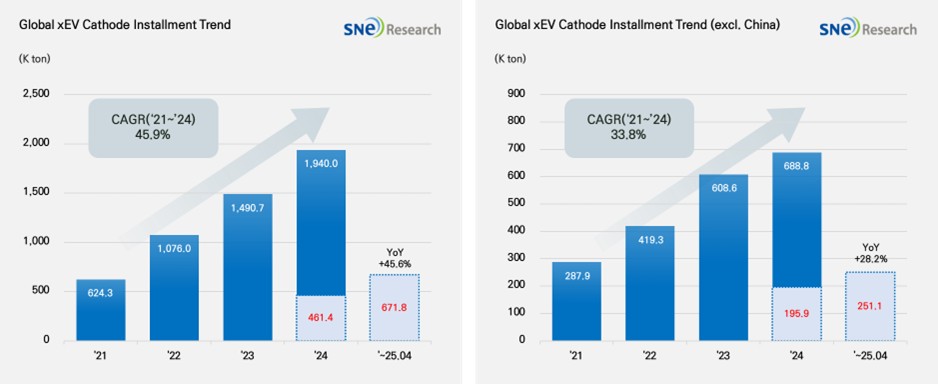

From Jan to Apr in 2025, Global[1] Electric

Vehicle Battery Cathode Material Installment [2] Reached

671.8K ton, a 45.6% YoY Growth

- From Jan to Apr in 2025, EV battery cathode material installment in non-China market was 251.1K ton, posting 28.2% growth

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Apr in 2025, the total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 671.8K ton, posting a 45.6% YoY growth. In particular, the installment of cathode materials used in electric vehicles in the non-China market recorded 251.1K ton, exhibiting a 28.2% stable growth. Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently, the battery market can be divided into the one centered around NCx ternary cathode material and the other mainly led by LFP cathode material, and both are driven by technical and economic advantages of each cathode material. Amidst the diversification of global cathode material demand, NCx ternary cathode material and LFP cathode material are positioning themselves as two main axes in the market.

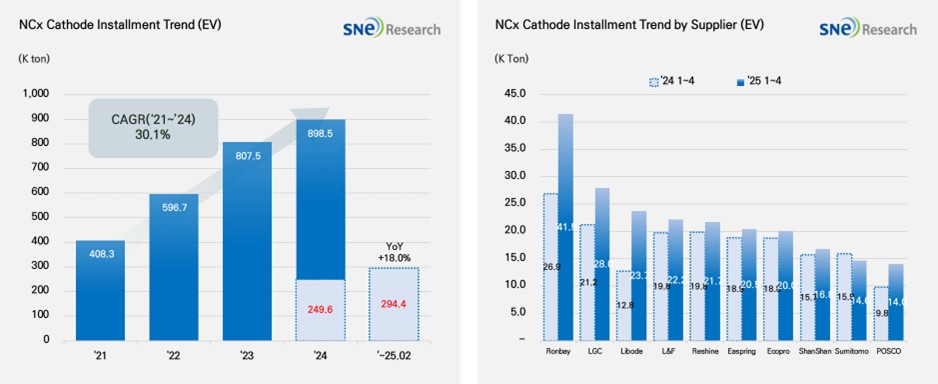

If we look at the market by different cathode materials, the installment of ternary cathode material during the relevant period was 294.4K ton, posting a 18.0% YoY growth and continuously expanding in the market. By company, Ronbay and LG Chem ranked 1st and 2nd, leading the market, while Libode jumped to the 3rd place based on the increasing demand for mid-Ni cathode material, posting a 65.9% YoY growth. Major cathode suppliers in Korea such as L&F, EcoPro, and POSCO posted a 12.0%, 6.7%, and 43.5% growth respectively, capturing the 4th, 7th, and 10th places, but, overall, the growth of Chinese cathode material makers were significant. The Chinese companies have been rapidly expanding their global market shares based on steady demand from the Chinese domestic market, their aggressive ramp-up strategies, and cost competitiveness.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

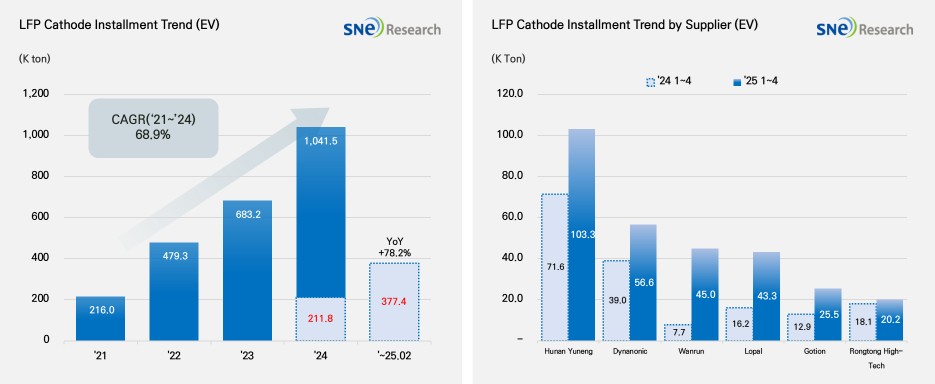

During the same period of time, the total installment of LFP cathode material was 377.4K ton, posting a rapid growth of 78.2% compared to the same period of last year which surpassed that of ternary cathode materials. Among the total cathode material installments, the portion captured by LFP cathode material was 56.2%, demonstrating that the LFP cathode material has been further intensifying its presence in the market. This upward trend was interpreted as strongly affected by a monopolistic structure of cathode supply chain led by China. Currently, the market of LFP cathode material for electric vehicles was in fact dominated by the Chinese suppliers among which Hunan Yuneng and Dynanonic solidified their dominance in the market, capturing the 1st and 2nd places in the ranking. Following them, Wanrun and Lopal ranked 3rd and 4th on the list based on their rapid growth, intensifying the competition in the market. As a result, the explosive expansion of LFP cathode material market has been acting as a catalyst for the market dominance by the Chinese companies. All of these have led to a trend that the supply chain of global battery material has become centered around the Chinese suppliers.

(Source: 2025 May Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The global cathode material market has continued solid growth based on a rapid growth of LFP cathode material and steady demand for ternary cathode material. However, the intensified US IRA regulations and high tariffs policy again the Chinese battery materials ignited the restructuring of market. In particular, the US strengthened the requirements for tax credits in an effort to rule out the Chinese key minerals and components from the supply chain, which may open a new opportunity for the material suppliers from the FTA member countries such as Korea and Japan to expand their presences in the North American market. China responded to the US tariffs policy and other related regulations by producing more materials and imposing bans on export. Meanwhile, Europe has been trying to secure its own supply chain but struggling to respond to the low-cost strategy by China. In this regard, the global OEMs and material suppliers are required to come up with strategic response measures such as expansion of local production, diversification of supply chain, and restructuring of product portfolio as their market competitiveness is expected to be determined whether they can adapt to the volatility of policy and have a capability to build and secure their own supply chain.

[2] Based on batteries installed to electric vehicles registered during the relevant period.