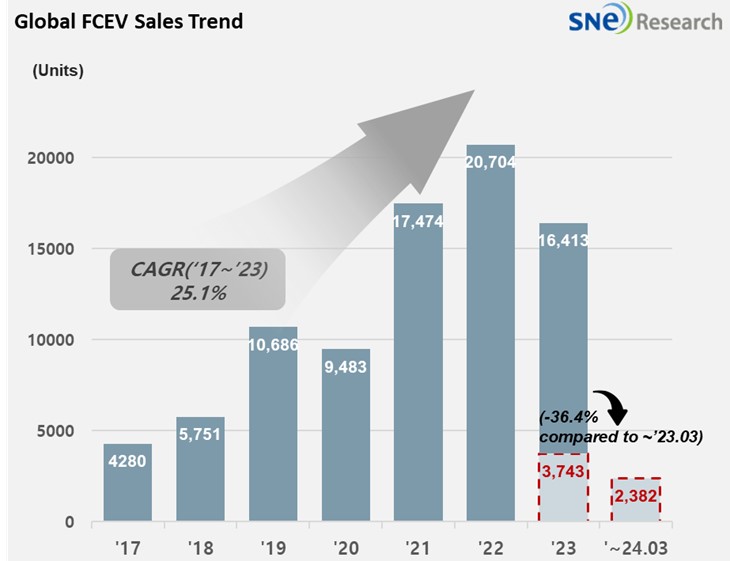

In Q1 2024, Global FCEV Market with a 36.4% YoY Degrowth

- In Korea market, Hyundai Motor Group saw the sale of NEXO plummet.

A total number of globally registered FCEVs sold in Q1 2024 was 2,382 units, recording a 36.4% YoY degrowth.

(Source: Global FCEV Monthly Tracker – April 2024, SNE Research)

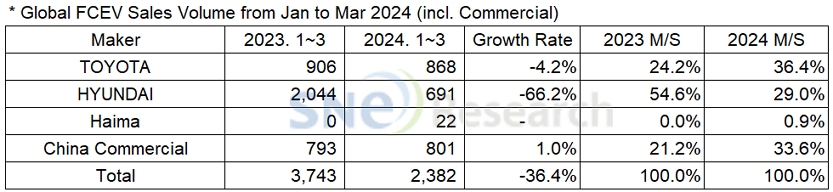

By company, Hyundai Motors sold 691 units of NEXO and ELEC CITY, posting a 66.2% decline from the same period of last year. Such a huge drop in the sales of Hyundai Motors was mainly caused by a plummeting sale of NEXO in the Korean domestic market. Toyota, selling 868 units of Mirai and Crown, posted a 4.2% YoY decline. Haima from China delivered a small quantity of Haima 7X-H, a hydrogen electric vehicle developed based on the existing MPV, Haima 7X. Other Chinese makers recorded a continuous sales revolving around the commercial vehicle market.

(Source: Global FCEV Monthly Tracker – April 2024, SNE Research)

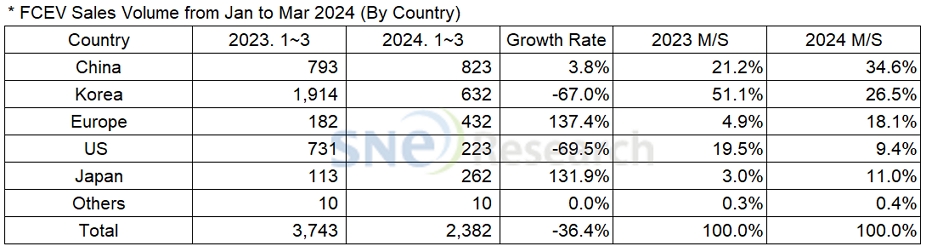

By country, due to the impact from sluggish sales of NEXO, Korea saw a huge drop in the FCEV market share, accounting for 26.5% of market share – a 67.0% decline from the same period of last year. China recorded a continuous growth centered on hydrogen commercial vehicles, taking the top position not only on the list of global EV market share but also the FCEV vehicle one. In Europe, 424 units of Toyota’s Mirai were sold, a 137.4% YoY increase. On the other hand, in the US, the sale of Mirai dropped significantly and recorded a 69.5% YoY decline. In Japan, 233 units of Toyota’s Crown, newly launched in the market last year, were sold, recording a 131.9% YoY increase.

(Source: Global FCEV Monthly Tracker – April 2024, SNE Research)

In 2023, the hydrogen vehicle market recorded a 30.2% degrowth, and such downward trend has aggravated this year, leading the market to drastically dwindle. In particular, the Korean domestic market, which has remained at the top of the list in terms of hydrogen market share, saw a continuous decline in sales after reaching the peak in 2022. The scale of entire market, in turn, has also diminished. NEXO, released in 2018 by Hyundai Motors, is the only option for consumers to choose in the Korean market, and the launch of a next-generation model by Hyundai has been continuously postponed. With the launch of next-generation FCEV model delayed, what makes the situation worse are; the shortage of hydrogen charging infrastructure, defective hydrogen incidents, the increasing charging cost of hydrogen car, and unsolved issues with durability of hydrogen vehicle fuel cell. All of these negative factors have made customers turn away from hydrogen vehicles in the green car market.