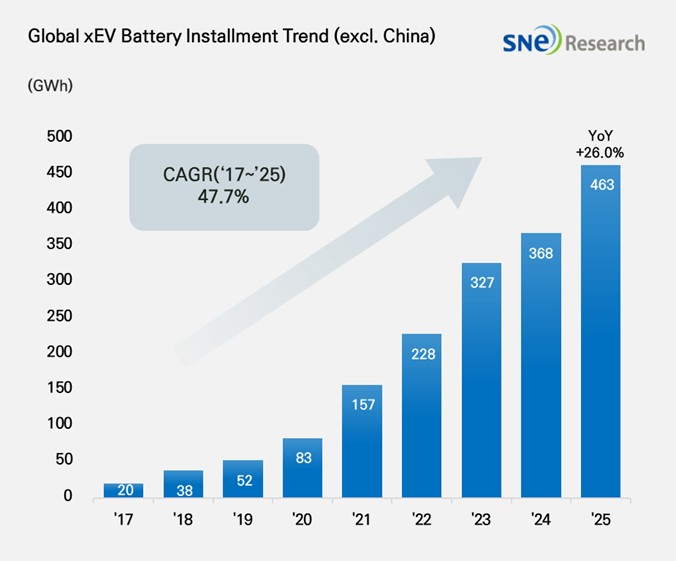

From Jan to Nov 2025, Non-Chinese Global[1] EV Battery Usage[2] Posted 463GWh, a 26.0% YoY Growth

- From Jan to Dec 2025, K-trio’s combined M/S recorded 36.3% (except China market)

Battery installation for global

electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from Jan to

Dec in 2025 was approximately 463.3GWh, posting a 26.0% YoY growth.

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

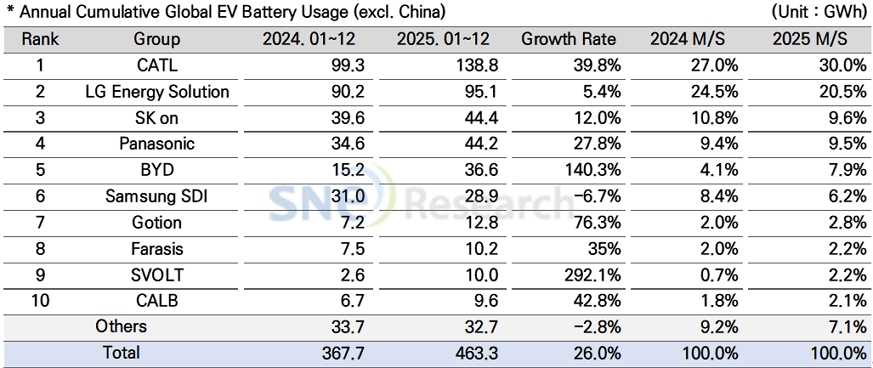

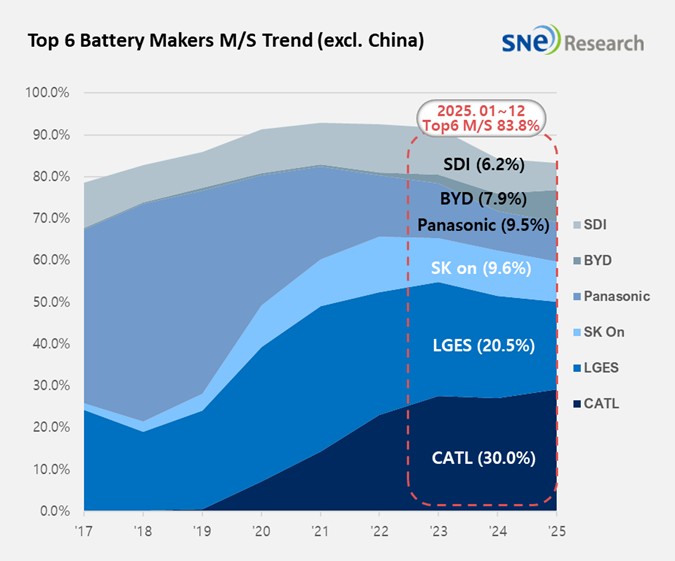

From January to December 2025, the combined global market share of the three major South Korean battery manufacturers—LG Energy Solution, SK on, and Samsung SDI—recorded 36.3%, a 7.4 percentage point (p) decrease compared to the same period last year. LG Energy Solution maintained its second-place position with a 5.4% year-on-year growth (95.1 GWh), while SK On climbed to third place with a growth rate of 12.0% (44.4 GWh). In contrast, Samsung SDI saw its usage decrease by 6.7% (28.9 GWh).

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

Examining the battery usage of the three South Korean manufacturers in relation to EV sales, Samsung SDI showed the highest supply concentration in the following order: BMW, Audi, Rivian, and Jeep. BMW equips its major electrified models, including the i4, i5, i7, and iX, with Samsung SDI batteries. Notably, the robust sales of its flagship i4 and i5 models acted as a factor in partially offsetting the overall decline in Samsung SDI’s installation volume. Audi also saw a positive response, particularly in Europe, for the Q6 e-tron—which is based on the PPE platform and powered by SDI batteries. However, due to sluggish sales of the existing Q8 e-tron, Audi’s total SDI battery installation volume saw a slight decrease. In the case of Jeep, sales of the Wagoneer S, featuring SDI’s 100 kWh high-capacity battery pack, were particularly noteworthy. While Rivian utilizes Samsung SDI batteries for its R1S and R1T models, SDI's installation volume remained limited due to the expansion of standard trims and an overall slump in Rivian's vehicle sales.

SK On’s batteries were primarily installed in major vehicles from Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. In the case of Hyundai Motor Group, the IONIQ 5 and EV6 accounted for the largest installation volumes, while the steady sales of Volkswagen’s ID.4 and ID.7 also had a positive impact on SK On’s annual battery usage. On the other hand, sales of the Ford F-150 Lightning, which is equipped with high-capacity batteries, plummeted following the announcement of a production halt in late 2025. Furthermore, with the dissolution of BlueOval SK—the joint venture between SK on and Ford—the slowdown in EV demand in the U.S. market is expected to act as a significant burden on SK On’s future installation volumes.

LG Energy Solution’s battery usage was primarily driven by major automakers such as Tesla, Chevrolet, Kia, and Volkswagen. Although global sales of Tesla models equipped with LG Energy Solution batteries continued to struggle, the company achieved a 5.4% year-on-year increase. This growth was bolstered by the expansion of Chevrolet’s EV lineup and the robust sales of key models like the Kia EV3, Hyundai Casper (Inster) EV, and Renault Scenic. However, following the termination of the battery supply agreement with Ford and the suspension of operations at Ultium Cells plants, a shift in the company’s business strategy in the U.S. market is anticipated. This includes a strategic pivot toward expanding ESS (Energy Storage Systems) operations to mitigate current market risks.

Panasonic, which primarily supplies batteries to Tesla, recorded a total battery usage of 44.2 GWh in 2025, ranking 4th globally. To reduce its heavy reliance on Tesla, Panasonic is focusing on enhancing the efficiency of its North American production lines and developing next-generation 4680 and 2170 cells. As the facility conversion at its Kansas and Nevada plants gains momentum, its cost structure is stabilizing, and discussions for new partnerships with other North American automakers are expanding, establishing a foundation for demand diversification. This strategy is expected to buffer the risks associated with Tesla's expansion of in-house battery production and support the maintenance of Panasonic's mid-to-long-term market share in North America. Furthermore, the company is shifting away from an EV-centric business structure by promoting the expansion of ESS (Energy Storage Systems) battery production. Panasonic is actively diversifying its business portfolio to address the surging power demand driven by North American grid stabilization and the proliferation of AI data centers.

CATL firmly maintained its position as the global leader, recording a battery usage of 138.8 GWh, a 39.8% increase compared to the same period last year. Not only are major Chinese OEMs such as ZEEKR, AITO, Li Auto, and Xiaomi adopting CATL's batteries, but a vast number of global OEMs, including Tesla, BMW, Mercedes-Benz, and Volkswagen, continue to utilize their products. Meanwhile, while maintaining a portfolio centered on lithium-ion batteries, CATL is also accelerating its efforts to preoccupy the next-generation battery market by promoting the commercialization of sodium-ion batteries. In particular, CATL is reportedly planning to expand full-scale mass production of sodium-ion batteries in 2026 for application in both passenger and commercial vehicles. Based on its strengths in cost competitiveness and performance in low-temperature environments, the company is expected to broaden its application range significantly.

BYD rose to second place globally, recording a battery usage of 36.6 GWh, a staggering 140.3% increase. As a vertically integrated manufacturer producing both batteries and electric vehicles (BEV+PHEV), BYD is expanding its sales across various vehicle segments based on its superior cost competitiveness. The company is rapidly strengthening its foothold not only in the Chinese domestic market but also in international markets. Notably, amid this overseas expansion, BYD's battery usage in Europe reached 14.9 GWh in 2025, representing a 201.4% year-on-year surge. Meanwhile, to further secure its cost-competitive edge, BYD is increasing investments in the commercialization of sodium-ion batteries. The company is reportedly working on establishing a dedicated production capacity of 30 GWh per year, signaling its intent to lead the next-generation battery market alongside its existing LFP lineup.

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

In 2025, the global electric vehicle (EV) battery market excluding China maintained its physical growth, expanding by 26.0% year-on-year. However, as the competitive landscape underwent a significant reshuffling, the combined market share of the three major South Korean battery manufacturers declined. Notably, Chinese battery makers, led by CATL and BYD, continued to increase their usage even in non-Chinese markets. The diversification of supply chains by global OEMs and intensifying price competition are analyzed as the key drivers behind these shifts in market share. As a result, Korean manufacturers are facing heightened earnings volatility tied to the sales performance of their major clients. For 2026, uncertainties in EV demand within North America and the expanding presence of Chinese competitors in Europe are expected to remain as burdens on both shipment volumes and profitability recovery. However, the ability to defend competitiveness in non-Chinese markets is likely to vary depending on the expansion of ESS (Energy Storage Systems) demand and successful product portfolio adjustments. Consequently, future performance trajectories will be determined by the specific customer mix and the effectiveness of business strategy realignments.

[2] Based on battery installation for xEV registered during the relevant period