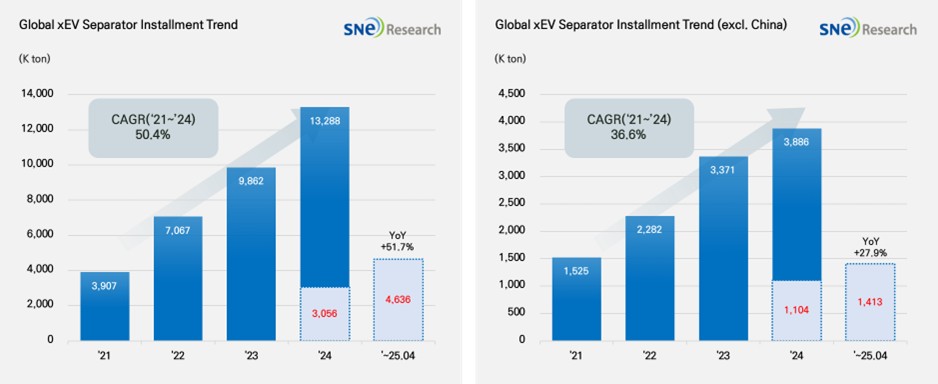

From Jan to Apr in 2025, Global[1] Electric Vehicle Separator Installment[2] Reached 4,636Mil ㎡, a 51.7% YoY Growth

- From Jan to Apr in 2025, the global separator market posted a steady growth due to the increasing installment of batteries in electric vehicles.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Apr in 2025, the total installment of separator materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 4,636 Mil ㎡, posting a 51.7% YoY growth. Specifically, in the global market excluding China, the total installment of separator increased by 27.9%, reaching 1,413Mil ㎡ and exhibiting a stable growth.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

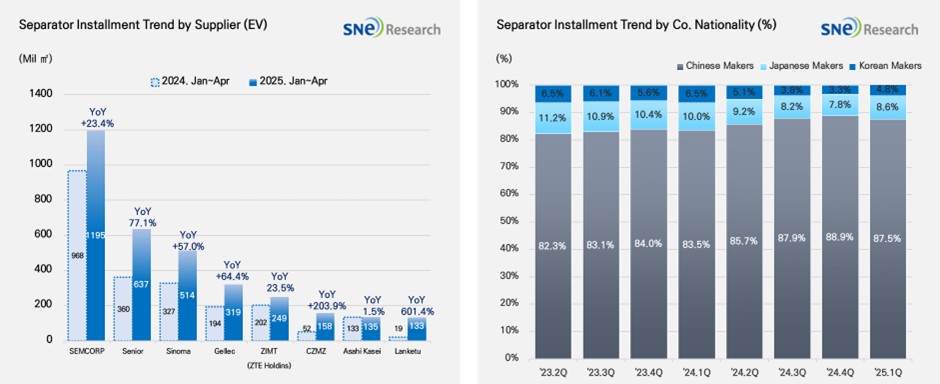

From Jan to Apr in 2025, major separator suppliers showed significant growth in the global separator market. In particular, SEMCORP recorded an overwhelming YoY growth of 23.4% equivalent to 1,195Mil ㎡. Other major Chinese companies such as Senior(+77.1%), Sinoma(+57.0%), and Gellec(+64.4%) also continued to exhibit a strong growth. Other than this, both ZIMT and CMZF posted double-digit growth, enjoying the expansion of their market share. On the other hand, SK IE Technology from Korea showed a noticeable growth, reaching 129Mil ㎡ and exhibiting a 53.1% YoY growth.

In terms of market shares of companies by their nationality, the Chinese separator makers accounted for approx. 90% of the entire market shares, almost dominating the market. Since the 2nd quarter of 2023, the market shares of Japanese and Korean separator makers have been continuously declining. In the 1st quarter of 2025, while the Japanese companies took up 8.6%, the Korean makers accounted for 4.8%. As the market dominance by the Chinese makers have intensified, the competition landscape has been further polarized between the Chinse makers and the non-China companies in the global separator market.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

Global separator makers have been expanding their local production bases in Europe and North America in response to strategic movements by OEMs that are trying to internalize the supply chain of batteries. The Korean and Japanese separator companies are taking strategic steps to increase their overseas production bases, and some of the Chinese makers are working in earnest to establish a global production network. Recent changes in global policies such as the US IRA and intensified regulations on supply chain in Europe have made the securement of non-China separator supply chain as a major challenge.

In addition, as bigger and higher power battery cells have been developed, demand for high-quality and high-durability, premium separators have been increasing. In line with this, a preference for sophisticated separator products has become distinct. Major battery manufacturers have been expanding their strategic cooperation in different regions, and along with this, separator makers are accelerating their strategic movements to sophisticate technologies, diversify products, and localize production.

Together with high growth in the electric vehicle market, demand for separators has been rapidly increasing. What should be noticed in this circumstance is possible changes in the market structure driven by the growth of markets in other regions than China. In future, the competition landscape in the separator market is expected to continuously restructure depending on the development of battery technology and strategies of car OEMs. Global separator makers are expected to accelerate their strategic investment to secure dominant positions in the market based on their technologies and product competitiveness.

[2] Based on batteries installed to electric vehicles registered during the relevant period.