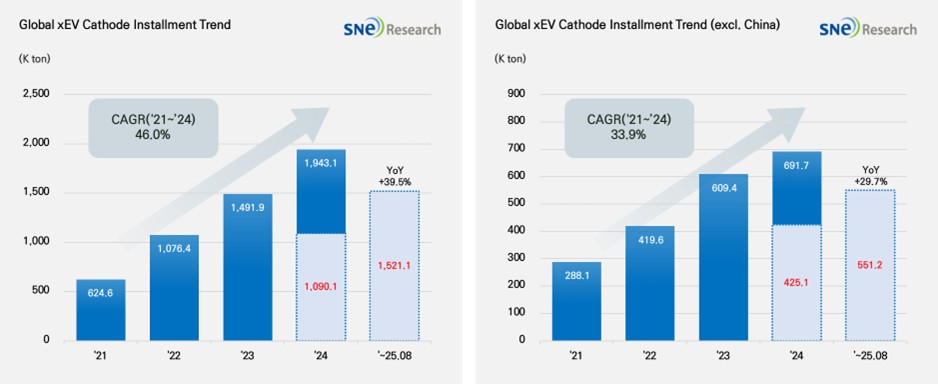

From Jan to Aug 2025, Global[1] Electric Vehicle Battery Cathode Material Installment[2] Posted 1,521K ton, a 39.5% YoY Growth

- From Jan to Aug 2025, EV battery cathode material installment in non-China market was 551K ton, posting a 29.7% growth

(Source: 2025 Sep Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Aug 2025, the total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 1,521K ton, posting a 39.5% YoY growth. If we look at the market except China, the total cathode usage was 551K ton, and the growth rate was 29.7% which was steady and stable. Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently, the battery market can be divided into the one centered around NCx ternary cathode material and the other mainly led by LFP cathode material, and both are driven by technical and economic advantages of each cathode material. Amidst the diversification of global cathode material demand, NCx ternary cathode material and LFP cathode material are positioning themselves as two main axes in the market.

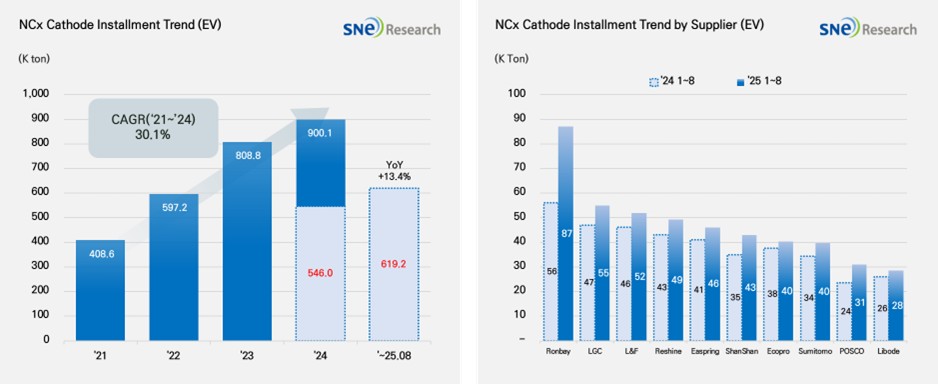

If we look at the market by different cathode materials, the installment of ternary cathode material during the relevant period was 619K ton, posting a 13.4% YoY increase and continuing a gradual growth. By company, Ronbay and LG Chem ranked 1st and 2nd on the list, leading the market. L&F (52K ton), Ecopro (40K ton), and POSCO (31K ton) all entered the upper rank, maintaining their reputation as leading Korean suppliers in the market. Overall, however, the growth of Chinese cathode material makers showed a noticeable growth. Major cathode suppliers such as Reshine, Easpring, and ShanShan are competing fiercely, and the Chinse cathode makers are gradually expanding their global market shares based on demand from the Chinese domestic market, price competitiveness, and their massive ramp-up plans.

(Source: 2025 Sep Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

During the same period, the total installment of LFP cathode material was 902K ton, showing a rapid growth of 65.7% compared to the same period last year. In terms of growth pace, LFP cathode material surpassed that of ternary cathode material. Among the total cathode material installment, the proportion taken by LFP was about 59% and higher (based on weight), meaning that the usage of LFP material has an increasing influence on the market. It is interpreted as being affected by the expansion of entry-level EV market in China, increasing preference to LFP chemistry with price competitiveness, and increasing adoption of LFP batteries by global OEMs. By cathode suppliers, Hunan Yuneng (214K ton) and Wanrun (145K ton) ranked 1st and 2nd on the list, while Dynanonic (111K ton) and Lopal (95K ton) took the 3rd and 4th places based on their growth higher than that of last year. Given the fact that the upper ranks are all taken by the Chinese companies, it is obvious that the LFP cathode material market is dominated by the Chinese companies. In turn, the growth of LFP cathode material market is directly connected to the reinforcement of global dominance by the Chinese material companies, which ultimately leads to solidify the China-centered structure in the global supply chain for battery materials.

(Source: 2025 Sep Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The cathode materials market has reached a turning point where technological regulations and reshuffling of supply chain mount pressures to the market. China strictly restricts the transfer of key cathode technology to overseas, while the EU requires a transition to the circulation system by heightening standards for recycling efficiency and recovery. While the Chinese companies are taking a so-called “China Plus One” strategy for their overseas expansion, the global market is expected to face oversupply and intensifying price competition. Under these circumstances, it is highly likely that those who succeed in developing in-house technology, securing supply stability based on recycling, and local distribution of production, would capture a leading position in the market.

The structure of the product landscape has long been shaped around vehicle performance and cost, and this trend has become increasingly pronounced in recent years. LFP batteries are expanding their presence on the back of strong cost competitiveness and wider adoption in mass-market EVs, while high-nickel chemistries are firmly securing their position in the long-range and high-performance segments. At the same time, portfolio diversification into LMFP, solid-state, and sodium-ion batteries has become a matter of survival rather than choice. For companies, the core of strategy now lies in accuracy rather than speed. It is deemed more effective to expand production capacity in stages, starting with lines that have proven demand, modularize manufacturing by region, and redesign sourcing and processes in accordance with U.S. FEOC and tariff frameworks to establish localized supply chains.

[2] Based on batteries installed to electric vehicles registered during the relevant period.