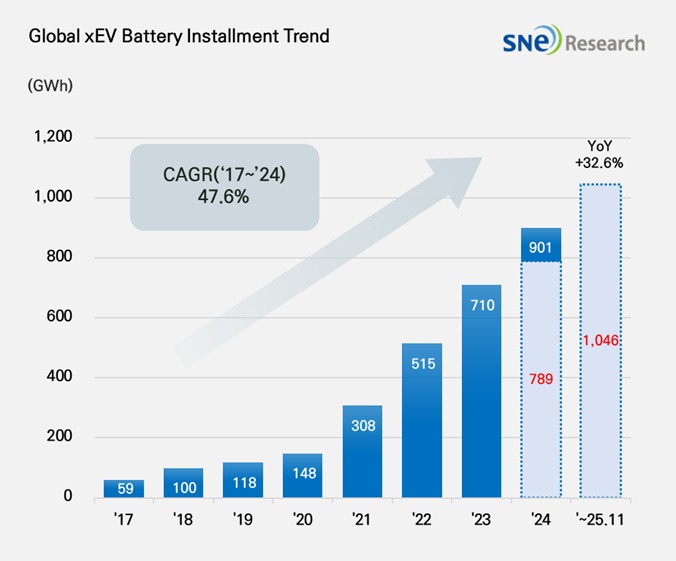

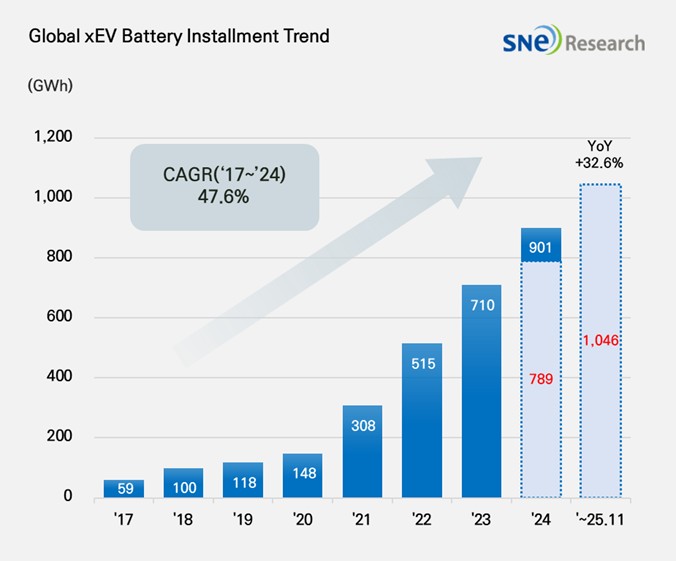

From Jan to Nov 2025, Global[1] EV Battery Usage[2] Posted 1,046GWh, a 32.6% YoY Growth

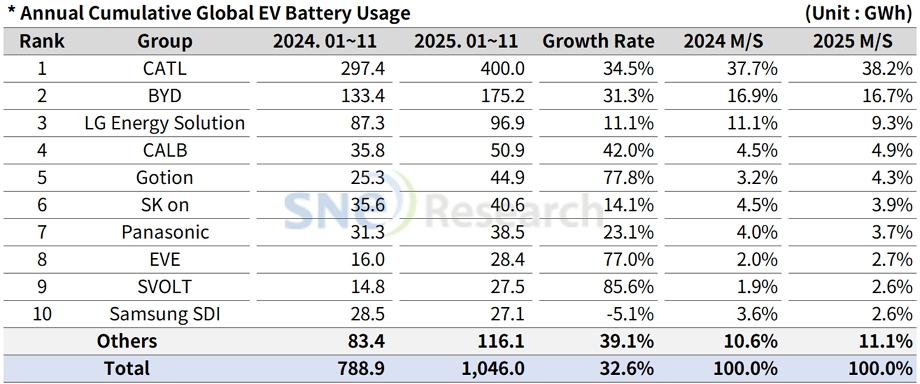

- From Jan to Nov 2025, K-trio’s M/S recorded 15.7%, a 3.5%p YoY decline.

From Jan to Nov 2025, the amount of energy held by batteries

for electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 1,046GWh, a 32.6% YoY growth.

(Source: 2025 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from Jan to Nov in 2025 posted 15.7%, a 3.5%p decline from the same period last year. LG Energy Solution remained 3rd on the list with 11.1%(96.9GWh) YoY growth. While SK On ranked 6th with a 14.1%(40.6GWh) growth, Samsung SDI posted 5.1%(27.1GWh) degrowth.

(Source: 2025 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of EVs, Samsung SDI’s battery was mainly supplied to BMW, Audi, and Rivian. BMW has Samsung SDI’s batteries in its major electrified models such as i4, i5, i7, and iX. With the increasing sales of electric vehicles to which Samsung SDI’s batteries are installed, the installation volume of their batteries has also increased, accordingly. In case of Rivian, although they recorded stable sales of R1S and R1T in the US, the newly launched standard range trim, to which Gotion’s LFP batteries are installed, has had a negative impact on the share of batteries supplied by Samsung SDI to Rivian. In addition, a slowdown in sales of Rivian has also affected the usage of Samsung SDI’s battery in a negative way. Meanwhile, Audi’s Q6 e-Tron, built on the PPE platform and equipped with batteries of SDI and CATL, has been received well mostly in Europe.

SK On’s battery was installed to electric vehicles made by Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group has SK On’s battery in IONIQ 5 and EV 6 most. And the steady sales of VW ID.4 and ID.7 also contributed to an increase in the usage of batteries made by SK On. On the other hand, although Ford F-150 Lighting, to which large-capacity batteries are installed, saw a slowdown in sales, thanks to favorable sales of Explorer EV, the volume of batteries used in Ford’s electric vehicles has seen a 12.3 % YoY growth.

LG Energy Solution’s battery was mainly used by Tesla, Chevrolet, Kia, and Volkswagen. Due to a slowdown in sales of Tesla models, to which LG Energy Solution’s batteries are installed, the usage of LGES’ batteries by Tesla saw an 8.2% YoY decrease. On the other hand, thanks to favorable sales of Kia EV 3 in the global market and expanded sales Chevrolet Equinox, Blazer, and Silverado EV, to which the Ultium platform was applied, in the North American market were regarded as a major drive behind the increasing usage of batteries made by LG Energy Solution.

Panasonic, which mainly supplies its batteries to Tesla, ranked 7th on the list with the battery usage of 38.5 GWh. Panasonic has been focusing on the improvement of efficiency in its North American production lines as well as the development of next-gen 4680·2170 cells in order to lower its dependence on Tesla as a major client. The transition process in Kansas·Nevada plants has accelerated, bringing about stability in the cost structure. In addition, as it has been further deepening discussions on new cooperation opportunities with North American OEMs, the Japanese battery maker has been solidifying a foundation for client diversification.

CATL remained top in the ranking of global battery usage, posting a 34.5%(400.0GWh) YoY growth. Major OEMs such as ZEEKR, AITO, Li Auto, and Xiaomi have chosen CATL’s batteries for their EVs, and many global major OEMs like Tesla, BMW, Mercedes-Benz, and Volkswagen, have also adopted CATL’s batteries.

BYD took the 2nd position on the list with a 31.3%(175.2GWh) growth rate. BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, has been expanding sales of various models based on its strong price competitiveness. It has been expanding its presence not only in the Chinese domestic market but also in the overseas market. In particular, BYD has boasted a noticeable growth in the European market. Between Jan and Nov 2025, BYD’s battery usage in Europe reached 12.7GWh, exhibiting a 206.6% increase year-on-year.

(Source: 2025 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

By the end of 2025, the global electric vehicle (EV) battery market continued to grow, but the center of gravity of that growth became increasingly concentrated in China. As the expansion of domestic adoption and price competition progressed simultaneously within China, an LFP-centered trend spread globally, while Chinese battery manufacturers strengthened their influence through overseas local production and customer diversification. Meanwhile, North America faced a high risk of contraction in early 2025 due to policy uncertainty, tariffs, and tax credit risks; however, ESS incentives were maintained even after the OBBBA. In addition, as power demand from AI data centers surged, ESS demand increased rapidly, accelerating a structural shift from EVs to ESS applications. Nevertheless, the cost and time required to convert U.S.-based ternary (NCM/NCA) production facilities to prismatic LFP remain key variables. Ultimately, after 2026, the competitiveness of battery manufacturers is expected to depend less on global expansion itself and more on redesigning product, customer, and production footprint portfolios that can simultaneously address both EV and ESS markets in response to region-specific regulatory changes.

[2] Based on battery installation for xEV registered during the relevant period.