Global LIB ESS Market Reaches 550 GWh in 2025; CATL Ranks 1st with 30% Market Share

The global LIB Energy Storage System (ESS) market reached a scale of 550 GWh in 2025. Notably, China's domestic market and Chinese LIB manufacturers accounted for more than half of the total market share.

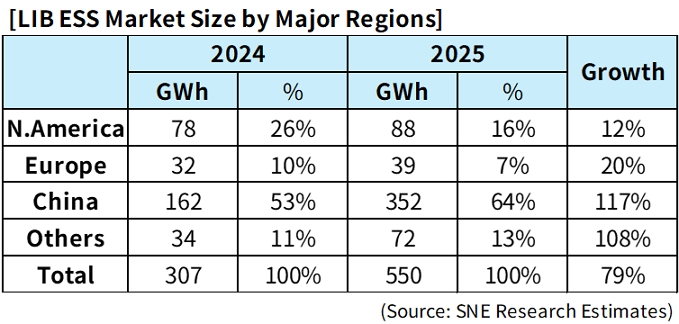

According to data released on Jan 28 by SNE Research, a market research firm specializing in electric vehicles and LIBs, the total ESS battery shipments from global LIB manufacturers reached 550 GWh in 2025. This represents a significant 79% growth compared to the 307 GWh recorded in the previous year (2024).

Unlike electric vehicles, where batteries are integrated into products sold to consumers, ESS batteries are installed directly into regional projects. Consequently, there is no disparity between shipment volume and actual installation capacity.

By region, China dominated the ESS market with a 64% share, recording 352 GWh. It also achieved a remarkably high year-on-year growth rate of 117%.

North America ranked as the second-largest region in terms of market share, reaching 88 GWh in 2025 with a 16% share of the global market. However, North America remained the region with the lowest year-on-year growth rate. This sluggish growth was largely influenced by policies within the United States, its primary market. Specifically, the U.S. government’s high-tariff policy against China created supply chain disruptions for low-cost Chinese-made Lithium Iron Phosphate (LFP) LIBs.

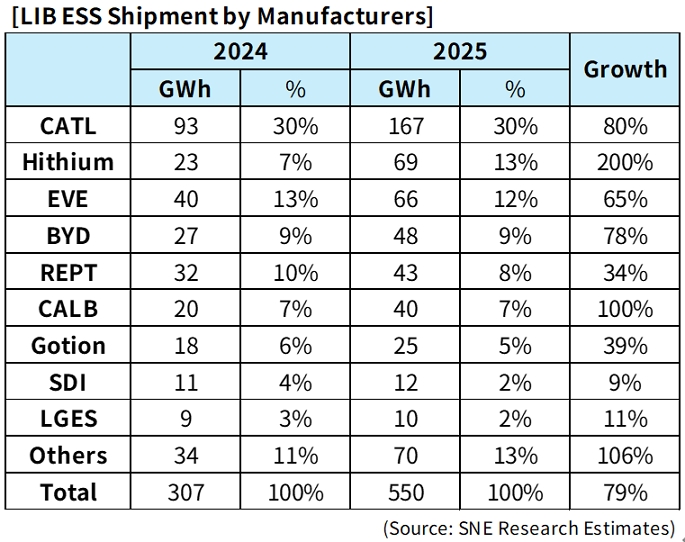

Meanwhile, in terms of market share (M/S) by manufacturer, the top seven positions were all swept by Chinese companies. Conversely, the market share of South Korean LIB manufacturers stood at approximately 4%, reflecting a decline compared to the same period last year.

CATL (China) secured the top spot in the 2025 LIB ESS market. CATL shipped 167 GWh of LIBs for ESS, capturing a 30% market share. With an 80% year-on-year increase in shipments, the company maintained its position as the global leader. Unlike electric vehicles, ESS batteries are installed directly into regional projects, meaning there is no disparity between shipment volume and actual installation capacity.

Other Chinese firms also demonstrated strong performance, with Chinese manufacturers occupying all top seven spots in the 2025 ESS LIB market. The combined market share of these top seven companies reached 83.3%.

On the other hand, South Korean LIB manufacturers ranked between 8th and 9th in terms of ESS market share. The combined ESS LIB shipments of Samsung SDI and LG Energy Solution reached 22 GWh in 2025, accounting for 4% of the total market. While their shipment volume increased slightly compared to the previous year, their overall market share declined.

The dominance of the Chinese LIB industry is attributed to the fact that Lithium Iron Phosphate (LFP) batteries, primarily produced in China, are well-suited for ESS applications. Unlike electric vehicle batteries, ESS units installed in outdoor energy storage facilities do not require high energy density. Instead, safety and cost-competitiveness are prioritized. In contrast, South Korean manufacturers have focused on ternary batteries such as NCM and NCA for their ESS products. Furthermore, the contraction of the domestic Korean ESS market, which has traditionally been a stronghold for local firms, has also negatively impacted their performance.

To counter this, South Korean LIB manufacturers plan to target the North American ESS market by converting their existing EV battery production lines in the U.S. into LFP battery lines. Meanwhile, Chinese LFP batteries are expected to remain the mainstream choice in other ESS markets, excluding China, Europe, and South Korea.