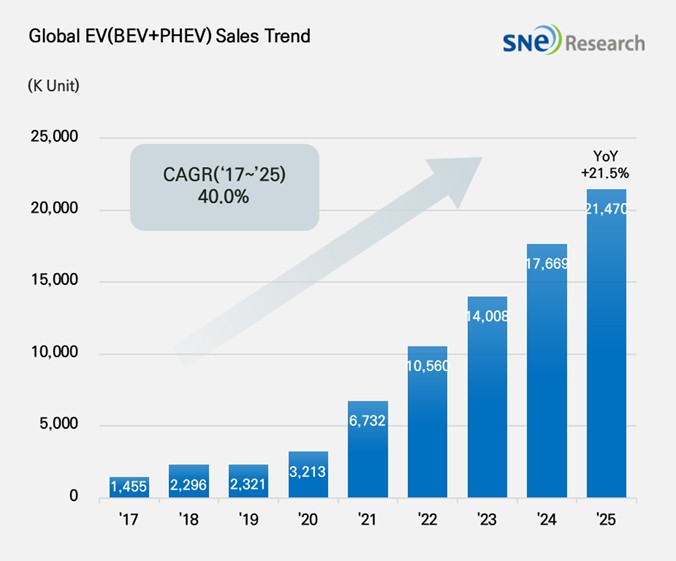

From Jan to Dec 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approximately 21.47 Mil Units, a 21.5% YoY Growth

- BYD remained top by selling 4.121 mil units; Geely ranked 2nd with 56.8% by selling 2.225 mil units

From January to

December 2025, global electric vehicle (EV) sales—based on deliveries—reached 21.47

million units, a 21.5% increase year-on-year. While China remained the primary

driver of growth, Europe also contributed to the global increase by recovering

to double-digit growth. Conversely, North America remained in negative growth

territory.

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

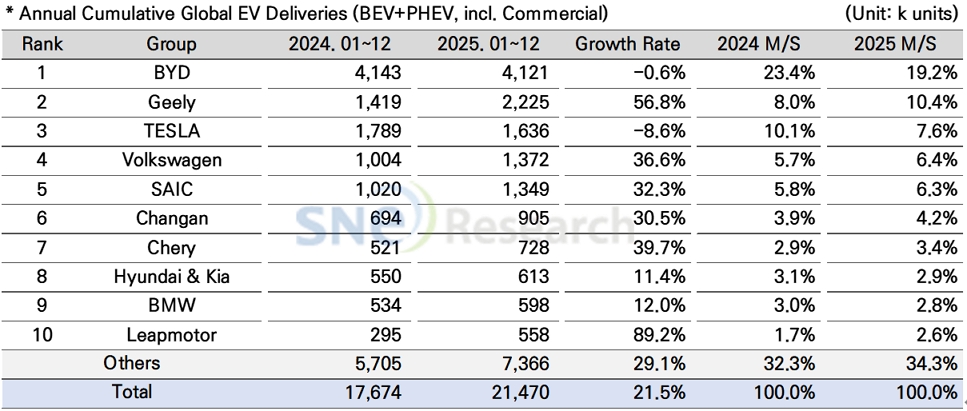

As of the period from January to December 2025, BYD maintained its number one position in global EV sales, selling approximately 4.12 million units, despite a slight year-on-year decrease of 0.6%. Even amid a cooling global EV market, BYD is strengthening its responsiveness to shifting tariff and subsidy policies by simultaneously establishing and expanding production facilities, particularly in Europe (Hungary, Turkey) and Southeast Asia (Thailand, Indonesia, Cambodia). By expanding its local production hubs, BYD is maintaining its cost-competitive edge while consistently enhancing brand awareness based on its proprietary battery technology and superior vehicle cost structure. Furthermore, the company is broadening its presence across the entire EV ecosystem by diversifying its portfolio with expanded commercial and compact vehicle lineups tailored to the specific demand characteristics of each region.

Geely Group, which ranked second, continued its robust double-digit growth by selling approximately 2.225 million electric vehicles, a 56.8% increase compared to the same period last year. While the success of the Star Wish (Xingyuan) model drove volume expansion, the group is targeting a broad consumer base through its multi-layered brand portfolio, which includes the premium brand ZEEKR, the hybrid-dedicated brand Galaxy, and the global-market-focused LYNK & CO. Notably, after establishing a solid foundation in the Chinese domestic market, Geely is expanding its electric vehicle business by simultaneously pursuing brand and model strategies aimed at global markets. In the process of actively transitioning from an internal combustion engine-centric business structure to electric vehicles, the group is also accelerating the in-house development of core technologies in areas such as batteries, electrical components, and software, while strengthening its production capabilities. This strategy of vertical integration and technology insourcing serves as a foundation for securing both cost competitiveness and product differentiation. Consequently, Geely is highly regarded for its potential to further expand its presence in the future global electric vehicle market.

Tesla ranked third in the global electric vehicle (EV) sales rankings, selling approximately 1.636 million units, an 8.6% decrease compared to the previous year. The sluggish sales performance of its flagship Model 3 and Model Y served as the primary driver behind the overall decline in results. Globally, Model 3/Y sales fell by 7.0% year-on-year to 1.585 million units, acting as a significant burden on the brand’s overall performance. By region, a synchronized downturn was observed across all key markets. In Europe, sales dropped 19.6% year-on-year to 272,000 units, while China saw a 4.8% decrease, totaling 626,000 units. The North American market also faced significant headwinds, recording 575,000 units—a 12.8% decline—as the slowdown in demand intensified following the expiration of consumer tax credit benefits. Meanwhile, although Tesla continues its strategy of enhancing Full Self-Driving (FSD) capabilities and expanding its software-as-a-service (SaaS) subscription model, analysts suggest that the visible impact on performance has been limited in the short term—not yet enough to offset the decline in vehicle sales.

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

As of the period from January to December 2025, Hyundai Motor Group continued its relatively stable growth in the global market, selling approximately 613,000 electric vehicles, an 11.4% increase compared to the previous year. In the BEV (Battery Electric Vehicle) segment, the IONIQ 5 and EV3 drove the performance, while compact and strategic models such as the Casper (Inster) EV, EV5, and Creta Electric also received positive responses in key global markets. On the other hand, existing flagship models like the EV6, EV9, and Kona Electric showed a slowdown in sales, failing to maintain the growth momentum seen in the past. In the PHEV (Plug-in Hybrid Electric Vehicle) segment, a total of 104,000 units were delivered. While SUV-centered models such as Sportage, Tucson, and Sorento maintained a steady performance, certain models like the Niro and Ceed recorded a decline.

By region, Hyundai Motor Group delivered approximately 166,000 units in the North American market, maintaining its third-place position in sales following Tesla and GM. Despite a 19.6% year-on-year decrease in North American sales, outperforming major global competitors such as Ford, Stellantis, Toyota, and Volkswagen is regarded as a significant achievement. Meanwhile, on January 26th and 27th, President Trump remarked that he could increase tariffs on South Korean electric vehicles from 15% to 25%. He justified this move by citing delays in the South Korean National Assembly’s ratification of the bilateral trade agreement. If these remarks materialize into actual policy, the price competitiveness of automobiles exported from South Korea to the United States is expected to take a direct hit.

(Source: Global EV and Battery Monthly Tracker – Jan 2026, SNE Research)

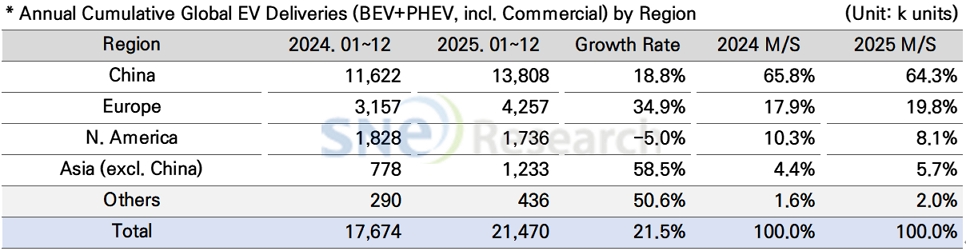

In 2025, the global electric vehicle (EV) market exhibited diverging trends based on regional policy environments and demand structures, leading to an increasingly complex growth trajectory. China recorded sales of 13.808 million units (an 18.8% increase), accounting for 64.3% of the global market share. However, as prolonged price competition and concerns over oversupply intensified within the domestic market, the phase of explosive high growth seen in the past has begun to wane. With the growth engine shifting toward entry-level models and the electrification of commercial vehicles, Chinese OEMs are increasingly focused on mitigating trade barrier risks. They are doing so by strengthening their international presence through the establishment of overseas production facilities and Complete Knock-Down (CKD) operations.

Europe saw a rebound with 4.257 million units sold (a 34.9% increase), accounting for 19.8% of the global market share. However, this recovery is characterized not so much by subsidies or regulations unilaterally driving demand, but rather by a "selective" increase in demand centered on models with established price competitiveness and diverse product lineups, even amidst fluctuating regulatory signals. This shift comes as policy uncertainty surrounding the EV transition resurfaces, following recent moves to adjust internal combustion engine (ICE) phase-out timelines or ease regulations. These environmental changes are directly impacting the electrification strategies of legacy automakers, with major OEMs such as Volkswagen, Mercedes-Benz, and BMW adjusting the pace of their electrification or re-evaluating certain strategies.

North America recorded 1.736 million units, a 5.0% decrease compared to the previous year. Following the expiration of the IRA-based clean vehicle tax credits after September 30, 2025, the policy leverage that had lowered the perceived purchase price for consumers weakened. Consequently, demand is increasingly likely to slow down further in the mid-to-low price segments, which are highly sensitive to price. In response, OEMs are intensifying efforts to mitigate risks by adjusting the speed of battery electric vehicle (BEV) expansion and optimizing powertrain distribution through HEVs (Hybrid Electric Vehicles) and EREVs (Extended Range Electric Vehicles).

Asia (excluding China) recorded robust growth of 58.5%, with 1.233 million units sold. In India, the market is expanding around entry-level models amidst intensifying competition among local manufacturers. Meanwhile, Thailand and Indonesia are strengthening their roles not only as consumer markets but also as key production and export hubs. Other regions (Middle East, South America, Oceania, etc.) also maintained their early-stage growth momentum, reaching 436,000 units (a 50.6% increase).

In 2025, the center of gravity for growth shifted from the high growth of the Chinese market alone toward the recovery of Europe and the expansion of the Asian market (excluding China). This trend highlights that Chinese OEMs are increasingly focused on expanding overseas production bases and localizing their supply chains to mitigate the burdens of domestic price competition and oversupply. In North America, the growth rate has become highly sensitive to incentives, interest rates, and the price competitiveness of entry-level lineups. Consequently, adjusting electrification targets and optimizing local production have emerged as the key variables determining market share.

Looking ahead, the global EV market in 2026 is expected to maintain a moderate growth trend, though regional volatility is likely to increase. In Europe, despite the introduction of regulatory flexibility, the need for electrification investment and sales expansion will likely drive a rapid increase in mid-to-low priced models and local production volumes. In North America, growth momentum will depend heavily on tax incentives and regulatory directions. In China, the key pillars will be entry-level models, commercial vehicle electrification, and the commercialization of next-generation battery technologies. Ultimately, global competition is projected to converge into a race for cost efficiency, supply chain resilience, and regulatory responsiveness, rather than mere technological superiority.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period