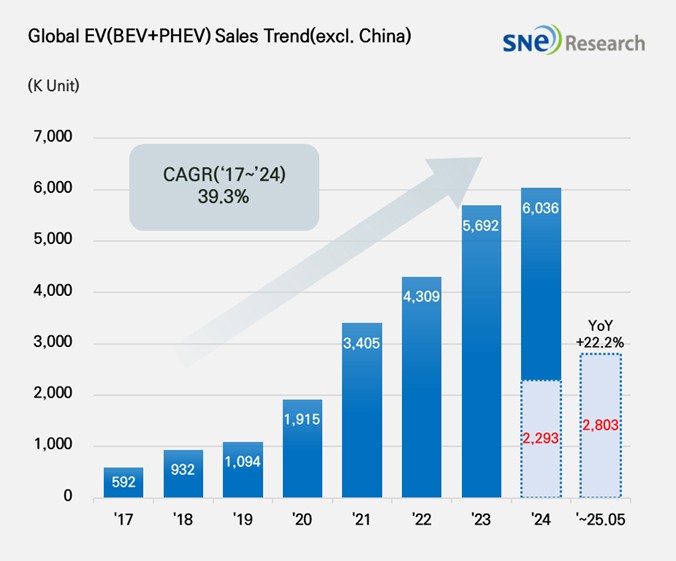

From Jan to May in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 2.803 Mil Units, a 22.2% YoY Growth

- Tesla ranked 2nd; VW took No. 1 position with a 70% YoY growth

From Jan to May in 2025, the total number of electric vehicles registered in countries around the

world except China was approx. 2.803 million

units, a 22.2% YoY increase.

(Source: Global EV & Battery Monthly Tracker – June 2025, SNE Research)

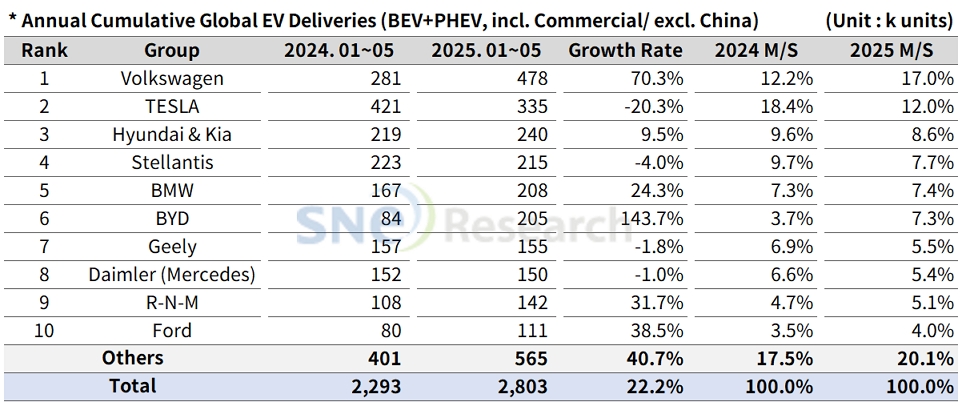

By group, Volkswagen Group outperformed Tesla and captured the 1st place in the ranking by selling 478k units, a 70.3% increase compared to the same period of last year. The growth of VW Group was mainly driven by strong European sales of ID.4, ID.7, and ENYAQ which are built on MEB platform, and sales expansion of new models such as A6/Q6 e-Tron, and Macan 4 Electric to which PPE platform is applied.

Tesla ranked 2nd by selling 335k units and posting a 20.3% YoY decrease. Sales of Model Y and Model 3 declined by 22.0% and 18.3% respectively, showing a visible decrease in demand in major model line-up. Sales of Model S (-66.1%) and Model X (-43.4%) recorded a double-digit drop as Tesla has been losing its competitiveness in the premium segment market. On the other hand, sales of Cybertruck were noteworthy with 15k units sold, posting an 89.2% YoY increase, but Cybertruck alone was not enough to divert the downward trend.

Hyundai Motor Group sold approx. 240k units, posting a 9.5% YoY increase and showing steady growth. The existing major models – IONIQ 5 and EV 6 – continued to see a stable demand in the midsize SUV segment where competition is fierce. The sales expansion of EV 3 and Casper (Inster) EV was also a drive behind the growth of overall sales. To be specific, EV 3 has been drawing attention mainly in the emerging markets in Europe and Asia. Casper EV has emerged as a new growth engine for the group by absorbing demand for small-size, urban electric vehicles.

(Source: Global EV & Battery Monthly Tracker – June 2025, SNE Research)

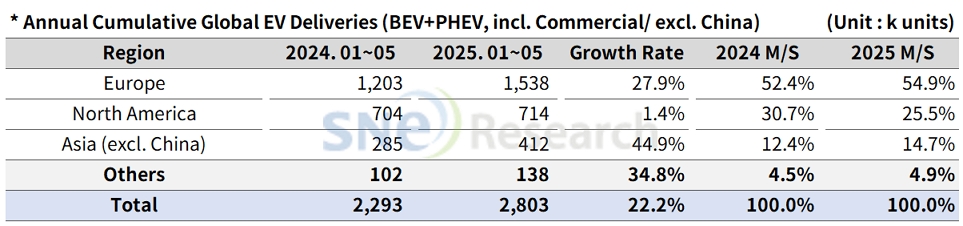

By region, Europe posted a 27.9% YoY growth with 1.538 million units of electric vehicles sold. The market share held by Europe slightly dropped to 54.9%. Although a recovery in the market continued in terms of figures, in the European market, customers has been increasingly sensitive to car prices, which led to the expansion of marker shares held by the Chinese electric vehicles other than the existing car brands. The Chinese OEMs such as BYD, NIO, and Xpeng are working in earnest to invest in local production plants in countries like Hungary and Spain. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles. The landscape in the European EV market is expected to be determined later depending on which OEMs in Europe will be able to leverage their price competitiveness.

The North American market only posted an 1.4% YoY growth with 714k units sold, accounting for 25.5% of the non-China EV market share. While major manufacturers such as GM, Ford, and Hyundai Motor Group have been trying to increase their local production in North America based on tax credit benefits under the US IRA, demand for electric vehicles in the market remained below expectation. What’s worse is that, since the inauguration of Trump administration, as the policy stance shifts toward greater tax cuts and easing of environmental regulations, discussions are gaining momentum at the federal level to reduce EV subsidies. Consequently, the outlook for electric vehicle demand is being revised downward, and automakers are beginning to realign their strategies, such as returning to internal combustion engine-focused portfolios.

The Asia market (excluding China) exhibited a 44.9% YoY increase with 412k units sold, taking up 14.7% of market share. In the emerging markets, mainly led by India, demand for electric vehicles, of which price range is from US$ 10k to 20k, has been rising. Japan is also signaling a full-fledged shift toward battery electric vehicles (BEVs), led by Toyota and Honda. However, disparities in charging infrastructure and consumer subsidies across countries continue to result in significant differences in the pace of growth by region.

In other regions (Middle East, South America, Oceania, etc.), sales of electric vehicles were 138k units, posting a 34.8% YoY increase and accounting for 4.9% of market share. Global OEMs are taking these regions as new growth bases in an effort to expand their EV line-ups, but facing a high barrier in terms of price, infrastructure, and policy.

(Source: Global EV & Battery Monthly Tracker – June 2025, SNE Research)

The global EV market excluding China in 2025 showed disparities in major regions. OEMs have been earnest to readjust their strategies. Europe maintained a certain level of growth supported by the introduction of new EV models and demand arising before the termination of EV tax credits, but, as the price-cutting race among OEMs is getting fiercer, it has become an important challenge to keep profitability. Since the launch of Trump administration, the US government has been working on reducing tax credits offered for EVs, and the overall demand for electric vehicles, mainly those by Tesla, has been slowing down. All of these have led to lower the expected sales of electric vehicles in the North American market. Some of the OEMs decided to expand their ICE vehicle line-ups in an effort to adjust the pace of conversion to electric vehicles. On the other hand, the distribution of low-priced EV models and small-size, commercial EVs has been rapidly increasing in the emerging countries in Asia where the growth of EV market, thus, has become palpable based on actual demand. In Japan, the market structure is still centered on hybrid models, but OEMs are taking two-track strategies by considering various electrification options. In this global trend, global OEMs are focusing on developing localization strategies and platform diversification mainly in regions showing high growth. At the same time, they are trying to address double challenges – expansion of sales in short term and securement of profitability and technical competitiveness in mid to long term.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period