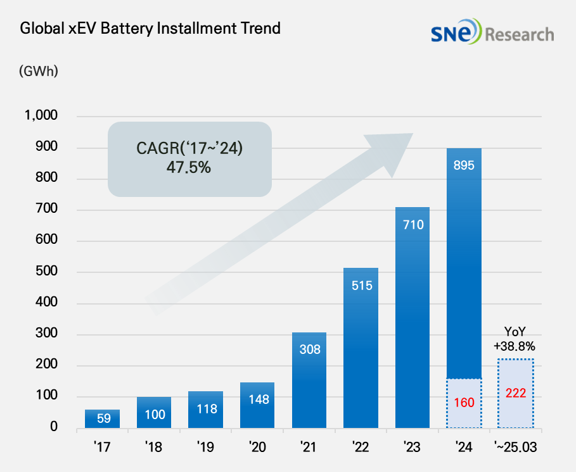

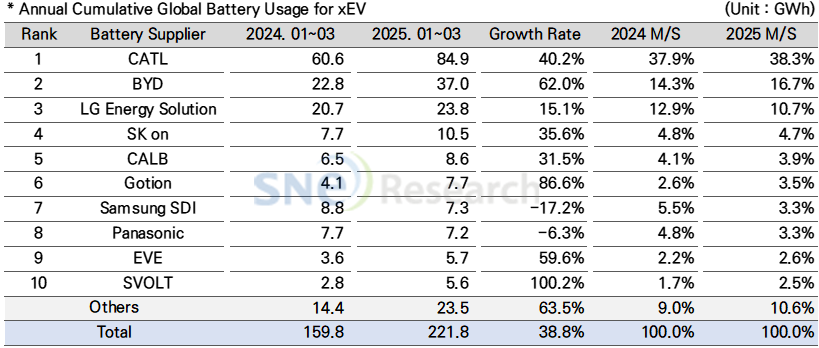

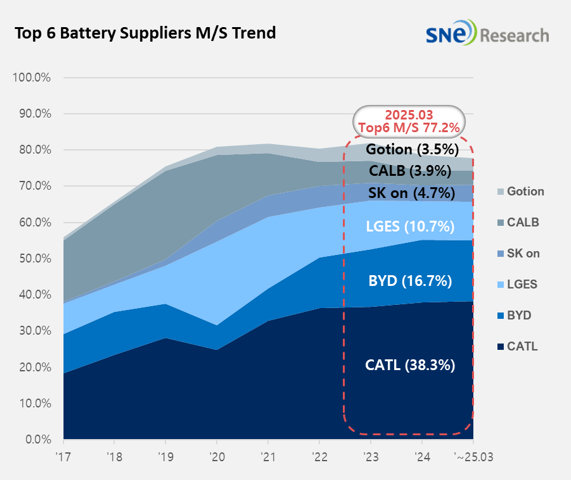

From Jan to Mar 2025, Global[1] EV Battery Usage[2] Posted 221.8GWh, a 38.8% YoY Growth

- From

Jan to Mar 2025, K-trio’s M/S recorded 18.7%

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the

sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed

by Audi and Rivian. BMW recorded steady sales of models equipped with Samsung

SDI’s battery such as i4, i5, and iX. However, the launch of standard-range

trims for Rivian’s R1S and R1T, equipped with LFP batteries made by a battery

maker other than Samsung SDI, had a negative impact on Samsung SDI’s battery

usage. Audi also saw a decline in the sales of Q8 e-Tron, resulting in a

negative growth in the usage of Samsung SDI’s battery.

SK On’s battery was mainly installed in EV models made by Hyundai Motor

Group, followed by Mercedes-Benz and Volkswagen. Hyundai Motor Group saw a

recovery in sales after the facelifted versions of IONIQ 5 and EV6 were

released. Mercedes-Benz saw favorable sales of compact SUVs EQA and EQB, to

which SK On’s battery is installed, maintaining a stable performance similar to

the same period of last year. Along with this, strong sales of VW ID.7 and ID.4

had a positive impact on the growth of battery usage made by SK On.

Panasonic, which mainly

supplies batteries to Tesla, recorded 7.2GWh in battery usage and ranked 8th on

the list. Given its high dependence on Tesla, the decline in Tesla’s sales this

year—driven by lower demand for Model 3 and Y—was the main reason behind

Panasonic’s decreased battery usage. However, Panasonic is expected to quickly

recover its battery usage in North America, centered around Tesla, with the

release of improved 2170 and 4680 cells.

China’s CATL maintained its solid position as the global No.1 battery

maker, posting 40.2% (84.9GWh) YoY growth. In addition to key OEMs such as

ZEEKR, AITO, Li Auto, and Xiaomi adopting CATL’s batteries, many global major

OEMs including Tesla, BMW, Mercedes-Benz, and Volkswagen are also using CATL’s

batteries.

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker,

SNE Research)

After Trump’s re-election, the U.S. has officially implemented strong

tariff policies on Chinese batteries and raw materials, reigniting tension

across the global supply chain. In response, Korean battery companies are

expanding joint ventures with local OEMs and reinforcing their strategy to

increase the share of production in the U.S. in order to secure continued

eligibility for incentives in the North American market. However, given the

industry’s high dependence on Chinese materials, mid- to long-term efforts to

restructure the supply chain and diversify raw material sourcing have become

urgent. Ultimately, the Korean battery industry must seek new growth strategies

amid a complex environment shaped by intensified U.S. protectionism, stricter

environmental regulations in Europe, and rising price pressure from China.

[2] Based on battery installation for xEV registered during the relevant period.