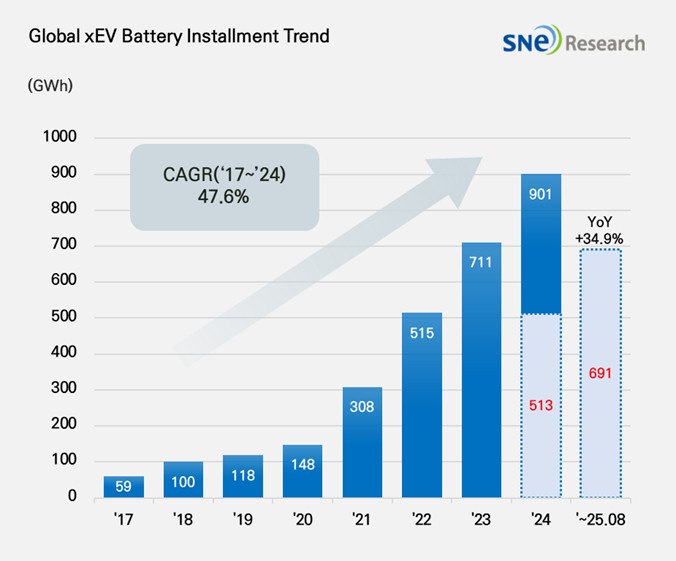

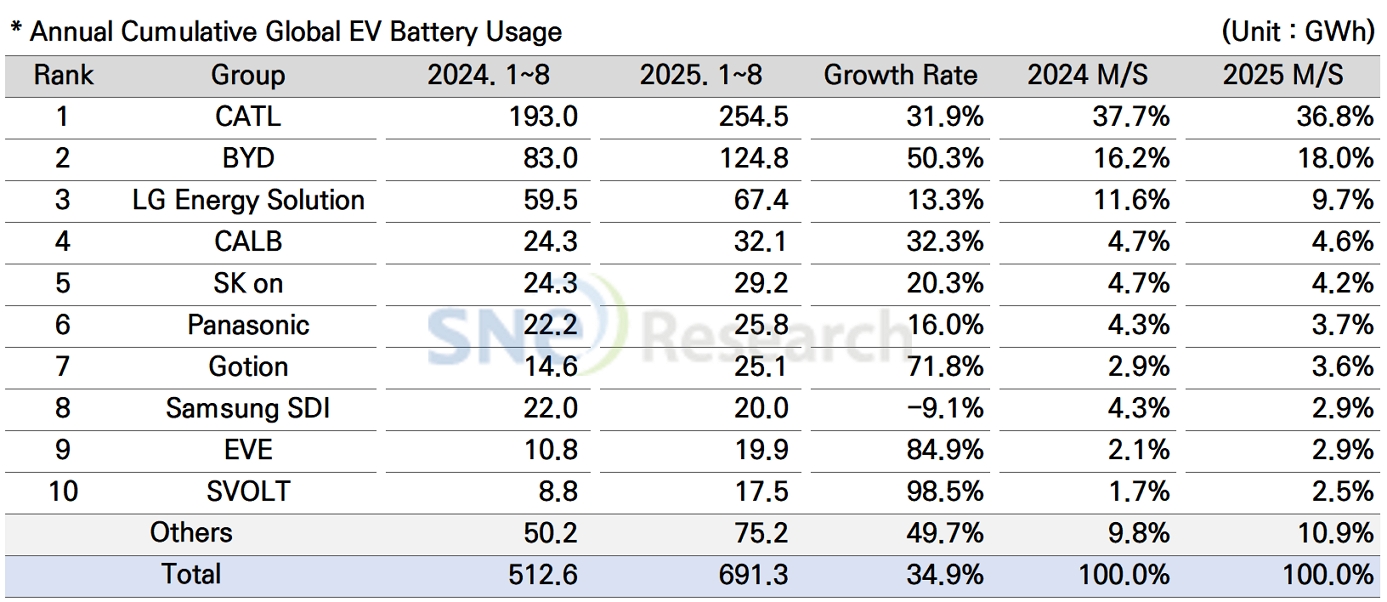

From Jan to Aug in 2025, Global[1] EV Battery Usage[2] Posted 691.3GWh, a 34.9% YoY Growth

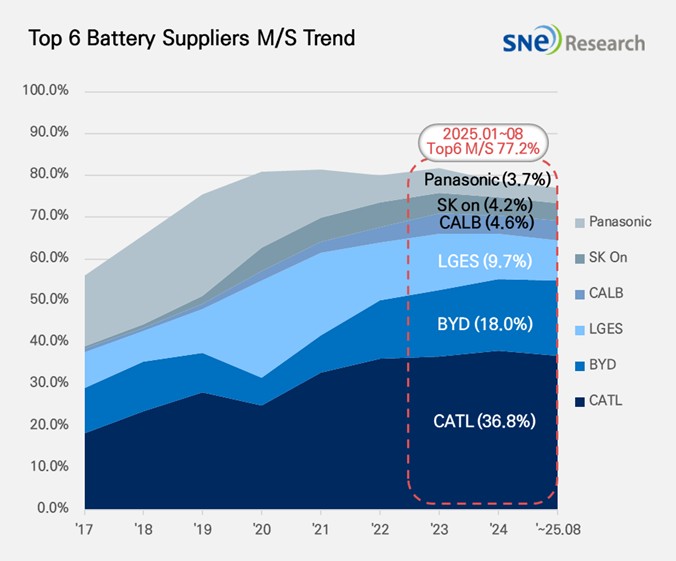

- From Jan to Aug in 2025, K-trio’s M/S recorded 16.8%, a 3.8%p YoY decline

From Jan to Aug in 2025, the amount of energy held by batteries

for electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 691.3GWh, a 34.9% YoY growth.

(Source: 2025 Sept Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from Jan to Aug in 2025 posted 16.8%, a 3.8%p decline from the same period last year. LG Energy Solution remained 3rd on the list with a 13.3%(67.4GWh) YoY growth. While SK On ranked 5th with a 20.3%(29.2GWh) growth, Samsung SDI posted a 9.1%(20.0GWh) degrowth.

(Source: 2025 Sept Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of EVs, Samsung SDI’s battery was mainly supplied to BMW, Audi, and Rivian. BMW has Samsung SDI’s batteries in its major electrified models such as i4, i5, i7, and iX, and thanks to the overall increase in sales of those models, the usage of Samsung SDI’s battery by BMW consequently increased. In case of Rivian, although they recorded stable sales of R1S and R1T in the US, the newly launched standard range trim, to which Gotion’s LFP batteries are installed, has had a negative impact on the share of batteries supplied by Samsung SDI to Rivian. On the other hand, as Audi started selling Q6 e-Tron, built on the PPE platform, the usage of batteries recorded a 15.9% YoY growth.

SK On’s battery was installed to electric vehicles made by Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group has SK On’s battery in IONIQ 5 and EV 6 most, and the steady sales of VW ID.4 and ID.7 also contributed to an increase in the usage of batteries made by SK On. Despite a slowdown in sales of Ford F-150 Lighting, to which large-capacity batteries are installed, the increasing sales of Explorer EV has led to a 13.0% YoY growth in the usage of batteries made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, Chevrolet, Kia, and Volkswagen. Due to a slowdown in sales of Tesla models, to which LG Energy Solution’s batteries are installed, the usage of LGES’ batteries by Tesla saw a 15.8% YoY decrease. On the other hand, thanks to favorable sales of Kia EV 3 in the global market and expanded sales of Chevrolet Equinox, Blazer, and Silverado EV, to which the Ultium platform was applied, in the North American market were regarded as a major drive behind the increasing usage of batteries made by LG Energy Solution.

Panasonic, which mainly supplies its batteries to Tesla, ranked 6th on the list with the battery usage of 25.8GWh. Panasonic has been speeding up the reshuffling of supply chain to focus on the North American market, in response to the recently fortified US tariffs on the Chinese batteries and raw materials. To be specific, Panasonic is working on lowering its dependency on the Chinese materials, expanding the procurement of local materials, and securing new material sources in order to increase the stability in battery production. These efforts are expected to lay a significant foundation for recovery in the usage of batteries made by Panasonic and maintaining its market share in the North American market.

CATL firmly remained top in the ranking of global battery usage, posting a 31.9%(254.5GWh) YoY growth. Major OEMs such as ZEEKR, AITO, Li Auto, and Xiaomi have chosen CATL’s batteries for their EVs, and many global major OEMs like Tesla, BMW, Mercedes-Benz, and Volkswagen, have also adopted CATL’s batteries.

BYD took the 2nd position on the list with a 50.3%(124.8GWh) growth rate. BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, has been expanding sales of various models based on its strong price competitiveness. It has been solidifying its presence not only in the Chinese domestic market but also in the global market. In particular, BYD showed a noteworthy expansion in the European market. In the 1st half of this year, the usage of BYD batteries in Europe recorded 8.6GWh, a 263.1% YoY increase.

(Source: 2025 Sept Global Monthly EV and Battery Monthly Tracker, SNE Research)

The global secondary battery market continues to grow rapidly; however, regulatory changes and raw material supply risks have emerged as key variables shaping regional strategies. As the G7 and the European Union consider introducing price caps and export controls on rare earth elements, securing stable access to critical minerals has become a central challenge in the battery cost structure. Meanwhile, the United States is accelerating government-led efforts to strengthen its lithium supply chain, exemplified by its acquisition of a stake in Lithium Americas. At the same time, Chinese battery manufacturers are rapidly expanding their presence in Europe by increasing local production, such as CATL’s plant construction in Spain, which is heightening competitive pressure on local companies in terms of technology and investment. Against this backdrop, battery makers face complex challenges that go beyond simply scaling up production—ensuring regulatory compliance, diversifying material sources, and pursuing sustainable design and recycling strategies. Only companies with technological innovation and flexible business structures are expected to gain a competitive edge in the medium to long term.

[2] Based on battery installation for xEV registered during the relevant period.