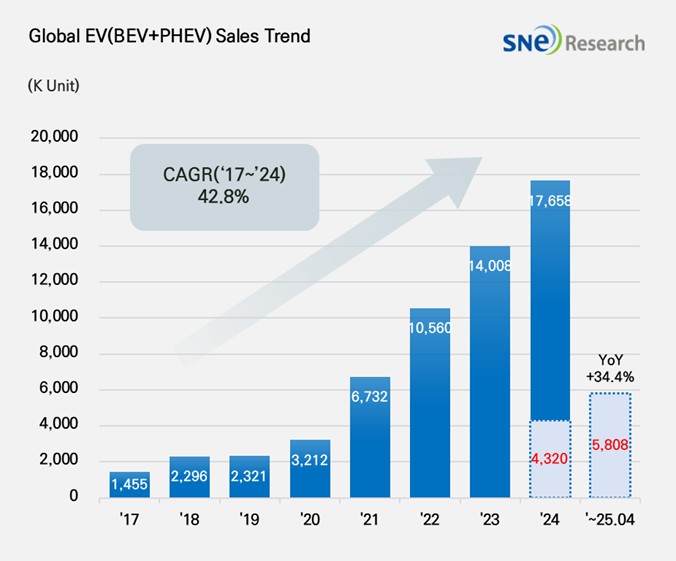

From Jan to Apr 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approx. 5.808 Mil Units, a 34.4% YoY Growth

- From Jan to Apr 2025, BYD ranked No. 1, selling approx. 1.24 mil units

From

Jan to Feb 2025, the number of electric vehicles registered in countries around

the world was approximately 5.808 million units, about 34.6% YoY increase.

(Source: Global EV and Battery Monthly Tracker – May 2025, SNE Research)

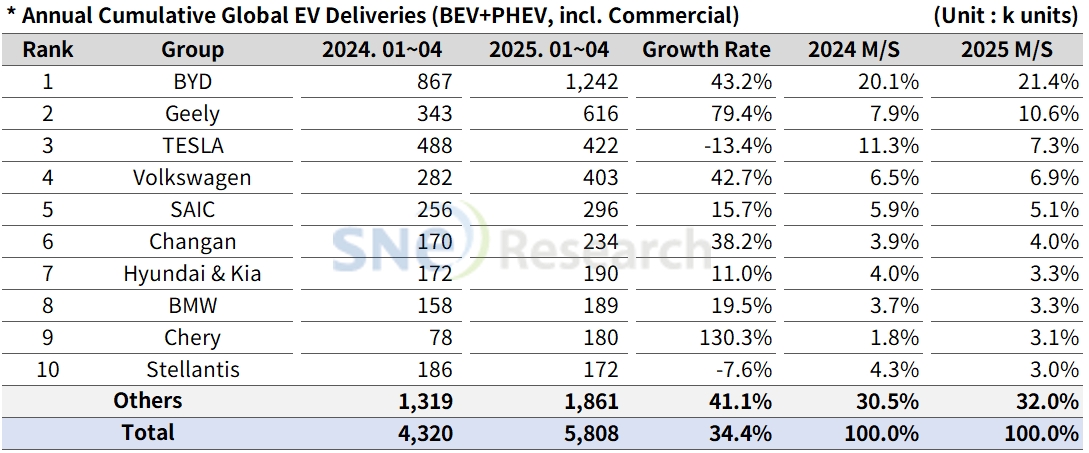

From Jan to Apr 2025, BYD ranked No.1 in the global ranking of electric vehicle sales by selling approx. 1.242 million units, a 43.2% YoY increase. BYD, aiming to sell about 6 million units of its electric vehicles this year, has been actively responding to changes in tariffs and subsidies policy by building local production lines or expanding them in Europe (Hungary and Turkey) and the Southeast Asia (Thailand, Indonesia, and Cambodia). Based on its price competitiveness and technology, BYD has been on a strategic move to enhance its brand awareness and strengthen the competitive edge in the entire ecosystem of electric vehicle.

Geely Group, ranked 2nd on the list, recorded a high growth of 79.4% compared to the same period of last year by selling 616k units. Geely’s Star Wish(星愿) model has drawn a huge popularity in the market, while its premium brand ZEEKR(极氪), hybrid-dedicated Galaxy(银河), and LYNK & CO(领克), targeting the global market, have been targeting different classes of customers. As it focuses on the development of technology and strengthening of production capacity, the Group is expected to exhibit high growth this year.

Tesla, in the 3rd place, saw a 13.4% decrease in sales compared to the same period of last year due to a slowdown in sales of Model 3 and Y, selling 422k units. In Europe, sales dropped by 34.6%, and in North America, they decreased by 9.1%. Specifically in Europe, the sales drop was mainly caused by the suspension of production decided to launch ‘Juniper,’ the facelifted version of Model Y, and shortage of inventory. Tesla planned to release a new, entry-level model, but as the The production schedule has been delayed by at least three months, with mass production now expected to begin sometime between the second half of 2025 and early 2026. Additionally, Tesla is working on sophisticating the Full Self-Driving (FSD) software and expanding its subscription-based services to strengthen its software-driven revenue model. However, CEO Elon Musk’s political statements have negatively impacted the brand image, leading to a decline in consumer trust.

(Source: Global EV and Battery Monthly Tracker – May 2025, SNE Research)

(Source: Global EV and Battery Monthly Tracker – May 2025, SNE Research)

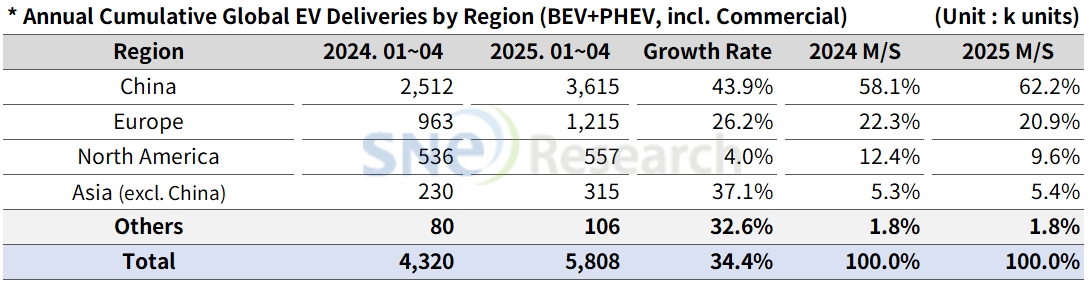

The China market accounted for 62.2% of the global market share, a 43.9% YoY growth, which means that it has successfully positioned itself as a key market for electric vehicle adoption. Major drives behind such successful growth were continuous tax credit support from the government, expansion of charging infrastructure, and increases in EV production by local brands such as BYD, NIO, and Xpeng. In addition, the Chinese major battery makers like CATL and CALB have been closely cooperating with key OEMs to solidify their competitive edge in supply chain.

Europe showed a recovery in growth, posting a 26.2% increase in electric vehicle sales compared to the same period of last year. Launch of new models such as Renault R5, Stellantis e-C3, Kia EV3, and Hyundai Casper Electric (Inster) is leading the recovery of demand in the market. While BYD is currently building a production base in Hungary, NIO와 MG, Leapmotor have decided to either enter the European market or expand their presence. Meanwhile, the EU postponed the implementation of CO₂ regulations to 2027, with the compliance criteria adjusted to allow the use of average emissions from 2025 to 2027.

The North American market posted only a 4.0% of growth, accounting for 9.6% of the global market share. Due to the tax credit benefits under the US Inflation Reduction Act(IRA), major manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their local production share in North America. On the other hand, policy uncertainty is growing under the Trump administration due to potential subsidy cuts and the review of additional tariffs. Automakers are now required to maintain a balanced portfolio between internal combustion engine vehicles and electric vehicles, along with flexible response strategies.

The Asia market (excluding China) exhibited a 37.1% YoY growth, but due to differences in related policies and gaps in national infrastructure, the pace of EV adoption varies in different countries. In addition, as hybrid vehicles have already gained popularity and each country has their own national policies, the potential for further growth is limited. Japan is shifting away from its traditional hybrid-focused strategy, as seen in Toyota and Lexus's recent moves to launch new BEV models. India has set a target of achieving a 30% share of electric vehicles by 2030 and is actively revamping its subsidy programs and expanding charging infrastructure. In Southeast Asia, countries like Thailand and Indonesia are emerging as key EV production hubs, with their governments offering incentives such as tax breaks and support for attracting local manufacturing facilities.

The global electric vehicle (EV) market is undergoing a varied pace of transition across regions, influenced by policy environments, supply chain dynamics, and brand strategies. In China, domestic demand continues to grow while export strategies are also accelerating, with major players like BYD and CATL expanding their global footprint. In Europe, EV adoption remains driven by regulatory mandates; however, the region is entering a period of recalibration - balancing its response to the rising influx of Chinese EVs with legacy OEMs’ continued investments in internal combustion engine (ICE) models. In North America, despite the impact of the Inflation Reduction Act (IRA), lingering policy uncertainties present significant challenges to long-term corporate planning. Against this backdrop, global OEMs are moving beyond simply expanding EV sales. They are now engaging in a broader competition for EV leadership - responding to region-specific policy shifts, diversifying their brand strategies, securing local infrastructure, and pursuing vertical integration across areas such as energy and software.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period