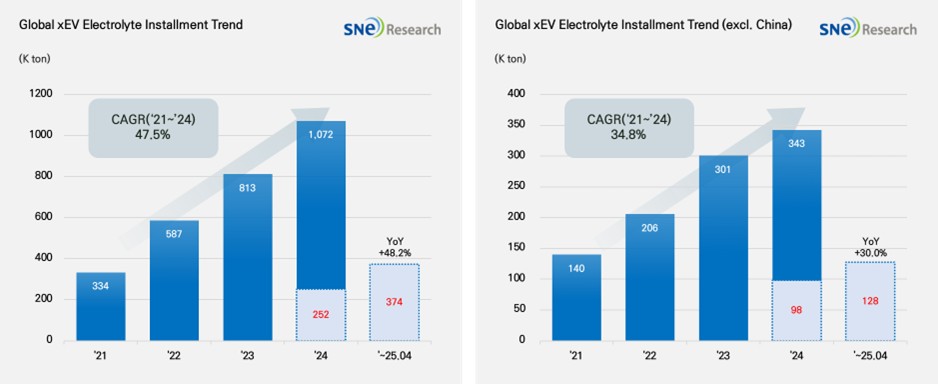

From Jan to Apr in 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Recorded 374K ton, a 48.2% YoY Growth

- From Jan to Apr in 2025, the electrolyte market continued to post a double-digit growth, while the non-China market showed a stable expansion in demand.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Apr in 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 374K ton, showing a 48.2% YoY growth. Particularly in the non-China market, the total usage of electrolyte grew by 30.0%, recording 128K ton and showing a stable expansion of growth.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market has been rapidly growing.

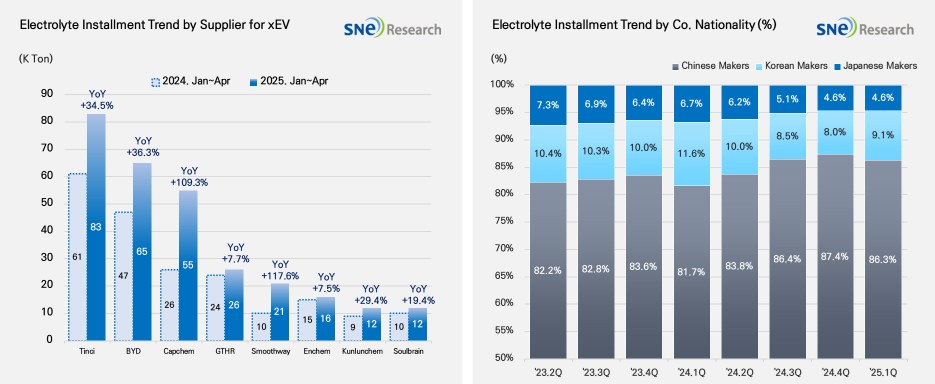

From Jan to Apr in 2025, the global electrolyte market witnessed a noticeable growth of major electrolyte suppliers. Tinci was the world’s No.1 electrolyte manufacturer, who supplied 83k tons and posted a 34.5% YoY growth. BYD followed Tinci on the list, supplying 65K ton and recording a 36.3% YoY growth. Capchem supplied 55K tons and exhibited a 109.3% YoY growth, while GTHR saw a minor growth with 26K tons. Smoothway boasted an explosive growth of 117.6%, recording 21K tons. The Korean electrolyte makers such as Enchem(16K ton, +7.5%) and Soulbrain(12K ton, +19.4%) also remained a steady growth.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market shares of companies by their nationality, the Chinese electrolyte suppliers are still leading the market. As of Q1 in 2025, the Chinese companies took up 86.3% of the entire market share, while the Korean and Japanese companies accounted for 9.1% and 4.6% respectively. The market shares held by the Korean makers were slightly less than those in the same period of last year. Amidst the increasingly intensifying dominance by the Chinese companies, it has become more important for the non-China electrolyte makers to secure their competitiveness in the market.

On the other hand, as the introduction of next-generation battery technologies such as all-solid-state batteries and high-voltage, high energy density cells, the technology development strategies of electrolyte companies are going through modification. Demand for premium electrolytes with high safety and high power has been increasing, leading the electrolyte makers to accelerate the development of high value-added products and channel more energy into research and development effort. It is likely to be a key point in the market whether the Korean and Japanese companies can lead the expansion of technology-driven market particularly through strategic collaboration with global OEMs.

The electrolyte market is expected to see continuous growth in future along with increasing demand for electric vehicles. Specifically in the non-China market, expansion of demand, diversification of supply chain, and technology competition are highly likely to rise as pivotal issues in the industry. Overall, the global electrolyte suppliers are expected to continue their strategic investment to secure their presence in the market by enhancing the quality of their products and technologies as well as reinforcing price competitiveness.

[2] Based on batteries installed to electric vehicles registered during the relevant period.