Global FCEV Market with Bull Maintenance and Hyundai Motors Stayed on Top from January to September 2022

- Hyundai Motors ranked No. 1 with a double-digit growth, and the September sales of Nexo recorded 1,120 units

Hyundai Motors remained top spot in the global FCEV sales ranking from January to September, 2022. Despite several unfavorable factors at home and in the entire global FCEV market, the Nexo model has seen steady sales. With that, Hyundai Motors seemed to put up a good fight in the market, recording a double-digit growth compared to the same period of last year.

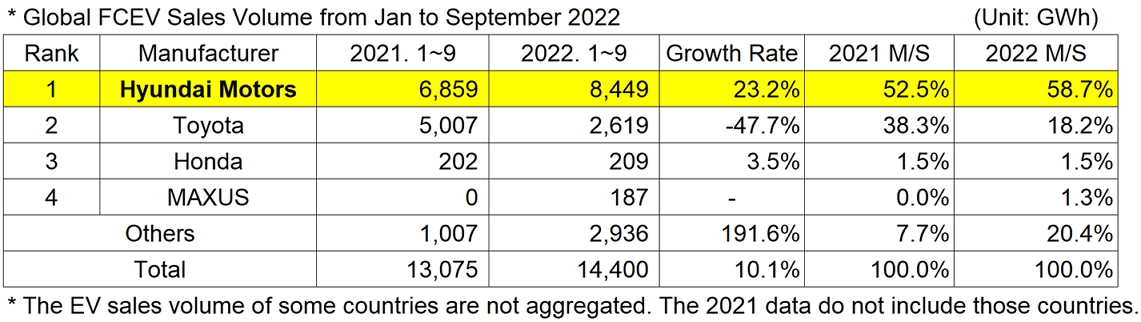

A total number of globally registered FCEVs sold from January to September 2022 was 14,400 units, an increase of 1,325 units from 13,075 units sold in the same period of last year. While Hyundai’s Nexo (1st gen.) 2021 model showed a steady sales record in September 2022, Mirai 2nd generation from Toyota saw a significant YoY drop in sales. This has led to a 40.5%p gap between the market shares of the two leading companies in the FCEV market.

A Chinese media outlet reported that Toyota would import and sell Mirai 2nd generation in China at the end of this year. It is expected that Toyota would recover from its market share loss gradually as the Japanese car maker reportedly planned to localize their manufacturing in China after the launch of their FCEV model in the Chinese market. Hyundai Motors has also been preparing itself for entering the Chinese local market at the end of this year. The giant car maker in Korea has had a plan to launch a model based on Nexo (1st gen.) in compliance with the Chinese local regulations. Recently, it formally registered the revamped Nexo to the list of New Energy Vehicles eligible for the purchase tax exemption implemented by the Ministry of Industry and Information Technology of the People's Republic of China (MIIT). Given the Chinese government’s strong commitment to develop a domestic hydrogen industry, it seems more attention would be drawn to the competition between Hyundai Motors and Toyota for FCEV sales in the Chinese market.

Those factors, that shrank the growth of the global FCEV market in the past couple of months, compared to the last year, have continued to affect the market: stagnation in growth of the FCEV market due to the EV-oriented strategies on a corporate level; lingering supply chain issues with raw materials and auto parts, especially semiconductors; and the Russia-Ukraine War. Despite all these adverse factors, Hyundai Motors has been at the forefront of the market growth with a growth rate of 23.2%. In September alone, except Korea, Hyundai sold the most FCEVs among other car makers in the US (27 units).

By company, Toyota remained at degrowth same as the previous month, while Hyundai Motors led the market with an upward trend in sales. Toyota has been still under the bombardment of unfavorable conditions including the nation-wide supply chain issues in Japan, natural disasters, and adverse factors in the world. Honda, with a single-digit YoY growth, has continuously seen a sluggish growth as the production of Clarity discontinued in August 2021. The EUNIQ 7 FCEV model by MAXUS, China, seemed to gradually recover from the declined sales seen earlier this year.

(Source: Global FCEV Monthly Tracker – Oct 2022, SNE Research)

The FCEV market, which recorded almost a two-fold growth in 2021, kept failing to show a remarkable growth due to numerous global issues and huge increases in new electric vehicle models. Hyundai Motors, propped up with steady sales of Nexo (1st gen.) 2021 model, seems to be able to keep its market-leading position without many difficulties. However, as automakers in Japan and China are reported to have plans to develop and release fuel-cell passenger vehicles, supported by the state-led investment, it is forecasted that they will fiercely run after the leading company in the FCEV market.