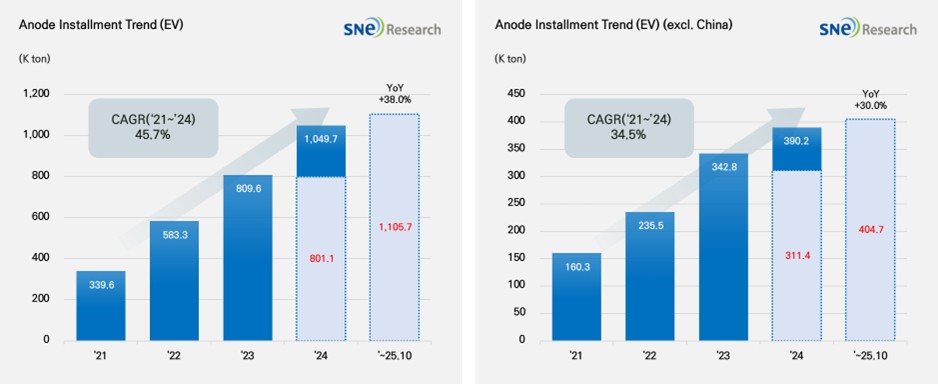

From Jan to Oct 2025, Global[1] Electric Vehicle Battery Anode Material Installment[2] Reached 1,106K ton, a 38.0% YoY Growth

- Anode installment in the non-China market

recorded 405K ton, a 30.0% YoY growth

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Sep 2025, the total installment of anode materials in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 1,106K ton, posting a 38.0% YoY growth and staying in an upward trend. During the same period, in the global market outside China, the total installment of anode material was 405K ton, recording a 30.0% growth. Despite relatively moderate growth, the overall trend of steady growth was maintained.

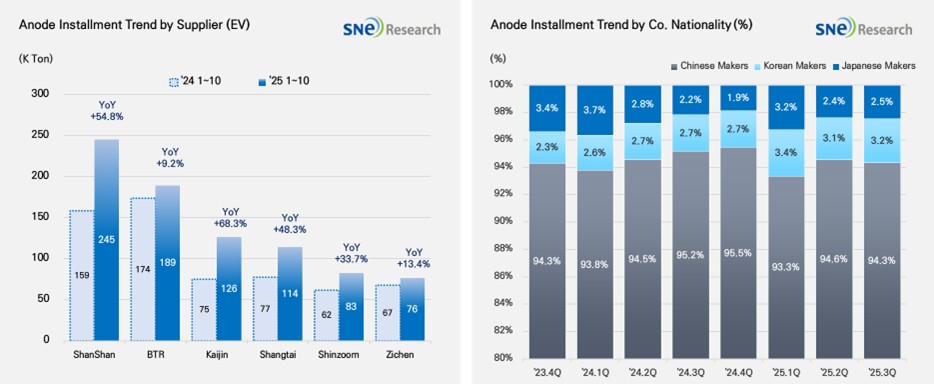

If we look at the market share held by companies, ShanShan (245K ton) and BTR (189K ton) ranked 1st and 2nd on the list, leading the global anode market. These two companies have successfully secured a broad customer base and mass production capabilities, by supplying anode materials to major battery makers such as CATL, BYD, and LG Energy Solution. Kaijin (126K ton), Shangtai (114K ton), Shinzoom (83K ton), and Zichen (76K ton) were all ranked high, exhibiting a double-digit YoY growth and expanding their presence in the global market.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

If we look at the market shares of companies by their nationality, the Chinese anode makers accounted for more than 94% of the entire market share, solidifying their absolute dominance in the market. Based on expansion of production capacity and sophistication of technology, they have been solidifying their market dominance. With the electric vehicle market expanded, more Si-anode has been adopted, leading them to further intensify cooperation with major battery makers. Although the market shares taken by the Korean anode makers were only around 3.2%, cooperation with major cell makers has expanded to enter the market in earnest. Those efforts to cooperate with cell makers are mainly led by POSCO and Daejoo. On the other hand, the Japanese anode manufacturers accounted for only 2.5% of the market share, showing a relatively insignificant presence in the market. For instance, Hitachi and Mitsubishi maintained their conservative strategies to depend on the existing customer base, which seemed to gradually weaken their competitiveness in the market.

In 2025, the anode materials market entered a structural inflection point, with supply-chain risks and technology transitions overlapping amid a phase of price rebound. The United States has announced preliminary anti-dumping and countervailing duties—at high tariff rates—on Chinese anode materials, while China, after requiring export licenses for high-purity synthetic and natural graphite since 2023, additionally designated lithium batteries and synthetic-graphite anodes as controlled items, only to later partially postpone enforcement. As a result, North America and Europe have accelerated efforts to diversify away from Chinese suppliers, though fully replacing China in the short term remains difficult. Given these dynamics, anodes may once again become a driver of rising battery costs by 2026–2027. Cell makers and automakers will need to include raw-material price indexation clauses in long-term supply agreements and allocate part of their North American and European-bound volumes to non-Chinese suppliers. At the same time, silicon-carbon composite anodes are emerging as a new alternative. If Korean material companies can effectively combine technology development with non-Chinese supply chains, the current transition phase could become a new growth opportunity.

[2] Based on batteries installed to electric vehicles registered during the relevant period.