by MAXUS, China, seemed to be in the trajectory of gradual recovery from sluggish sales earlier this year.

(Source: Global FCEV Monthly Tracker – Nov 2022, SNE Research)

According to the Global FCEV Monthly Tracker by SNE Research, Nexo has been sold more than twice the sales of Mirai if their total sales are compared. However, if their sales only in the overseas market are compared, the sales volume of Nexo was found to be smaller than that of Mirai. What’s noteworthy is that the sales of Chinese hydrogen commercial vehicles this year are approximately 3,100 units, accounting for a large portion of the global FCEV market.

Since its nearly-double-fold growth in 2021, the FCEV market has not seen any significant growth due to several global issues and an explosive increase in new electric vehicle models. While Hyundai Motors seems to be able to keep the leading position in the future FCEV market without difficulties thanks to steady sales of Nexo, OEMs in Japan and China, financially supported by each government in the form of investment, are known to develop and release their own fuel-cell passenger cars. Given the fact that aggressive policy initiatives, that the Socialist state implemented, allowed the Chinese market to grow as the world’s largest electric vehicle market in such a short period of time, it is expected that China, following the government’s strong will to foster the hydrogen industry, would fiercely run after the leading companies in the FCEV market.