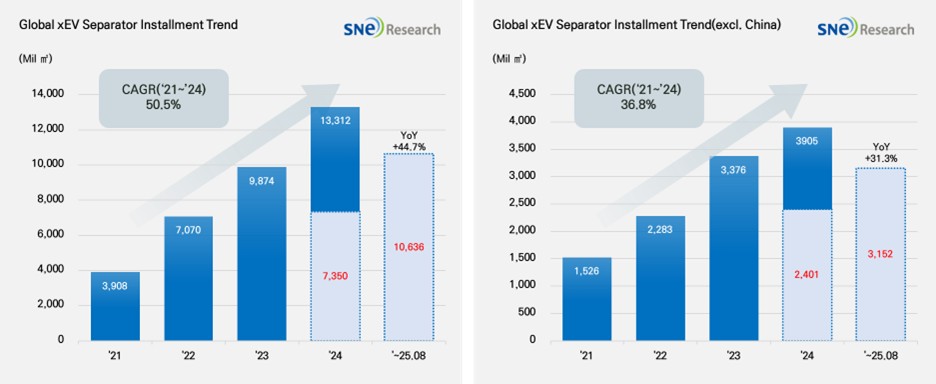

From Jan to Aug 2025, Global[1] Electric Vehicle Separator Installment[2] Reached 10,636Mil ㎡, a 44.7% YoY Growth

- With the increasing installment of

batteries in electric vehicles in 2025, the global separator market maintained

steady growth

(Source: 2025 Sep Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Aug 2025, the total installment of separators used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 10,636 Mil ㎡, posting a 44.7% YoY growth. During the same period, the total installment of separators in the non-China market was 3,152Mil ㎡, posting a 31.3% YoY growth and continuing to be in a stable growth.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

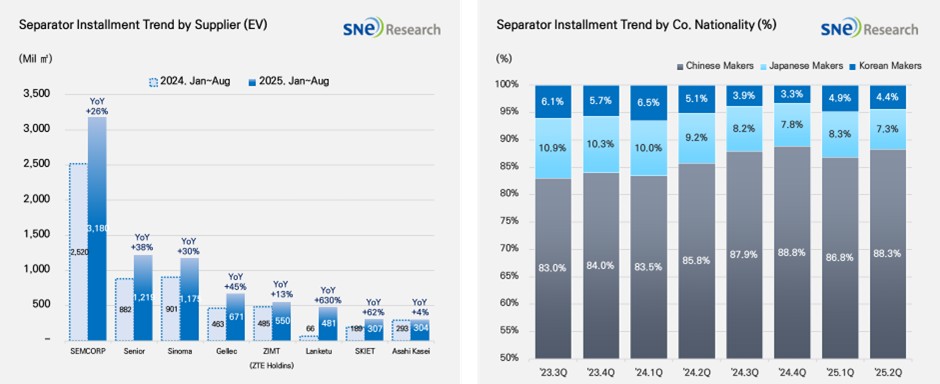

From Jan to Aug 2025, major separator suppliers showed noteworthy growth in the global separator market. In particular, the installment of SEMCORP’s separator was increased by 26.2% from the same period last year, reaching 3,180Mil ㎡ and leading the market. Other major Chinese companies such as Senior (+38.2%), Sinoma (+30.4%), and Gellec (+44.8%) also continued to be in an upward trend. Other than them, ZIMT and CMZF also posted more than double-digit growth, expanding their shares in the market. On the other hand, SK IE Technology from Korea also showed a 62.2% YoY growth, having 307Mil ㎡ of separator installed in EV batteries and exhibiting a steady growth.

In terms of market shares of companies by nationality, the Chinese separator makers accounted for almost 90% of the entire market share, boasting their dominance in the market. Since the 3rd quarter of 2023, the market shares of Japanese and Korean separator suppliers have been continuously declining. In the 2nd quarter of 2025, the Japanese separator makers took up 7.3%, and the Korean companies accounted for 4.4% of the market share. As the market dominance by the Chinese suppliers have strengthened, the competition landscape has been further polarized between the Chinese makers and non-China companies in the global separator market.

(Source: 2025 Sep Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

Recently, the separator market has entered a phase where technological advancement and diversification of production system are both required in accordance with widespread use of high-performance battery technology and change of regional procurement strategies.

With the increasing demand for high-power and high-energy density cells, more and more battery makers require separators to have thermal stability, precision in thickness control, and balance of ionic conductivity. In this regard, the global separator makers have been continuously expanding the proportion of high-value-added products with ceramic coating and others.

On the other hand, the US government has been suggesting a possibility in expanding its high-tariff policies to battery materials and components. Against this backdrop, it has become more important than ever for separator makers to secure stability in separator production and localize their product production.

The European Union, through the “EU Battery Regulation,” has explicitly mandated ESG due diligence obligations across the battery supply chain, underscoring that transparent sourcing and environmentally responsible manufacturing processes are becoming integral components of corporate competitiveness. However, the enforcement of this regulation has been postponed until 2027, providing companies with a preparatory window to proactively align with the forthcoming requirements.

Amid these developments, the separator market is undergoing structural change as competition shifts beyond capacity expansion toward product sophistication and supply-chain design capabilities. This transition reflects broader trends of rising technological requirements, the localization of production strategies, and the adoption of sustainability standards.

[2] Based on batteries installed to electric vehicles registered during the relevant period.