Global FCEV Market Registering Double-Digit Growth with Hyundai Motors in No. 1 Position from January to August 2022

- Hyundai Motors in No. 1 position with a double-digit growth, and Nexo saw a sharp growth in sales

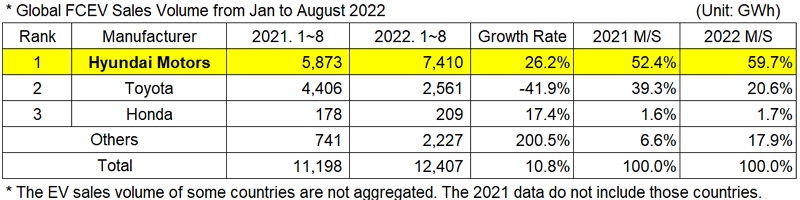

Amidst lingering uncertainties in the global FCEV market from January to August 2022, Hyundai Motors stayed on top of the list among the global FCEV manufacturers. Despite the tendency of automobile market to focus on electric vehicles and news about the postponement of new model release of Nexo, which has been in the market for 5 years, Hyundai Motors put up a good fight in the market, registering a double-digit growth compared to the same period of last year.

A total number of globally registered FCEVs sold from January to August 2022 was 12,407 units, staying in the trend of being steady with an upward tendency, compared to the same period of last year. While Hyundai’s Nexo (1st gen.) 2021 model showed a steady sales record in August 2022, a new model of Mirai 2nd generation from Toyota experienced a huge drop in sales if compared to the same period of previous year. This resulted in a 39.1%p gap between the market shares of the two leading companies in the FCEV market. A Chinese media outlet reported that Toyota would import and sell Mirai 2nd generation in China at the end of this year. As Toyota reportedly plans to localize their manufacturing in China after launching their FCEV model in the Chinese market, it is expected that Toyota may have a chance to recover its market share on a gradual basis. Since Hyundai Motors is also known to plan a model release in future, based on Nexo (1st gen), that will be prepared in compliance with the local regulations in China, future sales volume changes in the Chinese FCEV market between Hyundai Motors and Toyota seem to draw attention from the industry.

Several factors played a role in slowing down the growth of the global FCEV market compared to the previous year: stagnation in growth of the FCEV market affected by the EV-oriented strategies; non-stop supply chain issues with raw materials and auto parts, especially semiconductors; and the Russia-Ukraine War. Despite these harsh conditions, Hyundai Motors has been leading the market, registering a growth rate of 26.2%. In particular, the sales of Nexo (1st gen.) in Germany was 302 units, the biggest sales record outside of Korea.

By company, Toyota stayed at degrowth same as the previous month, while Hyundai Motors maintained the lead in the market with an upward trend in its sales. Toyota has been still under the influence of adverse conditions including the nation-wide supply chain issues in Japan, natural disasters, etc. Honda, although it managed to maintain a double-digit, YoY growth rate, has seen a sluggish growth as the production of Clarity discontinued in August 2021.

The FCEV market, which recorded almost a two-fold growth in 2021, has not made any remarkable achievements in 2022 due to diverse issues in the globe and rapid increases in new electric vehicle models. Hyundai Motors, thanks to the steady sales of Nexo (1st gen.) 2021 model, seem to safely keep the leading position in the market, but there are more changes expected in the FCEV market as global FCEV manufacturers have established various strategies for future. As they all aim to develop the next-generation fuel cell system to compensate the power output issues and cost competitiveness, they seem to finally find a way to satisfy customer needs for new model releases and to secure competitiveness in the fuel cell commercial vehicle fields, regarded as a blue chip in the market.