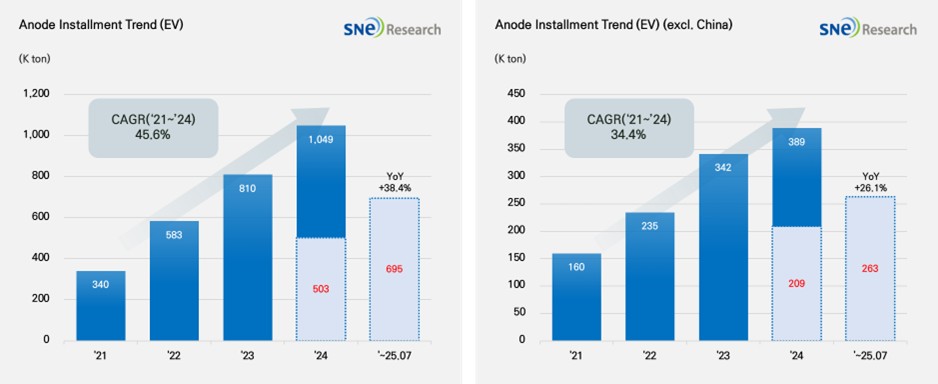

From Jan to June in 2025, Global[1] Electric Vehicle Battery Anode Material Installment[2] Reached 695K ton, a 38.4% YoY Growth

- Anode installment in the non-China market recorded 263K ton, a 26.1% growth

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to July 2025, the total installment of anode materials in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 695K ton, posting a 38.4% YoY growth and staying in an upward trend. On the other hand, in the global market outside China, the total installment of anode materials was 263K ton, recording a 26.1% growth only. Despite relatively moderate growth, the overall trend of steady growth was maintained.

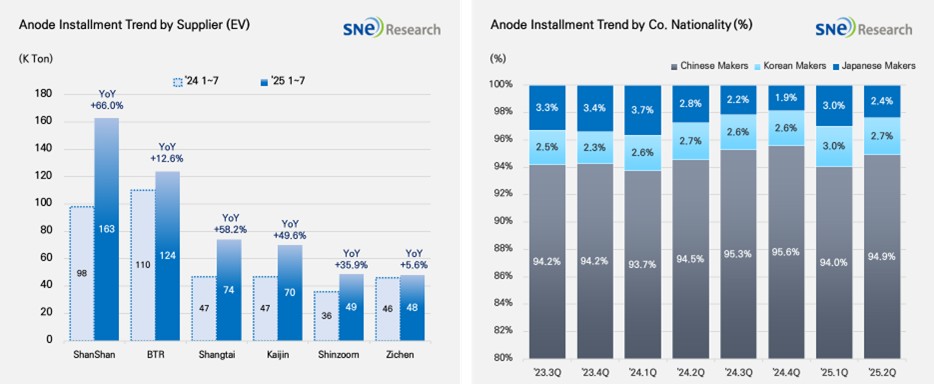

If we look at the market shares held by companies, ShanShan (163K ton) and BTR (124K ton) ranked 1st and 2nd on the list, leading the global anode market. These two companies have successfully secured a stable customer base and mass production capabilities, by supplying anode materials to major batter makers such as CATL, BYD, and LG Energy Solution. Shangtai (74 K ton), Kaijin (70 K ton), Shinzoom (49 K ton), and Zichen (48 K ton) were all ranked high, exhibiting a double-digit YoY growth and their expanding presence in the global market.

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

If we look at the market shares of companies by their nationality, the Chinese anode makers accounted for about 95% of the entire market share, keeping their absolute dominance in the market. Based on expansion of production capacity and sophistication of technology, they have been solidifying their market dominance. With the electric vehicle market expanded, more Si-anode has been adopted, leading them to further intensify cooperation with major battery makers. Although the market shares taken by the Korean anode makers were only around 2.7%, cooperation with major cell makers has been expanded mainly by POSCO and Daejoo. This means that the Korean anode suppliers are trying in earnest to enter the market. On the other hand, the Japanese anode manufacturers accounted for only 2.4% of the market share, showing a relatively insignificant presence in the market. Hitachi and Mitsubishi maintained their conservative business management system relying on the existing customers, which seemed to gradually weaken their competitiveness in the market.

The anode materials market is entering a new transition phase, as demand for conventional natural and synthetic graphite remains solid while recent U.S. tariff policies and the shift toward next-generation batteries intersect. In July 2025, the U.S. Department of Commerce issued a preliminary ruling to impose anti-dumping and countervailing duties on synthetic graphite for anode materials imported from China, directly influencing procurement strategies of battery manufacturers in North America. Consequently, efforts are accelerating in the United States to develop alternative materials to graphite and to secure non-China-based anode supply chains. Europe, likewise, is strengthening supply diversification and sustainability reviews in line with its carbon neutrality policies

Meanwhile, silicon-composite anode materials are emerging as a promising alternative, meeting the growing demands of electric vehicles for high energy density, fast charging, and long cycle life. Global battery makers are gradually expanding adoption of hybrid anodes with higher silicon content, while major material companies in the United States, Korea, and Europe are investing in commercialization technologies and expanding production capacity in preparation for the lithium-ion and solid-state battery era

As such, the anode materials market is facing a dual structure in which traditional graphite demand and next-generation silicon demand coexist, while also contending with overlapping challenges of geopolitical risks, supply chain reconfiguration, and technological transition. Going forward, market competitiveness is likely to be determined by the ability to secure raw materials, the pace of silicon anode commercialization, and the agility to respond to strategies targeting North America and Europe.

[2] Based on batteries installed to electric vehicles registered during the relevant period.