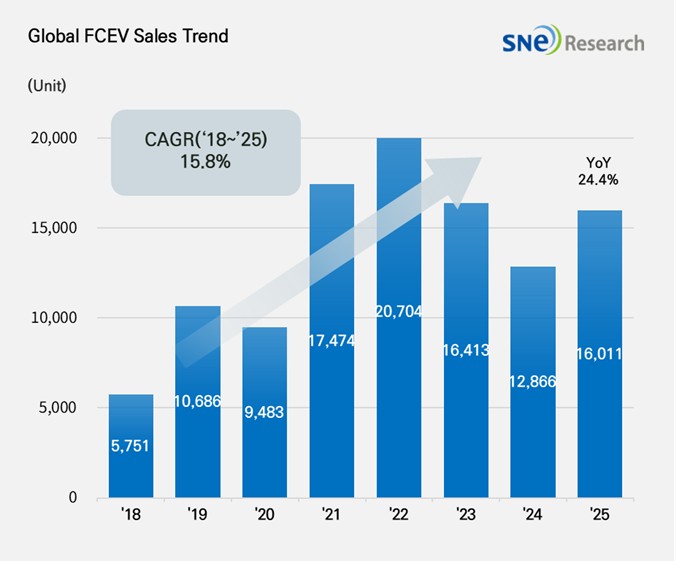

Global FCEV Market Grows 24.4% YoY in 2025

- Hyundai Tops Global FCEV Sales: China Ranks #1 by Region

From January to December 2025, the global Fuel Cell Electric Vehicle (FCEV) market rebounded in the second half of the year following a slowdown in the first half, recording 16,011 units sold – a 24.4% increase compared to the same period last year. In December, a temporary surge in sales was observed in China. This is interpreted as the result of a "rush to buy" as consumers moved to capitalize on the full exemption from the New Energy Vehicle (NEV) purchase tax before it transitions to a 50% reduction starting in 2026. This surge was further amplified by the fulfillment of performance targets in hydrogen pilot city clusters before the year-end deadline.

(Source: Global FCEV Monthly Tracker – Jan 2026, SNE Research)

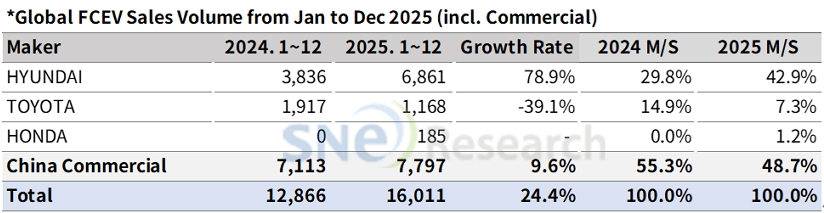

By company, Hyundai Motor maintained its top position in the global market, selling a total of 6,861 units, primarily driven by NEXO. The launch of the second-generation NEXO in April 2025 propelled the company to a high growth rate of 78.9%. Toyota sold 1,168 units across its Mirai and Crown models, marking a 39.1% year-on-year decrease, with its domestic sales in Japan also dropping by 37.3%. Despite these figures, Toyota continues to consistently invest in hydrogen technology R&D and infrastructure development. Meanwhile, Chinese manufacturers are maintaining a relatively stable sales trend by focusing on commercial vehicles rather than passenger cars. Honda introduced the 2025 Honda CR-V e: FCEV in the U.S. and Japan, though sales remained modest at 185 units. As the first SUV to combine hydrogen fuel cell technology with plug-in hybrid functionality, the CR-V e: FCEV features a 4.3 kg hydrogen tank and a 17.7 kWh battery, achieving an EPA-estimated driving range of 435 km (270 miles).

(Source: Global FCEV Monthly Tracker – Jan 2026, SNE Research)

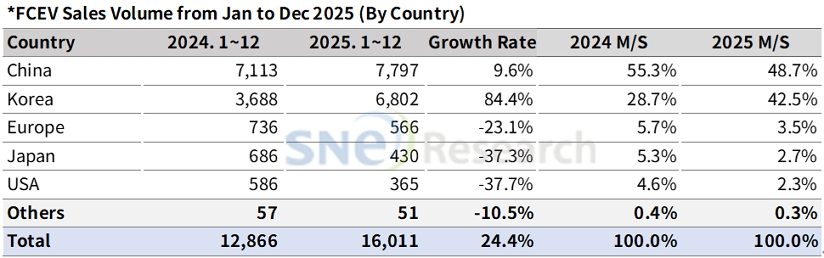

By country, China, which focuses its strategy on commercial vehicles, experienced a temporary surge in sales. This spike was driven by consumers rushing to purchase vehicles before the full exemption of the New Energy Vehicle (NEV) purchase tax transitions to a 50% reduction starting in 2026. South Korea captured a 42.5% market share, bolstered by the robust sales of the Hyundai NEXO, yet ranked second globally behind China. Meanwhile, major advanced markets, including Europe, the United States, and Japan, are showing a distinct contraction. In Europe, combined sales of the Mirai and NEXO reached only 566 units, representing a 23.1% year-on-year decline. In the U.S., despite the introduction of the new Honda CR-V e: FCEV, overall sales fell by 37.7% due to a sharp drop in Mirai sales. The Japanese market also recorded a 37.3% decrease, weighed down by sluggish sales of the Mirai and Crown models.

(Source: Global FCEV Monthly Tracker – Jan 2026, SNE Research)

The growth of the global FCEV market in 2025 can be summarized as the combined result of Hyundai Motor's recovery in the second half and the year-end tax and settlement deadline effects in China. However, since China’s December surge was largely driven by front-loaded demand, there is potential for a short-term correction in early 2026. Furthermore, the fact that the 2026 Toyota Mirai features only minor updates suggests that the pace of demand expansion for passenger FCEVs remains limited for now. Ultimately, the market trajectory in 2026 will be determined by several critical factors: whether commercial-centric pilot projects can transition into sustainable operations rather than remaining one-off distributions; whether the expansion of charging infrastructure can keep pace with actual driving demand without bottlenecks; and whether subsidy policies remain stable enough to provide a predictable outlook for both vehicle prices and Total Cost of Ownership (TCO).