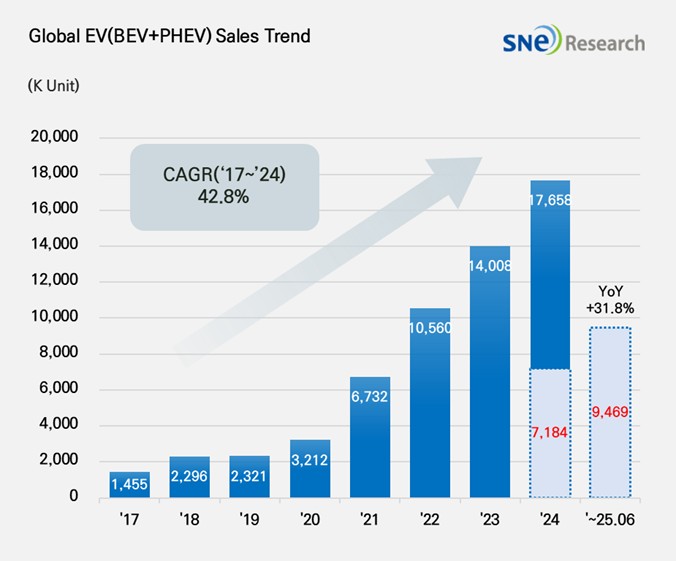

From Jan to June in 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approx. 9.469 Mil Units, a 31.8% YoY Growth

- BYD ranked top by selling 1.998 mil units in H1 2025; Geely ranked 2nd with 71.3% growth

From Jan to June in 2025, the number of electric vehicles

registered in countries around the world was approximately 9.469 million units,

a 31.8% increase from the same period last year (7.184 mil units).

(Source: Global EV and Battery Monthly Tracker – July 2025, SNE Research)

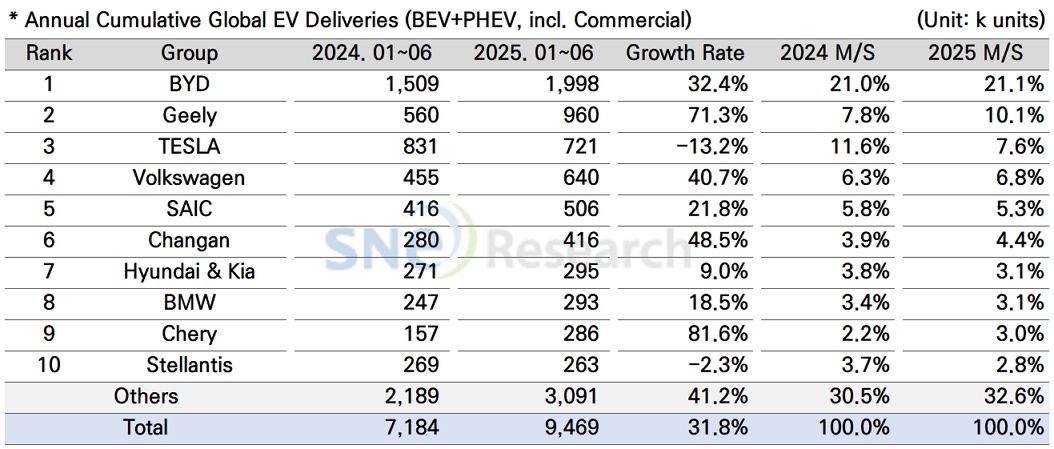

From Jan to June in 2025, BYD captured No. 1 position in the ranking of electric vehicles sales by selling approx. 1.998 million units, a 32.4% YoY increase. While steadily increasing its brand awareness based on price competitiveness and technology, BYD has been working to diversify its model line-ups from commercial vehicles to ultra-small vehicles to improve its competitiveness across the entire ecosystem for electric vehicles. However, there has been concerns about its financial solvency as BYD recently expanded a bit too rapidly and thus the amount of liabilities increased.

Geely Group, ranked 2nd on the list, continued to be in an upward trend, recording a 71.3% YoY growth and selling approx. 960k units. Geely’s Star Wish(星愿) model is gaining a huge popularity and contributing to expansion of line-ups. Its premium brand ZEEKR(极氪), hybrid-dedicated Galaxy(银河), and LYNK & CO(领克) aiming for the global market are targeting different classes of customers. Based on such a diverse brand portfolio, Geely has been expanding its presence in the global market.

Tesla, in the 3rd place, saw a 13.2% YoY decrease in sales, selling approx. 721k units. A drop in sales of Model Y and 3 was as a main reason for a decline in the overall sales. By region, Tesla experienced a 28.0% YoY decrease in sales in the European market and a 12.0% YoY decline in the North American market. In China, although sales of Model exhibited a 30.4% increase, that of Model Y declined 17.5%, making it difficult for Tesla to avoid a degrowth in sales. In particular, sales of models in the premium segment, such as Model S and X, experienced a dramatic fall. On the other hand, Tesla are trying to push forward with its future strategies such as sophistication of FSD function and robotaxi, but tangible outcomes seem to be limited in the short run.

(Source: Global EV and Battery Monthly Tracker – July 2025, SNE Research)

Hyundai Motor Group sold approx. 295k units of electric vehicles, recording a 9.0% YoY increase and showing steady growth in the global EV market. In terms of BEV, IONIQ 5 and EV 3 mainly contributed to sales, and small-size and strategic models including newly launched Casper (Inster) EV, EV 5, and Creta Electric received positive reviews from the market. In the North American market, Hyundai Motor Group ranked 3rd on the list, following Tesla and GM and still outperforming its major competitors such as Stellantis, Ford, and Toyota. However, some of the existing models such as EV 6, EV 9, and KONA Electric showed a slowdown in demand.

(Source: Global EV and Battery Monthly Tracker – July 2025, SNE Research)

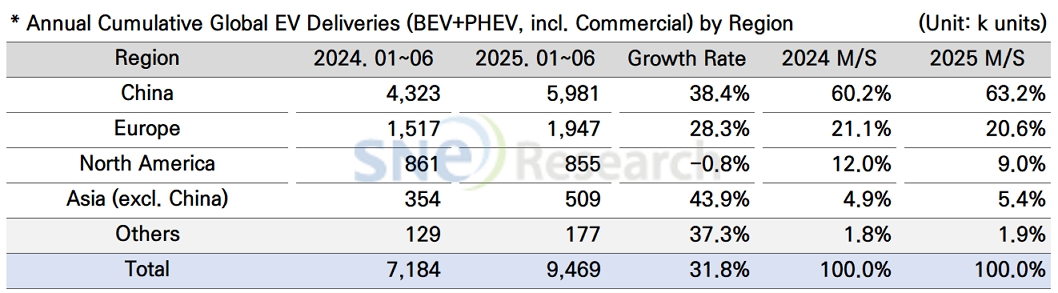

In the 1st half of 2025, the global electric vehicle market showed different trends in regions where the growth patterns have clearly diverged depending on related policies and demand structures in each country.

In China, taking up the biggest portion (63.2%) in the global market, a total of 5.981 million units of electric vehicles were sold, a 38.4% YoY increase. Centered around big cities in China, demand for entry-level electric vehicles expanded and the electrification of commercial EVs increased. Autonomous subsidy policies introduced by local Chinese governments and expansion of charging infrastructure were effective in driving demand in the market. In particular, low-cost LFP technology developed by battery suppliers like CATL and BYD was commercialized, leading to a rapid expansion of market for mid to low-priced electric vehicle models.

In Europe, a total of 1.947 million electric vehicles were sold, a 28.3% YoY growth, but the market share of European EV market slightly dropped to 20.6%. Although the numerical indicators show continued recovery, the overall rise in price sensitivity has notably accelerated the market share gains of Chinese electric vehicles at the expense of incumbent brands. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles. To be specific, the European OEMs are working on rearranging their production bases and launching mid/low-cost segment electric vehicles in response to the increasing penetration of Chinese EVs to the region.

In the North American market, a total of 855k units were sold, recording a 0.8% YoY decrease. The market share of North American market also dropped to 9.0%. Major OEMs such as GM, Ford, and Hyundai Motor Group have been trying to expand their local production in North America, taking advantage of tax credit benefits under the US IRA, but demand for electric vehicles was below expectation. The Trump administration has been pushing forward with tax cuts and easing of environmental regulations. The recent OBBB Act will end the federal tax credits for new EVs from the end of September. Given these circumstances, there are concerns about possible slowdown in demand in the latter half of this year. Especially more OEMs are trying to restructure their product portfolio in a more conservative manner, placing more focus on internal combustion engine vehicles.

The Asia market (excluding China) exhibited a 43.9% YoY growth with 509k units sold, accounting for 5.4% of the global EV market. In emerging markets, mainly led by India, demand for electric vehicles, of which price range is from US$ 10k to 20k, has been rapidly rising. Japan is also signaling a full-fledged shift toward battery electric vehicles (BEVs), led by Toyota and Honda. However, disparities in charging infrastructure and consumer subsidies across countries continue to result in significant differences in the pace of growth by region.

Overall, in the first half of 2025, the global electric vehicle (EV) market has been led by growth in China and Europe, while the North American market has remained stagnant due to policy uncertainty and weakening demand. As the United States undertakes a major overhaul of its EV-related policies, the dynamics of the global automotive industry are shifting. The U.S. has reduced EV subsidies and imposed high tariffs on foreign-made vehicles and components. However, it recently reached an agreement with South Korea to lower tariffs from the original 25% to 15%. As a result, Hyundai Motor Group is expected to save several trillion KRW annually, with major component suppliers also benefiting from the move. In response, Hyundai and Kia are not only expanding local production in the US but also accelerating their efforts to enter emerging markets such as Southeast Asia and Latin America. Global automakers are likewise restructuring their strategies in line with this protectionist trend. The global EV industry is entering a new phase where it is no longer driven solely by technology competition, but increasingly shaped by geopolitical factors such as trade policies, subsidy frameworks, and manufacturing location shifts.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period