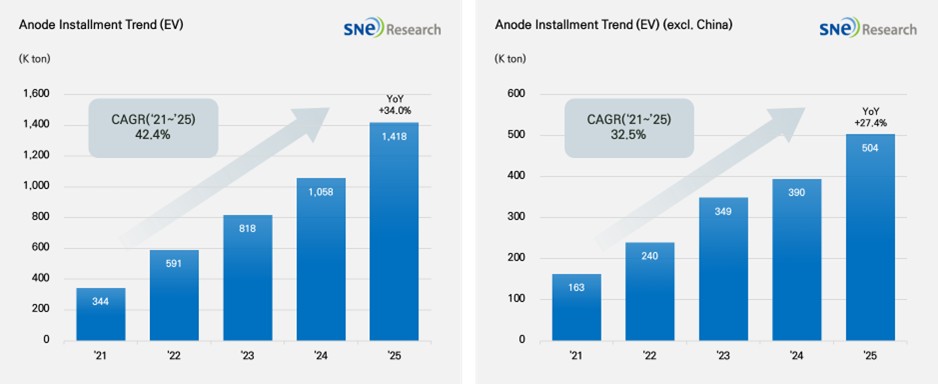

From Jan to Dec 2025, Global[1] EV Battery Anode Material Installment[2] Reached 1,418K ton, a 34.0% YoY Growth

- Anode installment in the non-China market recorded 504K ton, a 27.4% YoY growth

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From January to December 2025, the total amount of anode materials deployed in the global electric vehicle (EV, PHEV, HEV) market reached 1,418K tons, maintaining an upward trend with a 34.0% year-on-year increase. During the same period, the non-Chinese market recorded 504K tons, showing a relatively moderate but stable growth rate of 27.4%.

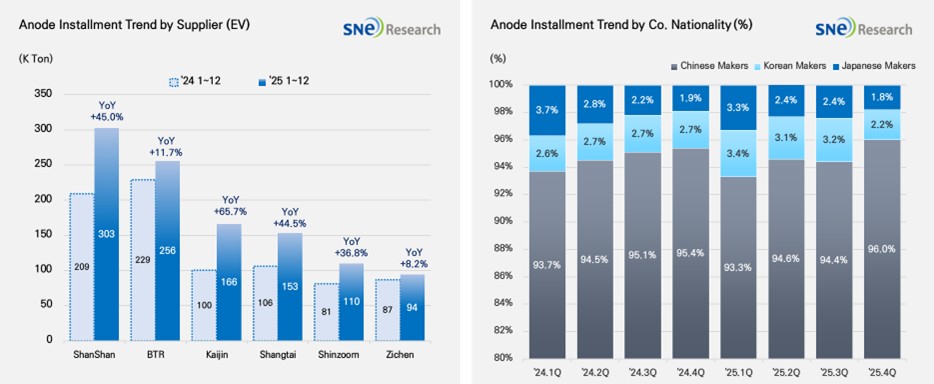

In terms of company rankings, ShanShan (303K tons) and BTR (256K tons) lead the global market, ranking first and second, respectively. The strength of these two companies lies in their broad customer base, supplying major battery manufacturers, combined with their large-scale production capabilities. Following them, Kaijin (166K tons), Shangtai (153K tons), Shinzoom (110K tons), and Zichen (94K tons) also secured top positions, with most of these companies expanding their presence by recording double-digit growth rates.

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

By corporate nationality, Chinese companies maintained their absolute dominance, with their market share fluctuating between 93.3% and 96.0% throughout the four quarters of 2025. Their market control is becoming increasingly entrenched, backed by aggressive capacity expansions and the advancement of their product portfolios. In contrast, the market share of South Korean companies declined from 3.4% in Q1 to 2.2% in Q4 2025, while Japanese companies also saw a downward trend, falling from 3.3% to 1.8% during the same period. As the EV market expands, the adoption of silicon-composite anodes (Si-Anodes) is on the rise, leading to closer collaboration with major battery manufacturers. Amidst this shift, South Korean firms—led by POSCO Future M and Daejoo Electronic Materials—are highlighting a strategic focus on expanding market entry opportunities by combining non-Chinese supply chain options with advanced silicon-composite technologies.

The anode material market is shifting from a focus on volume expansion toward a landscape where procurement risks, regulatory compliance, and the trade environment more directly dictate sourcing conditions and pricing. Following China's implementation of export licensing for certain graphite items, customers are increasingly prioritizing "verifiable supply" capabilities, which encompass not only lead times and quality but also country of origin and traceability.

In the United States, growing uncertainties surrounding anti-dumping and countervailing duties on Chinese active anode materials are driving discussions toward non-Chinese sourcing and localized processing. Similarly, in Europe, data-driven regulations such as the Battery Passport are making carbon footprint and traceability data mandatory conditions for trade. While natural and synthetic graphite continue to be used in tandem alongside a gradual increase in silicon-composite anodes, the graphite-based structure is expected to remain dominant for the time being, especially in the segment of mass-market EVs and LFP-equipped models.

The key takeaway is that the axis of competition is shifting from tonnage to stable procurement, verifiability, and customer-specific optimization. While the China-centric structure will persist for now, a gradual expansion of supply chain diversification, localized investments, and strategic partnerships targeting the U.S. and European markets is forecasted.

[2] Based on batteries installed to electric vehicles registered during the relevant period.