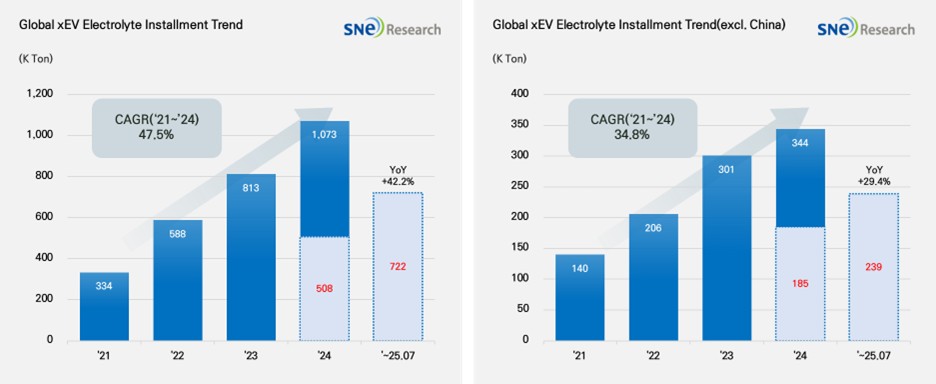

From Jan to July 2025, Global[1] Electronic Vehicle Battery Electrolyte Installment[2] Reached 722K ton, a 42.2% YoY Growth

- In 2025, the

electrolyte market continued to post a double-digit growth, while the non-China

market showed a stable expansion in demand

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to July 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 722K ton, posting a 239% YoY growth. Particularly in the global market outside China, the total usage of electrolyte for electric vehicles recorded 239K ton and 29.4% YoY growth, continuously exhibiting a stable expansion in demand.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market is expected to continue steady growth in the mid to long run.

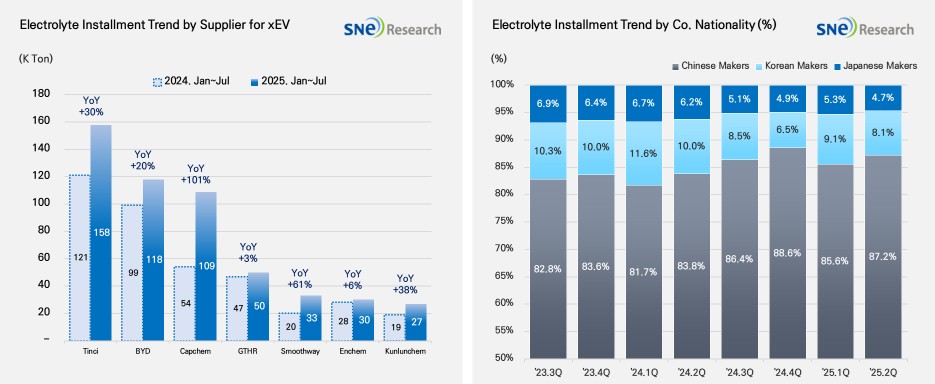

From Jan to July 2025, the global electrolyte market showed a remarkable growth among major electrolyte suppliers. Tinci took the top position in the market, posting a 30% YoY growth by supplying 159K tons of electrolyte. BYD followed Tinci in the ranking with 118K ton, a 20% increase. Capchem exhibited an 101% growth with 109K ton, while GTHR supplied 50K ton to be used in batteries installed in electric vehicles. Smoothway posted a 61% growth with 33K ton. The Korean electrolyte suppliers such as Enchem (30K ton, +6%) and Soulbrain (20K ton, +19%) also maintained steady growth.

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market shares of companies by their nationality, the Chinese electrolyte suppliers are still leading the electrolyte market. As of Q2 2025, the market shares taken by the Chinse electrolyte companies were 87.2%, while the Korean and Japanese companies took up 8.1 and 4.7%, respectively. The market shares held by the Korean and Japanese electrolyte makers were slightly lower than the same period of last year. While the Chinese companies are solidifying their market dominance, it becomes more important for the non-China companies to secure their own competitive edge.

In the recent electrolyte market, technological directions and competitive dynamics are shifting in line with the trend toward higher output in electric vehicles and the commercialization of next-generation batteries. In particular, with the full-scale introduction of new battery technologies such as all-solid-state batteries and high-voltage, high-energy-density cells, electrolyte manufacturers are accelerating the development of products with high safety and durability. As demand for premium electrolytes increases, strategic collaborations with global OEMs for joint technology development are emerging as a key to securing new competitiveness, and materials companies in Korea and Japan are actively leveraging this as an opportunity.

In addition, as the trend of expanding demand outside China continues, the push for supply chain localization in North America and Europe is prompting the electrolyte industry to adopt regional diversification strategies. Accordingly, some major companies are enhancing their customer responsiveness by securing local production bases, while also working to expand long-term contracts based on establishment of a stable supply chain.

The electrolyte market is expected to continue growing in the future, driven by the wider adoption of electric vehicles and the spread of high-performance battery technologies. In particular, companies that achieve differentiation in terms of technology, quality, and supply stability are likely to gain an advantage during the medium- to long-term market restructuring process, and competition among electrolyte manufacturers focused on technological capabilities is expected to intensify further.

[2] Based on batteries installed to electric vehicles registered during the relevant period.