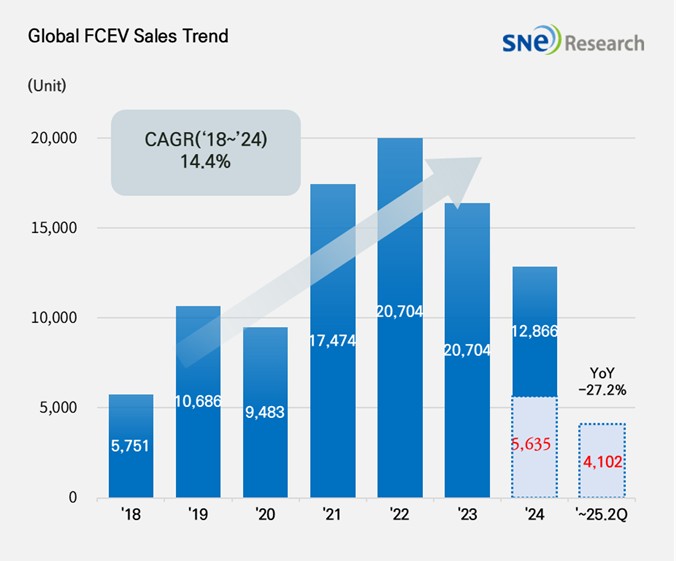

From Jan to June in 2025, Global FCEV Market Posted a 27.2% YoY Degrowth

- Hyundai Motor Group ranked No.1 in global FCEV market from Jan to June in 2025

A total number of globally registered FCEVs sold in H1 2025 was 4.102 units, recording a 27.2% YoY decrease and showing a visible downturn.

(Source: Global FCEV Monthly Tracker – July 2025, SNE Research)

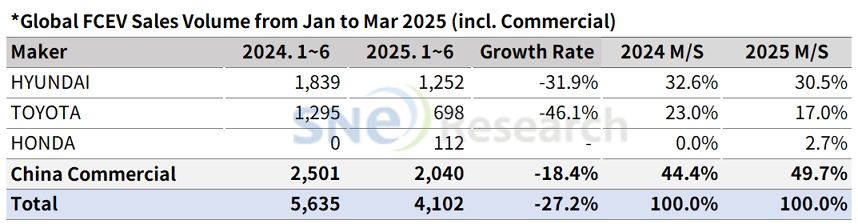

By company, Hyundai Motor Group sold a total of 1,252 units of FCEVs – mostly NEXO – and remained No. 1 in the market, despite posting a 31.9% degrowth. Last April, Hyundai released the 2nd generation model of NEXO in hopes for possible recovery, but the actual sales were below expectation. Toyota, selling 698 units of Mirai and Crown, experienced a sudden drop in sales, equivalent to a 46.1% YoY decrease. Even in Japan, Toyota faced a slowdown in sales. Despite going through such hard times, Toyota continued to invest in the development of FCEV technology and construction of related infrastructure. On the other hand, the Chinese FCEV makers have successfully kept themselves in a relatively stable position by focusing on commercial vehicles rather than passenger cars. Honda launched a hydrogen passenger car model, 2025 Honda CR-V e:FCEV, in the US and Japan. CR-V e:FCEV is the first plug-in FCEV SUV which combines a hydrogen fuel cell with plug-in charging technology. Equipped with a 4.3kg hydrogen tank and 17.7 kWh battery, the vehicle has received a 435-km EPA driving range rating.

(Source: Global FCEV Monthly Tracker – July 2025, SNE Research)

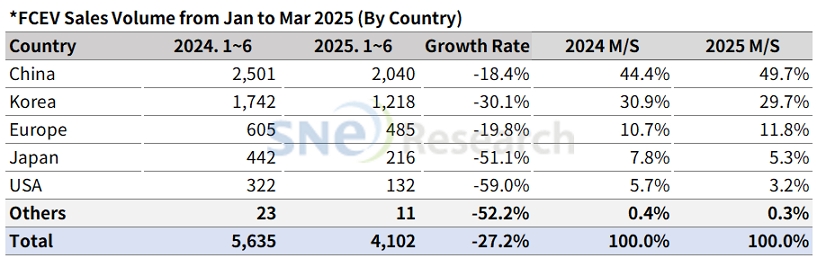

By country, due to decreasing sales of NEXO, Korea saw a slight decline in the market share, accounting for 29.7% of the global FCEV market. On the other hand, China, who has been focusing on developing commercial FCEVs, took up the biggest portion in the market and captured No. 1 position non only in the global EV market but also in the FCEV market. Other developed countries and regions such as Europe, the US and Japan all exhibited an obvious downturn in the growth of FCEV market. In Europe, 485 units of Mirai and NEXO combined were sold, posting a 19.8% YoY degrowth. In the US, sales of Mirai dropped dramatically by 59.0%. In Japan, the FCEV market experienced a 51.1% YoY degrowth due to a slowdown in sales of Mirai and Crown.

(Source: Global FCEV Monthly Tracker – July 2025, SNE Research)

The global hydrogen vehicle market is currently characterized by clear strategic differences among OEMs. BMW is targeting the premium SUV segment with its iX5 Hydrogen, while Hyundai is strengthening its demand-driven strategy in the commercial sector with models like the NEXO and Xcient fuel cell truck. Chinese manufacturers are rapidly expanding their share in the commercial segment, focusing on heavy-duty hydrogen trucks and long-haul freight routes. Japanese OEMs are concentrating on ecosystem development through technology exports and global partnerships, whereas Stellantis has officially withdrawn from the hydrogen vehicle business to focus entirely on its broader electrification strategy. The hydrogen vehicle market still faces structural limitations, including insufficient refueling infrastructure, high vehicle costs, and limited subsidies. However, strategies centered on real commercial demand, growing technological collaboration among OEMs, and intergovernmental hydrogen diplomacy are gradually paving the way for expansion—albeit within a small but increasingly sophisticated market. Looking ahead, the pace of hydrogen refueling infrastructure deployment and the long-term policy commitments of national governments are expected to be key factors influencing the growth trajectory of the global hydrogen vehicle market.