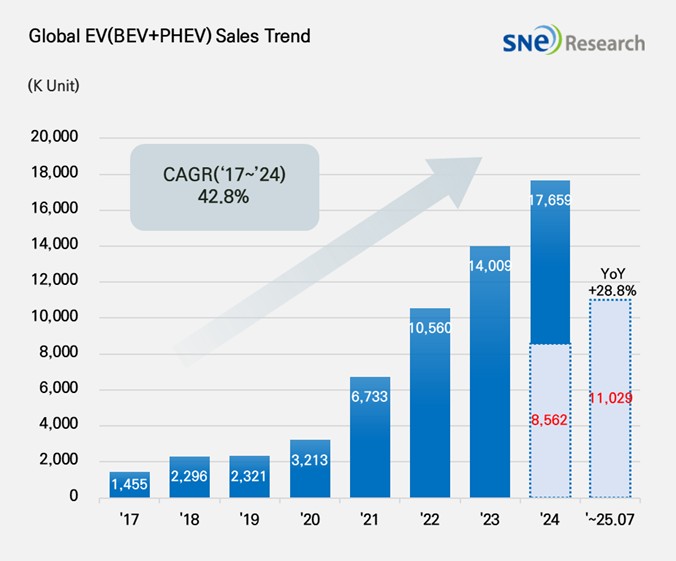

From Jan to July in 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approximately 11.029 Mil Units, a 28.8% YoY Growth

- BYD ranked top by selling 2.196 mil units; Geely ranked 2nd with 70.3% growth

From Jan to July in 2025, the number of electric vehicles

registered in countries around the world was approximately 11.029 million

units, a 28.8% increase from the same period last year (8.562 mil units).

(Source: Global EV and Battery Monthly Tracker – Aug 2025, SNE Research)

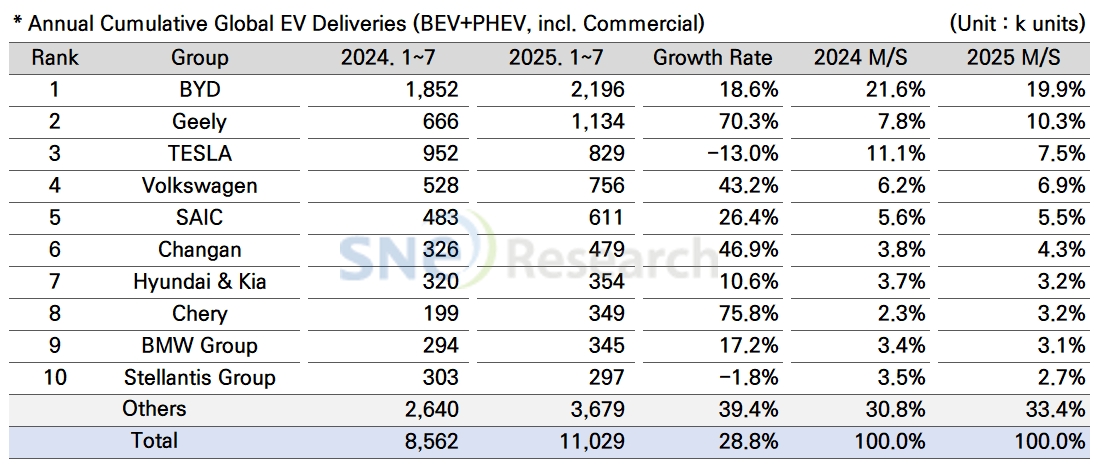

From Jan to July in 2025, BYD remained top on the list by selling approx. 2.196 million units, a 18.6% YoY increase. BYD has been flexibly responding to recent changes in tariffs and subsidy policies by building production sites in the European region (Hungary and Turkey) and the Southeastern Asian region (Thailand, Indonesia, and Cambodia). While steadily increasing its brand awareness based on price competitiveness and technology, BYD has been working to diversify its model line-ups from commercial vehicles to ultra-small vehicles to improve its competitiveness across the entire ecosystem for electric vehicles. However, there has been concerns about its financial solvency as BYD recently expanded a bit too rapidly and thus the amount of liabilities increased. Against this backdrop, attention has been drawn to BYD whether its ongoing, aggressive investments would have positive or negative impacts on its future profitability and market shares.

Geely Group in 2nd place continued to be in an upward trend and posted more than a double-digit growth, recording a 70.3% YoY growth and selling approx. 1.134 million units. Geely’s Star Wish(星愿) model is gaining a popularity and contributing to expansion of line-ups. Its premium brand ZEEKR(极氪), hybrid-dedicated Galaxy(银河), and LYNK & CO(领克 aiming for the global market are targeting different classes of customers. In particular, Geely Group has been proactive in converting from internal combustion engine vehicles to electric vehicles and accelerating the in-house development of technology for batteries, electrical equipment, and software as well as the increase of production capacities. These vertical integration and in-house technology development strategies have been evaluated as key drives behind the competitiveness of Geely. Based on these, Geely is highly likely to expand its presence in the global market.

Tesla, in the 3rd place, saw a 13.0% YoY decrease in sales, selling approx. 829k units. A drop in sales of Model Y and 3 was regarded as a main reason for declines in the overall sales. In particular, Model Y experienced a 13.7% decrease in the global sales (613k units → 529k units), adding pressures to the entire sales performance. By region, Tesla saw a 26.8% YoY decrease in sales in the European market (134k units), a 13.5% YoY decline in sales in the North American market (317k units), and a 6.3% YoY decrease in China (304k units). In Europe, sales of Model Y (-23.3%) and Model 3(-31.6%) all recorded a double-digit degrowth. In North America, Model Y also exhibited an obvious slowdown in sales, recording a 12.2% YoY decrease. In China, sales of Model 3 exhibited a 26.5% YoY increase, but that of Model Y declined 17.1%, making it difficult for Tesla to avoid a degrowth in sales. In particular, sales of models in flagship segment, such as Model S and X, exhibited 62.2% and 48.8% decline respectively in the global market, meaning that Tesla is suffering from decreasing competitiveness in premium electric vehicles. Although Tesla continued to push forward with strategies to sophisticate the FSD function and expand the profit model based on monthly subscription-based software, tangible outcomes seem to be limited in the short run.

(Source: Global EV and Battery Monthly Tracker – Aug 2025, SNE Research)

Hyundai Motor Group sold approx. 354k units of electric vehicles, recording a 10.6% YoY increase and showing steady growth in the global EV market. In terms of BEV, IONIQ 5 and EV 3 mainly contributed to sales, and small-sized, strategic models including newly launched Casper (Inster) EV, EV5, and Creta Electric received well in the market. On the other hand, some of the existing models, such as EV 6, EV 9, and Kona Electric, showed a slowdown in sales, failing to maintain its growth momentum. In the North American market, Hyundai Motor Group delivered 95k units, following GM and Tesla. Even though Hyundai saw a 20.0% YoY decrease in the North American market, it continued to outperform major competitors such as Ford, Stellantis, Toyota, and Volkswagen, which seems to be important in understanding the landscape of electric vehicle market. With the expansion of EV 3 sales in the global market and addition of new vehicle line-up such as EV 4 and IONIQ 9, Hyundai Motor Group’s electrification portfolio has been gradually diversified, leading to an expectation that Hyundai would have a bigger market share from the mid to long term perspective.

(Source: Global EV and Battery Monthly Tracker – Aug 2025, SNE Research)

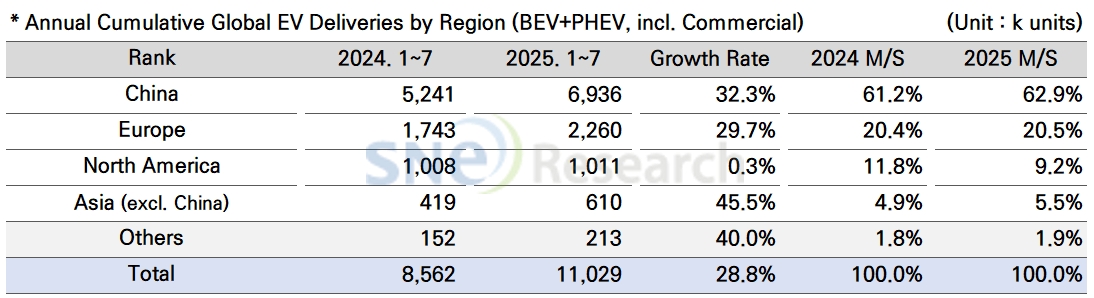

From Jan to July in 2025, the global electric vehicle market showed different trends in regions where the growth patterns have clearly diverged depending on related policies and demand structures in each country.

In China, taking up the biggest portion (62.9%) in the global market, a total of 6.936 million units of electric vehicles were sold, a 32.3 YoY increase. Centered around big cities in China, demand for entry-level electric vehicles expanded and the electrification of commercial vehicles increased. Autonomous subsidy policies introduced by local Chinese governments and expansion of charging infrastructure were effective in driving demand in the market. In particular, low-cost LFP technology developed by battery suppliers like CATL and BYD was commercialized, leading to a rapid expansion of market for mid to low-priced electric vehicle models.

In Europe, a total of 2.26 million electric vehicles were sold, a 29.7% YoY growth, the market share of European EV market was 20.5%, similar to the same period last year. Although the numerical indicators show continued recovery, the overall rise in price sensitivity has notably accelerated the market share gains of Chinese electric vehicles at the expense of incumbent brands. The Chinese OEMs, such as BYD, NIO, and Xpeng, are working to invest in local production sites in Hungary and Spain. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles. These structural shifts would be evaluated later depending on whether OEMs in Europe would later secure their own price competitiveness or not.

In the North American market, a total of 1.011 million units were sold, recording only a 0.3% YoY growth. The market share of North American market also dropped to 9.2%. Major OEMs such as GM, Ford, and Hyundai Motor Group have been trying to expand their local production in North America, taking advantage of tax credit benefits under the US IRA, but demand for electric vehicles was below expectation. As the Trump Administration has been pushing forward with tax cuts and easing of environmental regulations, the federal government is now considering reducing subsidies offered for electric vehicles. Under these circumstances, an outlook for electric vehicle demand seems to be adjusted downward, and OEMs are trying to modify their strategies, placing more emphasis on internal combustion engine vehicles.

The Asia market (excluding China) exhibited a 45.5% YoY growth with 610k units of electric vehicles sold in the market, accounting for 5.5% of the global market share. In emerging markets, mainly centered around India, demand for electric vehicles, of which price ranges from US$ 10k to 20k, has been rising. Japan is also signaling a full-fledged shift toward battery electric vehicles (BEV), led by Toyota and Honda. However,

Overall, from Jan to July in 2025, the global electric vehicle (EV) market has maintained its growth trajectory, but regional demand polarization and policy uncertainties are becoming increasingly prominent. Europe and emerging Asian countries are continuing their recovery, supported by the launch of new models across diverse price ranges and government promotion policies. In contrast, North America is showing weaker growth momentum due to a policy shift toward tax reductions and strategic adjustments by OEMs. In particular, major automakers are reducing the share of high-priced models in order to protect profitability, while reorganizing their strategies around mass-market vehicles. As a result, the price structure within the EV market is undergoing rapid readjustment. Going forward, automakers’ ability to secure technological competitiveness and cost efficiency in the mid- to low-priced segment is expected to become a key factor in reshaping the future market landscape.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period