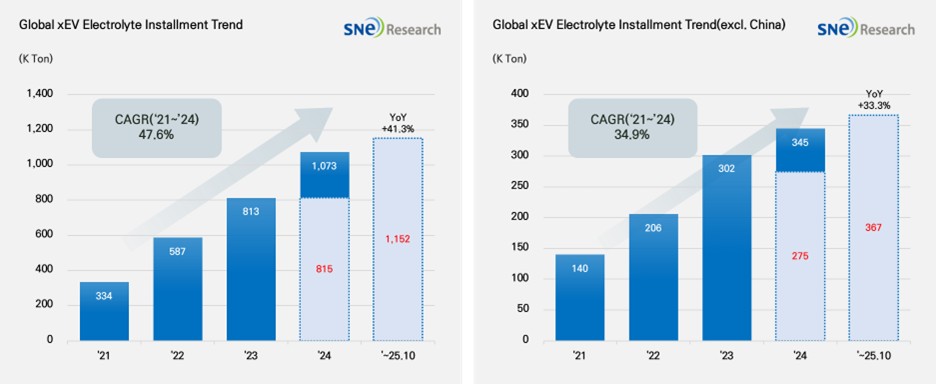

From Jan to Oct 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Reached 1,152K ton, a 41.3% YoY Growth

- In 2025, the electrolyte market continued

to post a double-digit growth, while the non-China market showed a stable

expansion in demand.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Oct 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 1,152K ton, posting a 41.3% YoY growth. Particularly in the global market outside China, the total usage of electrolyte for electric vehicles recorded 367K and 33.3% YoY growth, continuously exhibiting a stable expansion in demand.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market is expected to continue steady growth in the mid to long run.

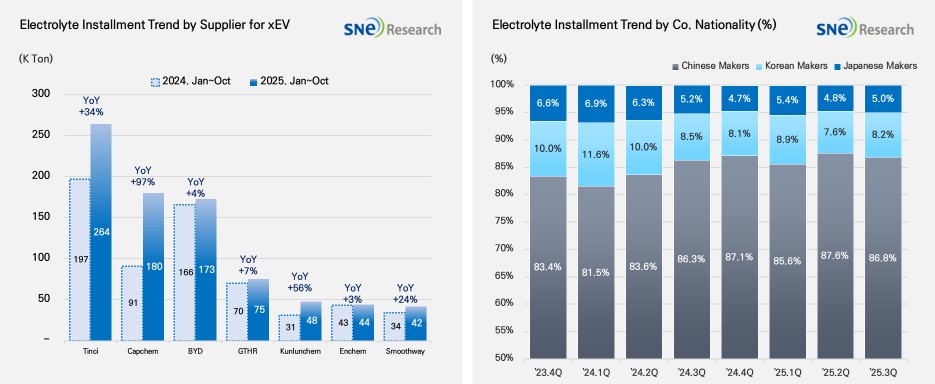

From Jan to Oct 2025, the global electrolyte market showed remarkable growth among major electrolyte suppliers. Tinci ranked 1st on the list, posting a 34.1% YoY growth by supplying 264K tons of electrolyte. Capchem showed a 96.9% growth with 180K ton, following Tinci on the list. BYD posted a 4.2% of growth by supplying 173K ton, while GTHR showed a 7.3% growth with 75K ton. Smoothway showed a remarkable growth of 24.4% with 42K ton. Korean electrolyte suppliers such as Enchem (44K ton, +2.7%) and Soulbrain (29K ton, +19.8%) also maintained steady growth.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market shares of companies by nationality, the Chinese electrolyte suppliers are still leading the market. As of Q3 2025, the market shares taken by the Chinese electrolyte companies were 86.8%, while the Korean and Japanese companies took up 8.2% and 5.0%, respectively. The market shares held by the Korean and Japanese electrolyte makers were slightly lower than the same period of last year. While the Chinese companies are solidifying their market dominance, it becomes more important for the non-China companies to secure their own competitive edge.

The electrolyte market has recently entered a phase in which rapidly rising technical requirements, driven by the expansion of high-performance batteries, are unfolding simultaneously with material competitiveness challenges and supply-chain restructuring. As pressure increases to reduce EV component costs, automakers and cell manufacturers are imposing stricter standards on electrolyte thermal stability, high-voltage durability, and cycle life performance. In response, major suppliers are focusing on additive formulation upgrades and the development of high-concentration electrolytes.

In North America and Europe, demand for regional supply-chain localization is increasing, prompting some electrolyte producers to pursue pilot-line expansions, broader quality-certification coverage, and stronger local customer-support operations.

In particular, in North America—despite EV demand fluctuations and production-delay issues—demand for ESS-grade electrolytes is rising, making downstream-market diversification increasingly significant. Amid these shifts, competition in the electrolyte market is transitioning from simple production expansion to a model driven by technical responsiveness to customer requirements, regional sourcing stability, and the breadth of product portfolios. Going forward, companies that secure high-performance materials and establish robust regional production and sourcing systems are expected to achieve a more stable foundation for growth.

[2] Based on batteries installed to electric vehicles registered during the relevant period.