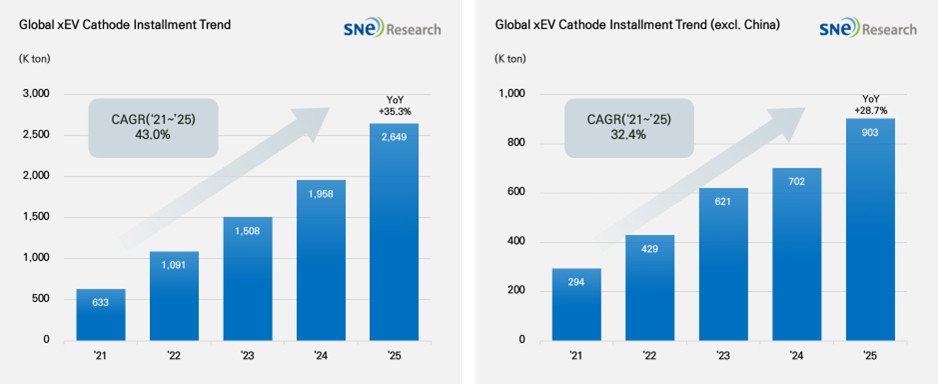

From Jan to Dec 2025, Global[1] EV Battery Cathode Installment[2] Reached 2,649K ton, a 35.3% YoY Growth

- EV battery cathode installment in the non-China market recorded 903K ton, a 28.7% YoY growth

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From January to December 2025, the total amount of cathode materials deployed in electric vehicles (EV, PHEV, HEV) worldwide reached 2,649 K ton, representing a 35.3% increase compared to the previous year. The non-Chinese market also maintained its growth trajectory, reaching 903K tons, up 28.7%. In 2025, the demand for cathode materials was characterized not only by increased sales volume but also by significant shifts in chemical composition. While LFP chemistry continued its high-growth streak and dominated volumes, the growth rate of ternary (NCM/NCA) materials slowed down. This indicates that the market's center of gravity is rapidly shifting from energy density toward cost efficiency and supply chain stability.

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

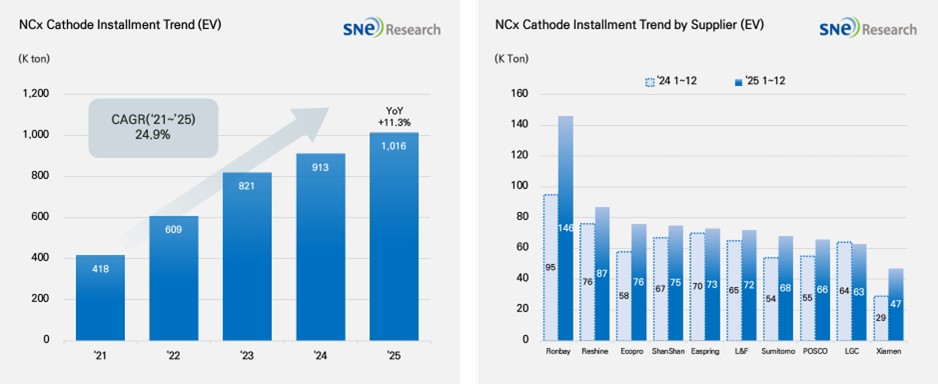

By type, the deployment of ternary (NCM/NCA) cathode materials reached 1,016K tons, an 11.3% increase compared to the previous year. Among the top suppliers, China’s Ronbay (146K tons) maintained its position at number one, followed by Reshine (87K tons) and ShanShan (76K tons) at second and fourth place, respectively. Among South Korean companies, EcoPro (76K tons) secured a spot in the top three, while L&F (72K tons) maintained its presence by ranking in the top six. POSCO Future M (66K tons) and LG Chem (63K tons) also successfully ranked within the global Top 10.

This month's rankings were significantly influenced by updates reflecting the quarterly earnings of South Korean cathode material manufacturers, customer inventory adjustments, and changes in utilization rates. Consequently, rankings shifted more sensitively in a range where the volume gap between companies was marginal. In particular, L&F's rankings were affected by its corrective disclosure in December 2025 regarding the high-nickel cathode supply contract with Tesla (originally announced in 2023), which saw the contract value adjusted down to approximately 9.73 million KRW. As a result, Tesla-related volumes were conservatively revised downward. This adjustment acted as a primary factor in the ranking shifts compared to the previous month's tally.

However, the competition at the top remains a landscape where Chinese manufacturers continue to hold the upper hand, driven by their expanding scale and superior cost competitiveness. Consequently, while NCM is expected to remain the preferred choice for the premium segment, its demand growth trajectory is becoming increasingly sensitive to regional incentives, the evolving trade environment, and the ongoing diversification of OEM vehicle lineups.

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

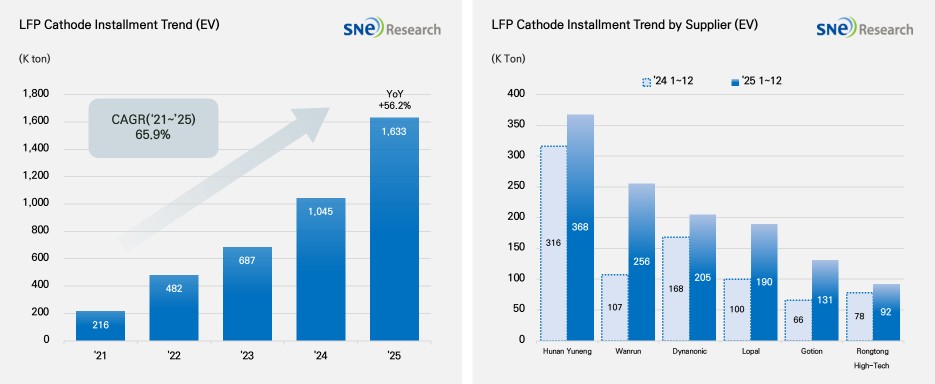

During the same period, the deployment of LFP (Lithium Iron Phosphate) cathode materials surged by 56.2% year-on-year, reaching 1,633K tons. LFP’s share of the total cathode material usage rose to approximately 62% (by weight), effectively driving the market. This rapid adoption is attributed to a combination of factors: the expansion of entry-level EVs in China, intensifying price competition, and the growth of budget-friendly models in Europe and emerging markets. By supplier, Hunan Yuneng (368K tons) maintained its top position, while Wanrun (256K tons) solidified its second-place ranking with significant growth. Dynanonic (205K tons) and Lopal (190K tons) also continued their upward trends. With Gotion (131K tons) and Rongtong High-Tech (92K tons) rounding out the list, the top tier remains exclusively composed of Chinese companies. Given the high concentration of the LFP supply chain in China, it appears unlikely that this supply structure will shift in the short term, even as efforts to expand local production in non-Chinese regions progress.

The cathode material market is moving beyond a simple volume race between ternary and LFP chemistries into a phase where procurement risks and regulatory compliance dictate prices and market share. Factors such as potential export controls, origin and incentive requirements, and Europe-centric demands for supply chain due diligence, carbon footprint reporting, and traceability data are accelerating investments in non-Chinese supply chains and localized cathode production. In 2026, there is a strong possibility that volatility in raw material costs, such as lithium, will resurface. Following a period of price declines, the cumulative effects of production cuts at high-cost mines and delays in new capacity expansions could lead to a tighter-than-expected supply. This coincides with rising demand from both EVs and Energy Storage Systems (ESS), making the supply-demand balance increasingly sensitive. Under these conditions, the market analysis suggests that lithium prices could experience significant fluctuations even from minor shocks, such as unexpected mining disruptions or policy shifts like export restrictions.

[2] Based on batteries installed to electric vehicles registered during the relevant period.