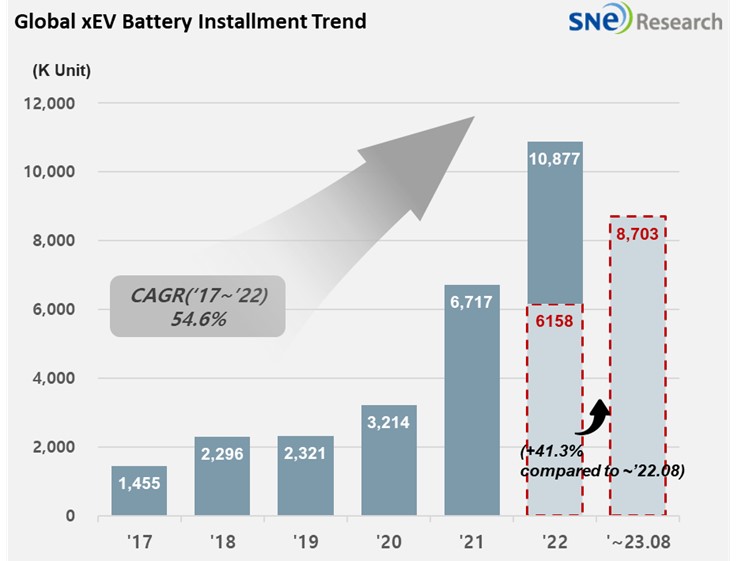

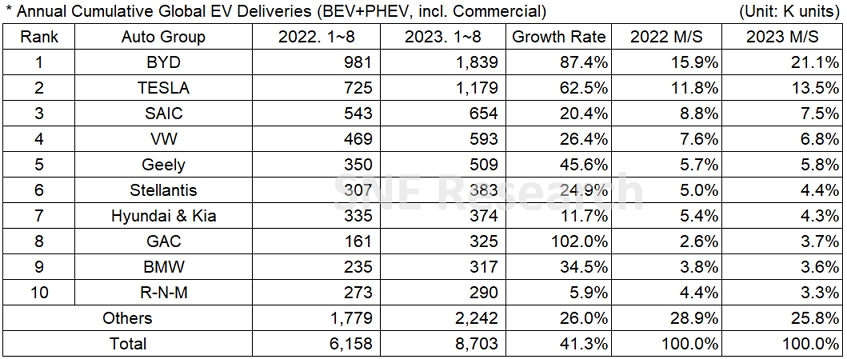

From Jan to August in 2023, Global[1] Electric Vehicle Deliveries[2] Posted 8.703 Mil Units, a 41.3% YoY Growth

- Combined M/S of Global No. 1 and 2, BYD and TESLA, Recorded 34.6%

From

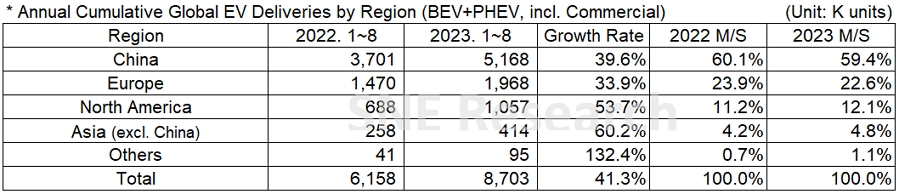

Jan to August in 2023, the total number of electric vehicles registered in

countries around the world was approximately 8.703 million units, a 41.3% YoY increase.

(Source: Global

EV and Battery Monthly Tracker – Sep 2023, SNE Research)

In the global EV sales by major OEMs from Jan to August in 2023, BYD, a leader in the Chinese EV market, recorded an 87.4% YoY growth, remaining on the top of the list. Its solid sales was mainly backed by continuous sales of Song, Yuan Plus(Atto3), Dolphin, and Qin in the Chinese domestic market. Among the top 10 OEMs, BYD is the only group who accounted for over 20.0% of the market share and has been gradually empowering its brand influence in the market. Tesla, following BYD and ranked 2nd on the list, posted a 62.5% YoY growth. Its major products – Model 3/Y – have continuously seen a favorable growth in sales, and particularly, Model Y has been sold more than twice compared to the same period of last year. Although there was a report that the Shanghai Gigafactory saw a 11% decline in sales in September, it is expected to reach the sales target of 1.8 million units by 2023 without difficulties.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period