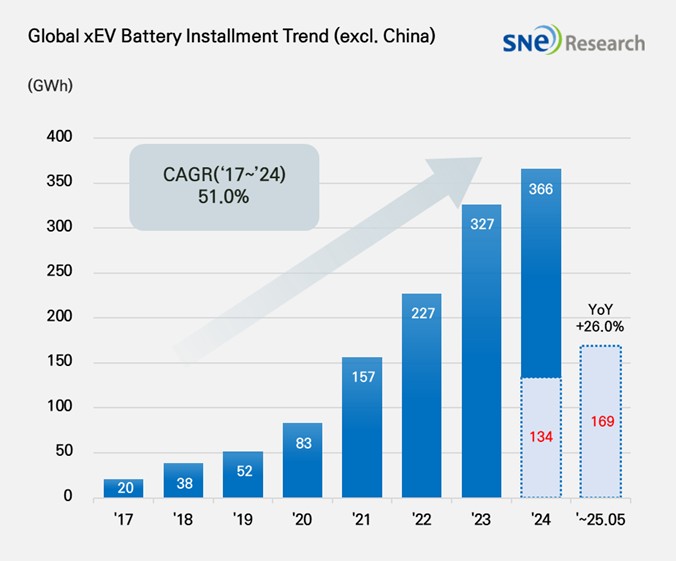

From Jan to May in 2025, Non-Chinese Global[1] EV Battery Usage[2] Posted 169.3GWh, a 26.0% YoY Growth

- From Jan to May in 2025, K-trio’s combined M/S recorded 39.2% (except China market)

Battery installation for global electric vehicles (EV,

PHEV, HEV) excluding the Chinese market sold from Jan to May in 2025 was

approximately 169.3GWh, a 26.0% YoY

growth.

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

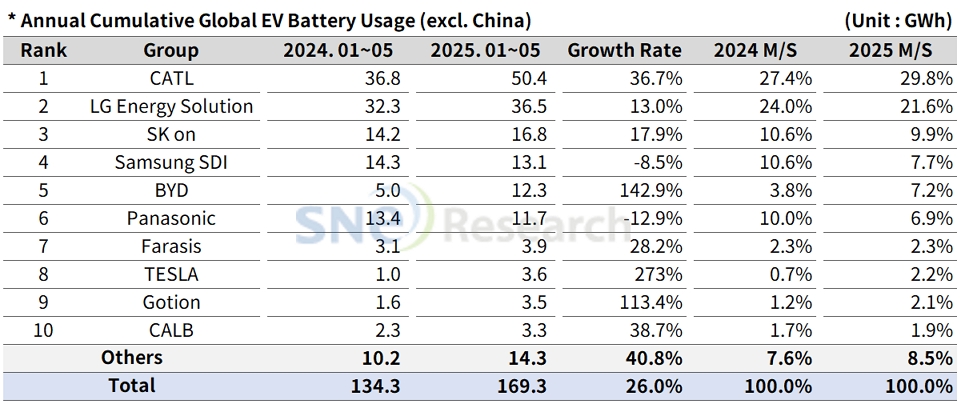

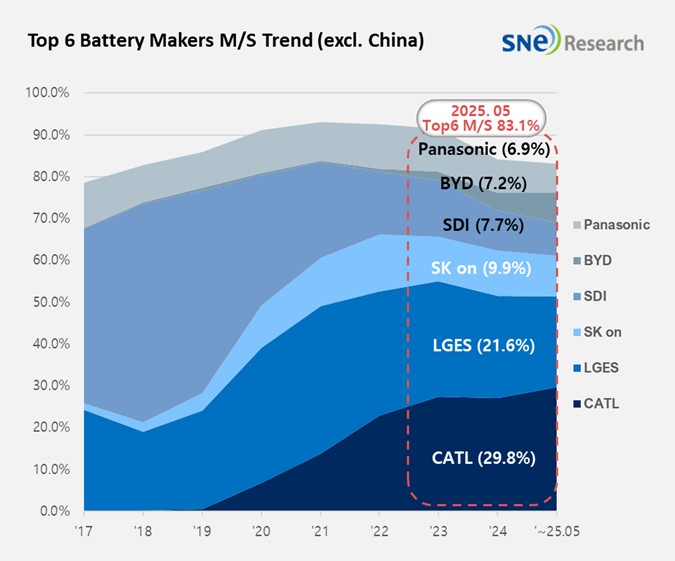

The combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from Jan to May in 2025 posted 39.2%, a 6.1%p decline from the same period of last year. LG Energy Solution ranked 2nd with 13.0% (36.5GWh) YoY growth, while SK On took the 3rd position with 17.9% (16.8GWh) growth. On the other hand, Samsung SDI posted 8.5%(13.1GWh) degrowth. The downward trend in Samsung SDI’s battery usage was mainly caused by a decline in demand for batteries from major car OEMs in Europe and North America.

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly supplied to BMW, Audi, and Rivian. Favorable sales of BMW i4 and i5 brought about a positive effect on sales of Samsung SDI’s batteries, but declining sales of Audi Q8 e-Tron and application of LFP battery, made by other cell makers, to the standard trim of Rivian has affected negatively.

SK On’s battery was mainly installed to electric vehicles made by Hyundai Motor Group, followed by Ford, Mercedes-Benz and Volkswagen. Hyundai Motor Group saw a recovery in sales of IONIQ 5 and EV 6, and Ford’s F-150 Lightning continued to be sold well in North America. Along with this, favorable sales of VW ID.4 and ID.7 in Europe have brought about a positive impact to increase the usage of battery made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by Chevrolet, Kia, and Volkswagen. In case of Tesla, the declining sales of models equipped with LG Energy Solution’s batteries led to a 23.2% decrease in Tesla’s usage of LG Energy Solution’s batteries. Particularly in the European market, while the sales of electric vehicles made by the Chinese OEMs has expanded, demand for Tesla has decreased, which can be regarded as a major reason for the declining usage of LG Energy Solution’s batteries by Tesla. Meanwhile, the total usage grew by 12.8% due to favorable sales of VW’s ID series and Kia’s EV 3 and expanded sales of Chevrolet Equinox, Blazer, and Silverado EVs, built on the Ultium platform, in North America.

Panasonic, which supplies batteries mainly to Tesla, ranked 6th on the list with a battery usage of 11.7GWh. Panasonic is currently working to restructure its supply chain in response to the recently strengthened U.S. tariffs on Chinese batteries and raw materials and is implementing a strategy to increase the proportion of local production within the North American region. In particular, Panasonic is focusing on reducing its dependence on Chinese materials and securing new materials while expanding local procurement to build a stable battery supply chain. These efforts are expected to lead to a recovery in battery usage and enhanced supply stability in the North American region in the future.

In the global market excluding China, CATL remained top on the list with a 36.7%(50.4GWh) YoY growth. Not only local Chinese OEMs, but many of major global OEMs also adopt CATL’s batteries for their electric vehicles.

BYD ranked 5th in the non-China market, posting a 142.9%(12.3GWh) YoY growth. BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, is gaining significant popularity by introducing a variety of electric vehicles to the market, leveraging its strong price competitiveness. BYD is working to increase overseas production capacities and expand the supply chain in order to increase its overseas market share, especially actively engaging in promoting itself in the Korean and European markets.

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

[2] Based on battery installation for xEV registered during the relevant period.