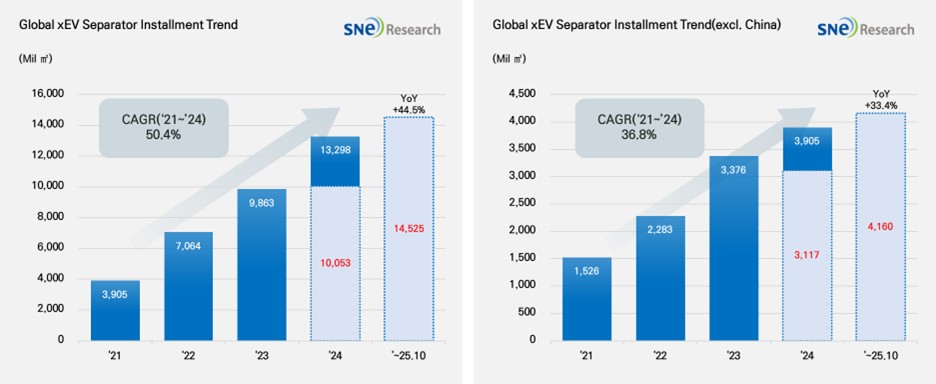

From Jan to Oct 2025, Global[1] Electric Vehicle Battery Separator Installment[2] Reached 14,525Mil ㎡, a 44.5% YoY Growth

- With the increasing installment of

batteries in electric vehicles in 2025, the global separator market maintained

steady growth

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Oct 2025, the total installment of separators used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 14,525 Mil ㎡, posting a 44.5% YoY growth. During the same period, the total installment of separators in the non-China market was 4,160Mil ㎡, registering a 33.4% YoY growth and continuing to be in a stable growth trend.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

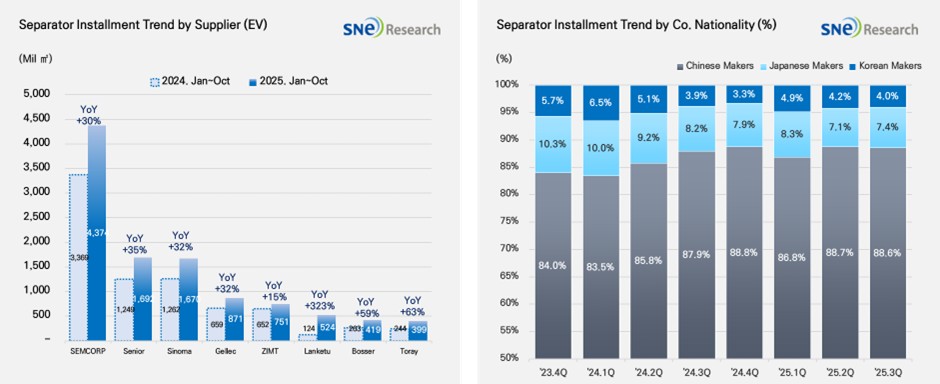

From Jan to Oct 2025, major separator suppliers showed notable growth in the global separator market. In particular, the installment of SEMCORP’s separator was increased by 30% from the same period last year, reaching 4,374Mil ㎡ and leading the market. Other major Chinese companies such as Senior (+35%), Sinoma (+32%), and Gellec (+32%) also continued to show strong growth in the market. Other than them, ZIMT and CMZF also recorded a double-digit growth, increasing their shares in the market. Meanwhile, SK IE Technology from Korea also showed a 55% YoY growth, having 385Mil ㎡ of separator installed in EV batteries and exhibiting a steady growth.

In terms of market shares of companies by nationality, the Chinese separator makers accounted for almost 90% of the entire market share, boasting their dominance in the market. Since the 3rd quarter of 2023, the market shares of Japanese and Korean separator suppliers have been continuously dropping. In the 3rd quarter of 2025, the Japanese suppliers took up 7.4%, and the Korean companies accounted for 4.0% of the market share. As the market dominance by the Chinese suppliers have strengthened, the competition landscape has been further polarized between the Chinese makers and non-China companies in the global separator market.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

Despite concerns over slowing EV sales, the global separator market is entering a new turning point as material sophistication and supply chain realignment progress simultaneously. As automakers accelerate the development of high-power, high-efficiency batteries, separators are required to deliver greater thermal stability and uniform quality. In response, major manufacturers are increasing investment in advanced coating processes and high-speed production equipment. In North America and Europe, a series of initiatives aimed at strengthening regional battery supply chains is underway. Separator companies, in turn, are working to enhance their responsiveness to local customers by establishing sample testing lines, engaging in joint-venture discussions, and expanding quality certification programs.

Global manufacturers are also moving away from growth strategies focused solely on capacity expansion and are instead reshaping their profitability-centered product portfolios, while pursuing differentiation strategies tailored to the technical requirements of individual customers. In response to expanding circular-economy regulations, companies are increasingly evaluating the use of recycled materials and improving processes from an energy-efficiency perspective, signaling a more active approach to environmental compliance. Amid these changes, the determinants of competitiveness in the separator market are shifting from sheer production volume to technological maturity, supply stability, and regional responsiveness. In the mid- to long term, companies that can secure a balanced customer base across EVs, ESS, and industrial applications are most likely to emerge as market leaders.

[2] Based on batteries installed to electric vehicles registered during the relevant period.