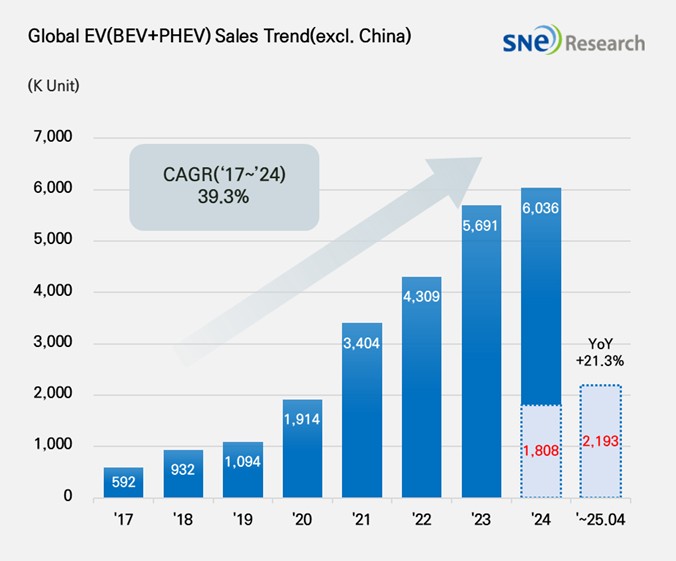

From Jan to Apr in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 2.193 Mil Units, a 21.3% YoY Growth

- Tesla ranked 2nd due to the impact of declining

sales in Europe

From Jan to Arp in 2025, the total number of electric vehicles registered in countries around the

world except China was approx. 2.193 million

units, a 21.3% YoY increase.

(Source: Global EV & Battery Monthly Tracker – May 2025, SNE Research)

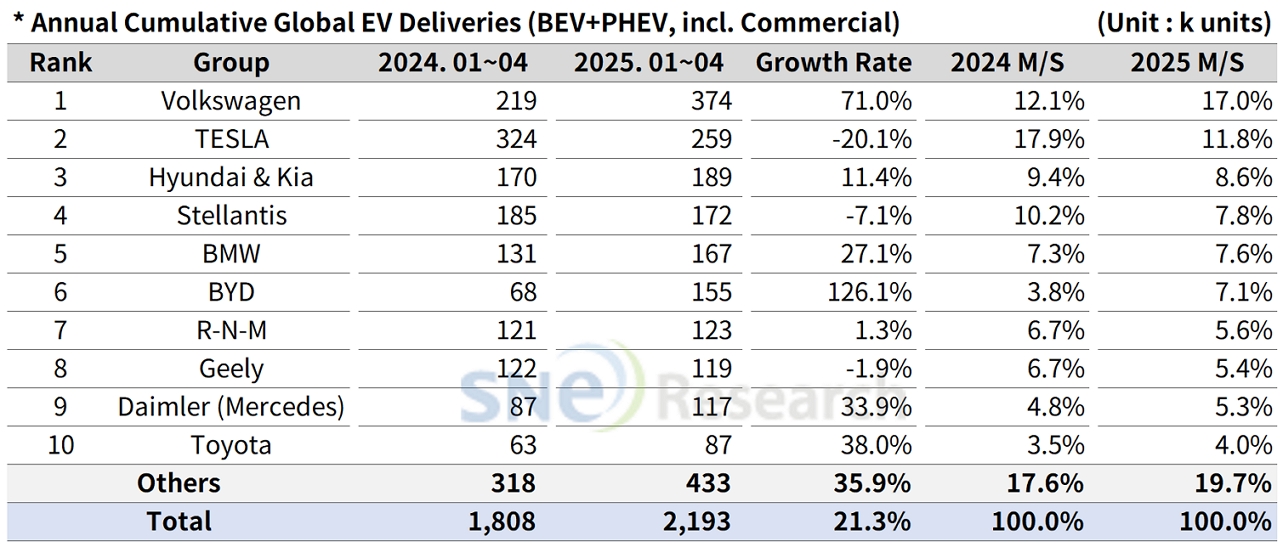

If we look at the number of electric vehicles sold in the world except China market from Jan to Apr 2025, Volkswagen Group outperformed Tesla and captured the 1st place in the ranking by selling 374k units, a 71.0% increase compared to the previous year. The growth of VW Group was led by favorable sales of VW’s main models such as ID.3, ID.4, ID.7, Q4 e-Tron, and ENYAQ to which MEB platform are installed.

Tesla ranked 2nd with declines in sales of Model 3 and Y, selling 259k units and posting a 20.1% YoY decrease. In Europe, sales dropped by 34.6%, and in North America, they decreased by 9.1%. Specifically in Europe, the sales drop was mainly caused by the suspension of production decided to launch ‘Juniper,’ the facelifted version of Model Y, and shortage of inventory. Tesla planned to release a new, entry-level model, but as the The production schedule has been delayed by at least three months, with mass production now expected to begin sometime between the second half of 2025 and early 2026. Additionally, Tesla is working on sophisticating the Full Self-Driving (FSD) software and expanding its subscription-based services to strengthen its software-driven revenue model. However, CEO Elon Musk’s political statements have negatively impacted the brand image, leading to a decline in consumer trust.

Hyundai Motor Group sold approximately 189k electric vehicles, recording an 11.4% YoY growth and showing steady growth. IONIQ 5 and EV 6 are about to be facelifted this year, and the global sales of Kia EV3 and EV 9 have been expanding, as well. In the North American market, Hyundai proved its market competitiveness, outperforming Stellantis, Ford, and GM in a certain period of time. Kia unveiled EV 4(max. driving range 533km, based on WLTP) and EV 2 concept car, targeting the European market, to strengthen its strategy to accelerate the mass adoption of electric vehicles.

(Source: Global EV & Battery Monthly Tracker – May 2025, SNE Research)

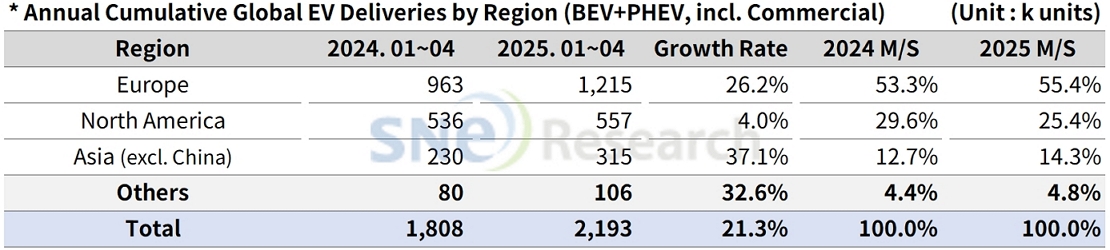

By region, Europe showed a recovery in growth, posting a 26.2% increase in electric vehicle sales compared to the same period of last year. Launch of new models such as Renault R5, Stellantis e-C3, Kia EV3, and Hyundai Casper Electric (Inster) is leading the recovery of demand in the market. While BYD is currently building a production base in Hungary, NIO와 MG, Leapmotor have decided to either enter the European market or expand their presence. Meanwhile, the EU postponed the implementation of CO₂ regulations to 2027, with the compliance criteria adjusted to allow the use of average emissions from 2025 to 2027.

The North American market posted only a 4.0% of growth, accounting for 25.4% of the non-China market share. Due to the tax credit benefits under the US Inflation Reduction Act(IRA), major manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their local production share in North America. On the other hand, policy uncertainty is growing under the Trump administration due to potential subsidy cuts and the review of additional tariffs. Automakers are now required to maintain a balanced portfolio between internal combustion engine vehicles and electric vehicles, along with flexible response strategies.

The Asia market (excluding China) exhibited a 37.1% YoY growth, but due to differences in related policies and gaps in national infrastructure, the pace of EV adoption varies in different countries. In addition, as hybrid vehicles have already gained popularity and each country has their own national policies, the potential for further growth is limited. Japan is shifting away from its traditional hybrid-focused strategy, as seen in Toyota and Lexus's recent moves to launch new BEV models. India has set a target of achieving a 30% share of electric vehicles by 2030 and is actively revamping its subsidy programs and expanding charging infrastructure. In Southeast Asia, countries like Thailand and Indonesia are emerging as key EV production hubs, with their governments offering incentives such as tax breaks and support for attracting local manufacturing facilities.

(Source: Global EV & Battery Monthly Tracker – May 2025, SNE Research)

The global electric vehicle market continues to grow gradually outside of China, but the underlying drivers vary by region. In general, the transition to EVs in markets excluding China is being adjusted due to factors such as technology, policy, and consumer acceptance, with each country finding its own balance at its own pace. The EV market has now entered a complex competitive phase that goes beyond environmental concerns, shaped by region-specific transition strategies and geopolitical factors. Companies are expected to gain strategic advantages by addressing both uncertainties and opportunities outside of China through product diversification, flexible policy alignment, and localized investment strategies.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period