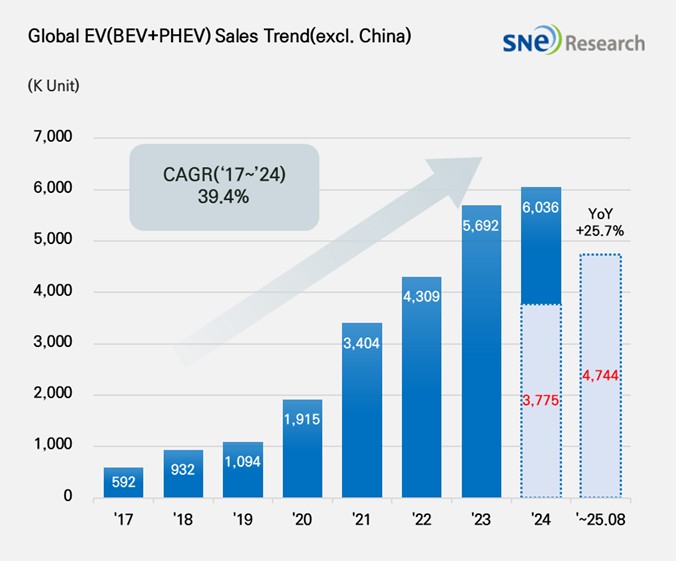

From Jan to Aug in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 4.744 Mil Units, a 25.7% YoY Growth

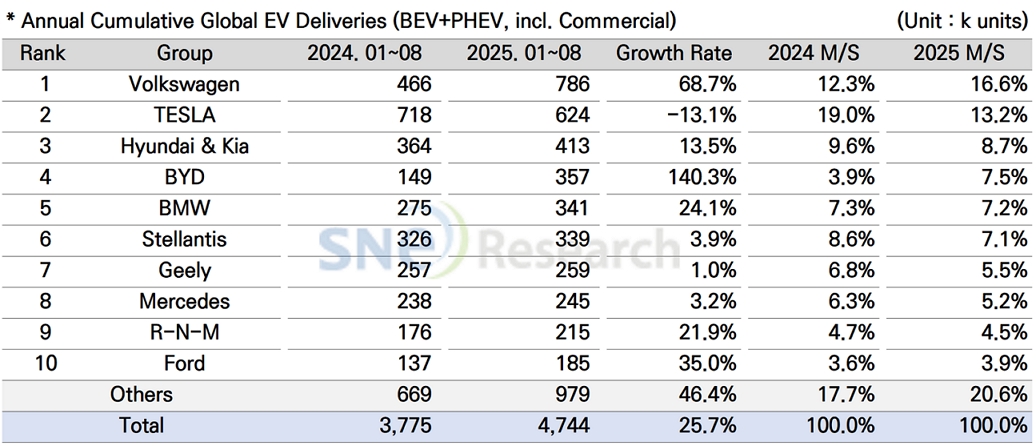

- Volkswagen ranked 1st by selling 786k units…Tesla

ranked 2nd with 13.1% degrowth

From Jan to Aug in 2025, the total number of electric vehicles

registered in countries around the world except China was approx. 4.744 million

units, a 25.7% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Sept 2025, SNE Research)

By group, Volkswagen Group took No. 1 position in the ranking of global electric vehicle deliveries, excluding China, by selling 786k units and posting a 68.7% YoY increase. Major models such as ID.4, ID.7, and ENYAQ, built on the MEB platform, showed strong sales momentum in the European market. Increasing sales of new vehicles, such as A6/Q6 e-Tron and Macan 4 Electric, to which the PPE platform is applied, are regarded as a drive behind such rapid growth of VW Group.

Even though Tesla ranked 2nd on the list by delivering 624k units, it saw a 13.1% YoY decrease, seriously affected by a slowdown in demand. Deliveries of Model Y and 3 reduced by 7.6% and 16.8% respectively, becoming a major reason for the overall sales decline. Sales of premium sedans – Model S and Model X – also decreased by 59.6% and 44.2% respectively, showing that Tesla’s competitiveness in the premium segment has weakened. Although 15k units of Cybertruck were delivered to customers, compared to the same period last year, its sales experienced a 26.4% YoY decline. It seems Cybertruck has not made a meaningful contribution yet to recovery of overall sales.

Hyundai Motor Group in the 3rd place sold approx. 413k units, posting a 13.5% YoY increase. In addition to steady demand for IONIQ 5 and EV 6, expanding sales of EV 3 and Casper (Inster) EV have led to the growth of sales. Particularly, EV 3 is received well in the markets of Europe and emerging countries in Asia, while Casper EV is contributing to expansion of sales by absorbing a new demand for electric vehicles suitable for urban commuting and driving.

(Source: Global EV & Battery Monthly Tracker – Sept 2025, SNE Research)

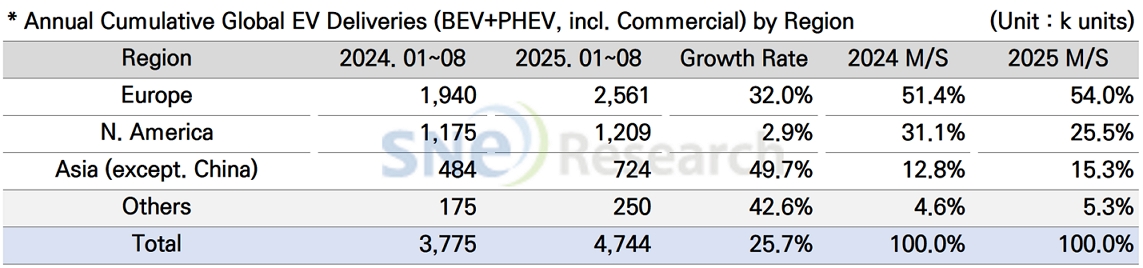

By region, Europe posted a 32.0% YoY growth with 2.561 million units of electric vehicles sold. The European market from Jan to Aug, in turn, accounted for 54.0% of the global EV market. Strengthened regulations on carbon emissions drove a recovery in demand, but the expansion of market shares held by the Chinese EVs has aggravated a price competition in the European market. The Chinese OEMs, such as BYD, NIO, and Xpeng, are working to invest in local production sites in Hungary and Spain. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles.

The North American market recorded only a 2.9% YoY growth with 1.209 million units sold, accounting for 25.5% of the non-China EV market. Taking advantage of tax credits under the US IRA, GM, Ford, and Hyundai have been expanding their local production in North America, but the actual demand has been lower than expected. With high tariffs on Chinese-made electric vehicles and the expanded application of the Foreign Entity of Concern (FEOC) exclusion rules effectively blocking Chinese players from entering the North American market, ongoing discussions over the reduction and potential termination of federal tax credits are amplifying short-term demand uncertainty.

The Asia market (excluding China) exhibited a 49.7% YoY growth with 724k units sold, taking up 15.3% of market share. In India, demand for entry-level electric vehicles, of which price ranges from US$ 10k to 20k, has been rapidly growing, while, in Japan, conversion to BEVs has become much visible mainly by Toyota and Honda. Due to huge gaps in EV subsidies and charging infrastructure in countries, differences in the pace of growth have remained. India is attracting global automakers by combining conditional tariff reductions on imported electric vehicles above a certain price threshold with requirements for local investment and localization. Meanwhile, Thailand and Indonesia are strengthening policy models that integrate production subsidies, tax incentives, and domestic demand stimulation measures.

(Source: Global EV & Battery Monthly Tracker – Sept 2025, SNE Research)

The success of the non-Chinese electric vehicle (EV) market will ultimately hinge on policy and cost competitiveness. In Europe, regulations such as battery carbon footprint requirements, battery passports, and supply-chain audits are becoming standard, increasing costs but benefiting companies that move quickly to localize procurement and production through advantages in pricing and lead time. As tariffs on Chinese imports erode the appeal of imported vehicles, localized manufacturing and component sourcing within Europe are becoming increasingly advantageous. In the United States, high tariffs and the Foreign Entity of Concern (FEOC) rule are effectively blocking Chinese supply chains, while changes to subsidies and tax credits are amplifying demand uncertainty. Ultimately, companies that rapidly establish compliant systems for procurement, production, and certification in line with each region’s regulatory framework – and that achieve a balance between price and profitability in the mass-market segment through low-cost batteries such as LFP and platform standardization – will be best positioned to maintain both market share and earnings.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period