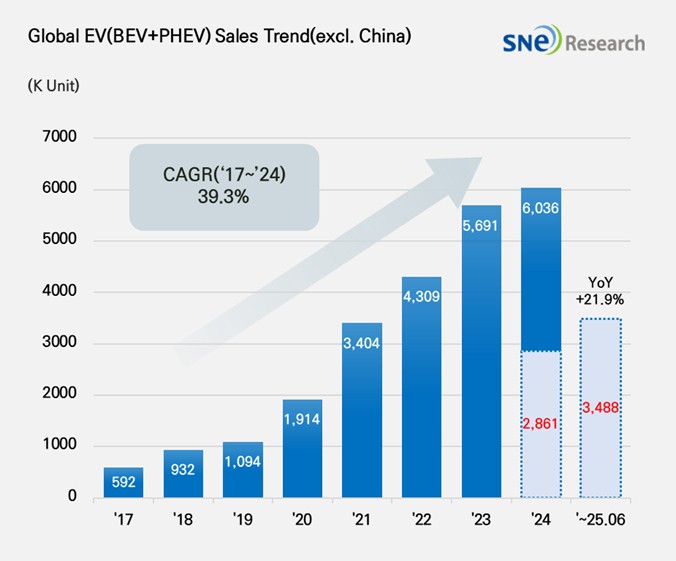

From Jan to June in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 3.488 Mil Units, a 21.9% YoY Growth

- Tesla ranked 2nd; VW took No. 1 position with a 66.2% YoY growth

From Jan to June in 2025, the total number of electric vehicles registered in countries around the

world except China was approx. 3.488 million

units, a 21.9% YoY increase.

(Source: Global EV & Battery Monthly Tracker – July 2025, SNE Research)

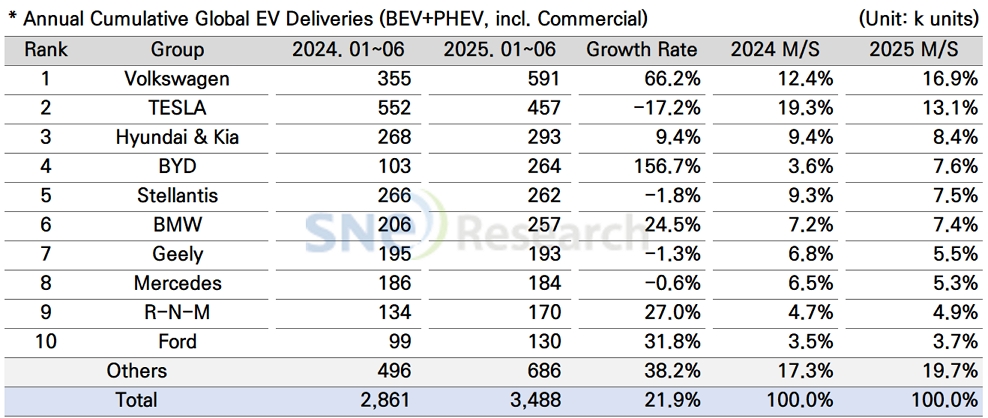

By group, Volkswagen Group outperformed Tesla and captured the 1st place in the ranking by selling 591k units, a 66.2% increase compared to the same period of last year. The growth of VW Group was mainly driven by strong European sales of ID.4, ID.7, and ENYAQ based on MEB platform, and sales expansion of new models such as A6/Q6 e-Tron and Macan 4 Electric to which PPE platform is applied.

Tesla in the 2nd position sold 457k units and posted a 17.2% YoY decrease. Sales of Model Y and 3 declined around 20%, leading to an obvious slowdown in demand for those models. Model S and Model X experienced a much more serious downturn in sales as Tesla has been losing its competitiveness in the premium segment market.

Hyundai Motor Group in the 3rd place sold approx. 293k units, posting a 9.4% YoY increase and showing steady growth. The existing major models – IONIQ 5 and EV 6 – continued to see a stable demand in the midsize SUV segment where competition is fierce. The sales expansion of EV 3 and Casper (Inster) EV was also a drive behind the growth of overall sales. To be specific, EV 3 has been drawing attention mainly from the emerging markets in Asia and Europe. Casper EV has emerged as a new growth engine for the group by absorbing demand for small-size, urban electric vehicles.

(Source: Global EV & Battery Monthly Tracker – July 2025, SNE Research)

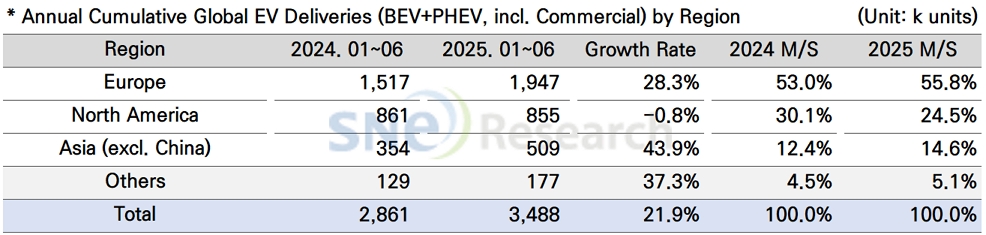

By region, Europe posted a 28.3% YoY growth with 1.947 million units of electric vehicles sold. The market share held by Europe from Jan to June in 2025 was 55.8%. Although a recovery in the market continued in terms of figures, in the European market, customers has been increasingly sensitive to car prices, which led to the expansion of marker shares held by the Chinese electric vehicles other than the existing car brands. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles. To be specific, the European OEMs are working on rearranging their production bases and launching mid/low-cost segment electric vehicles in response to the increasing penetration of Chinese EVs to the region.

The North American market recorded a 0.8% YoY degrowth with 855k units sold, accounting for 24.5% of the non-China EV market. While major manufacturers such as GM, Ford, and Hyundai Motor Group have been trying to increase their local production in North America based on tax credit benefits under the US IRA, demand for electric vehicles in the market remained below expectation. The Trump administration has been pushing forward with tax cuts and easing of environmental regulations. The recent OBBB Act will end the federal tax credits for new EVs from the end of September. Given these circumstances, there are concerns about possible slowdown in demand in the latter half of this year. Especially more OEMs are trying to restructure their product portfolio in a more conservative manner, placing more focus on internal combustion engine vehicles.

The Asia market (excluding China) exhibited a 43.9% YoY increase with 509k units sold, taking up 14.6% of market share. In the emerging markets, mainly led by India, demand for electric vehicles, of which price range is from US$ 10k to 20k, has been rising. Japan is also signaling a full-fledged shift toward battery electric vehicles (BEVs), led by Toyota and Honda. However, disparities in charging infrastructure and consumer subsidies across countries continue to result in significant differences in the pace of growth by region.

In other regions (Middle East, South America, Oceania, etc.), sales of electric vehicles were 177k units, posting a 37.3% YoY increase and accounting for 5.1% of market share. Global OEMs are taking these regions as new growth bases in an effort to expand their EV line-ups, but facing a high barrier in terms of price, infrastructure, and policy.

(Source: Global EV & Battery Monthly Tracker – July 2025, SNE Research)

In the first half of 2025, the global electric vehicle (EV) market outside of China has exhibited clear regional differentiation. Emerging markets, particularly in Southeast Asia and India, are experiencing rapid growth. Thailand has revised its EV policy to include export-oriented production under subsidy eligibility, thereby enhancing incentives for automakers to invest in local manufacturing. Indonesia and Vietnam are also expanding their market foundations by attracting Chinese OEMs. In India, demand for affordable, compact EVs continues to rise steadily, while Vietnam’s VinFast has begun mass production of new electric models and is actively expanding its operations in the Indian market. However, in India, key risks remain, such as low infrastructure penetration, slow charging speeds, and instability in the supply of rare earth components. Overall, while the EV market beyond China holds strong growth potential, it remains highly sensitive to a range of complex variables, including subsidy reductions, policy uncertainty, infrastructure disparities, and security risks. As such, governments and companies alike are facing a critical moment where strategies must go beyond short-term sales expansion and instead focus on structural stability and long-term sustainability.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period