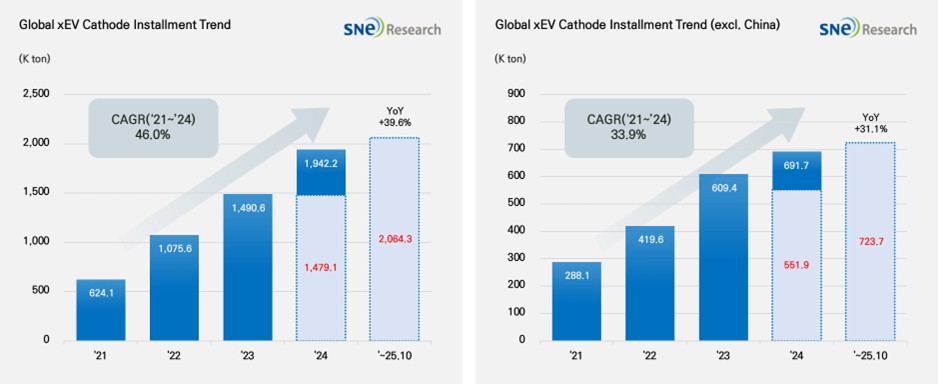

From Jan to Oct 2025, Global[1] Electric Vehicle Battery Cathode Material Installment[2] Reached 2,064K ton, a 39.6% YoY Growth

- From Jan to Oct 2025, EV battery cathode installment in

non-China market was 724K ton, posting a 31.1% growth

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Oct 2025, the total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 2,046K ton, posting a 39.6% YoY growth. If we look at the market except China, the total cathode usage was 724K ton, and the growth rate was 31.1%, which was steady and stable. Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently, the battery market can be divided into the one centered around NCx ternary cathode material and the other mainly led by LFP cathode material, and both are driven by technical and economic advantages of each cathode material. Amidst the diversification of global cathode material demand, NCx ternary cathode material and LFP cathode material are positioning themselves as two main axes in the market.

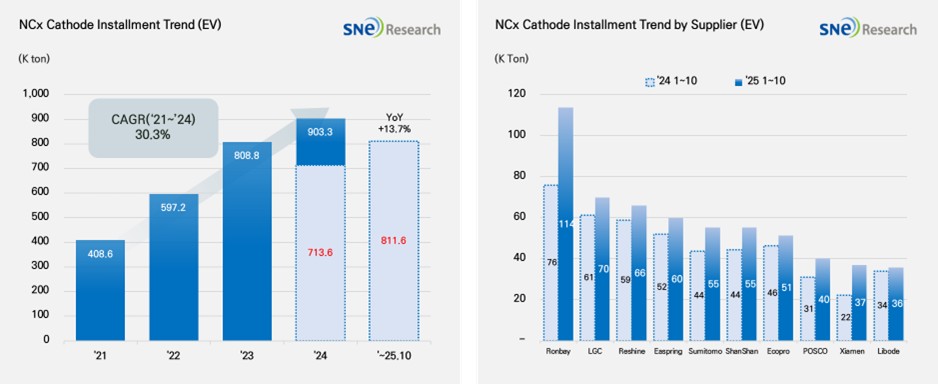

If we look at the market by different cathode materials, the installment of ternary cathode material during the relevant period was 727K ton, posting a 13.7% YoY increase and continuing a gradual growth. By company, Ronbay and LG Chem ranked 1st and 2nd on the list, leading the market. Ecopro (51K ton), POSCO (40K ton), and L&F (33K ton) all entered the upper rank, maintaining their reputation as leadingzz Korean suppliers in the market. Overall, however, the growth of Chinese cathode material makers showed a noticeable growth. Major cathode suppliers such as Reshine, Easpring, and ShanShan are competing fiercely, and the Chinse cathode makers are gradually expanding their global market shares based on demand from the Chinese domestic market, price competitiveness, and their massive ramp-up plans.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

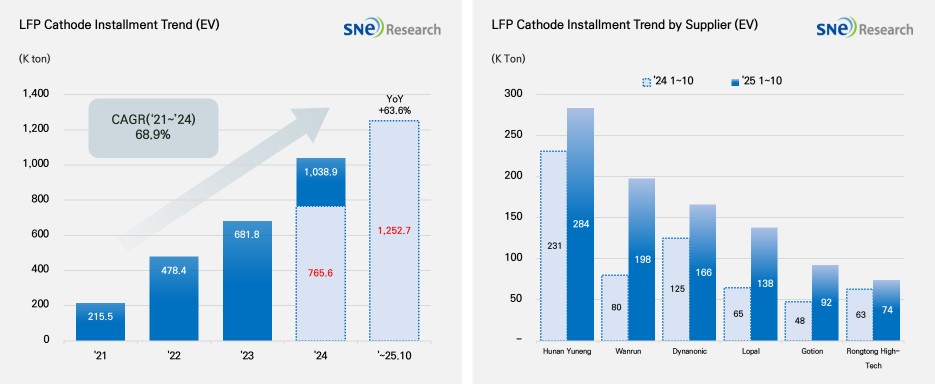

During the same period, the total installment of LFP cathode material was 1,253K ton, posting a rapid growth of 63.6% compared to the same period last year. In terms of growth pace, LFP cathode material surpassed that of ternary cathode material. Among the total cathode material installment, the proportion taken by LFP was about 60% (based on weight), meaning that the usage of LFP material has an increasing influence on the market. It is interpreted as being affected by the expansion of entry-level EV market in China, increasing preference to LFP chemistry with price competitiveness, and increasing adoption of LFP batteries by global OEMs. By cathode suppliers, Hunan Yuneng (284K ton) and Wanrun (198K ton) ranked 1st and 2nd on the list, while Dynanonic (166K ton) and Lopal(138K ton) took the 3rd and 4th places based on their growth higher than that of last year. Given the fact that the upper ranks are all taken by the Chinese companies, it is obvious that the LFP cathode material market is dominated by the Chinese companies. In turn, the growth of LFP cathode material market is directly connected to the reinforcement of global dominance by the Chinese material companies, which ultimately leads to solidify the China-centered structure in the global supply chain for battery materials.

(Source: 2025 Nov Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In 2025, the cathode materials market entered a clear transition phase as the rapid growth of LFP converged with the advancement of high-nickel chemistries. In terms of volume, LFP continues to gain dominance, especially in mass-market EVs, while high-nickel materials remain essential for long-range and high-performance electric vehicles. China’s temporary suspension of battery material export restrictions offers short-term stability, but the possibility of reinstatement leaves the global supply chain—and the recovery of Korea’s cathode material exports—highly dependent on policy developments. In this environment, Korean companies must go beyond simple capacity expansion and instead, they should restructure their supply chains around local production in North America and Europe and non-Chinese raw materials. They are also required to refocus their product portfolios on premium NCM cathodes and non-Chinese LFP/LMFP, and concentrate capital and capabilities on a select group of companies with proven financial performance, rather than spreading resources too thin. This strategic focus is expected to be essential for long-term competitiveness.

[2] Based on batteries installed to electric vehicles registered during the relevant period.