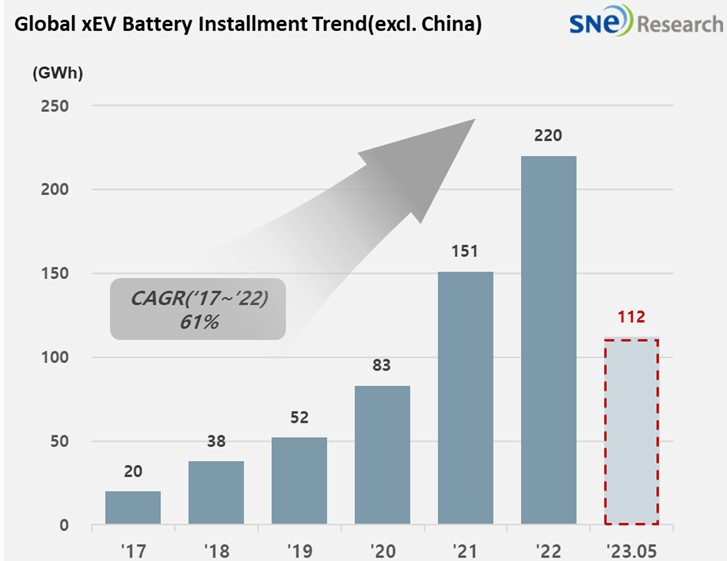

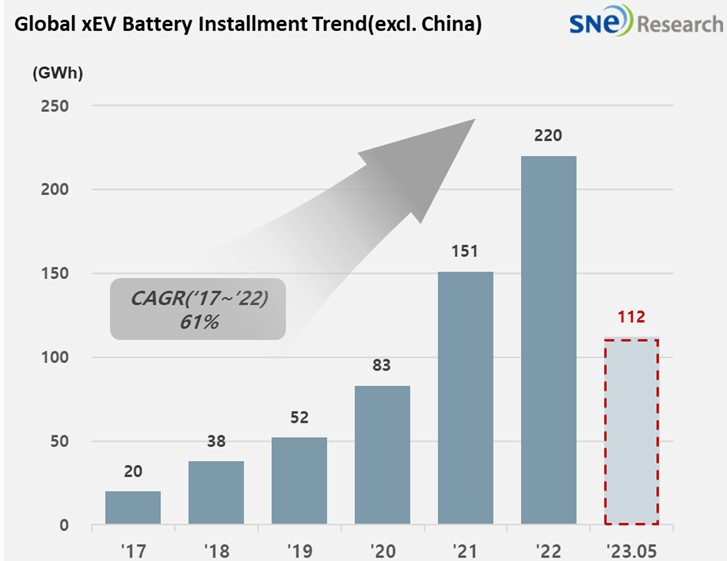

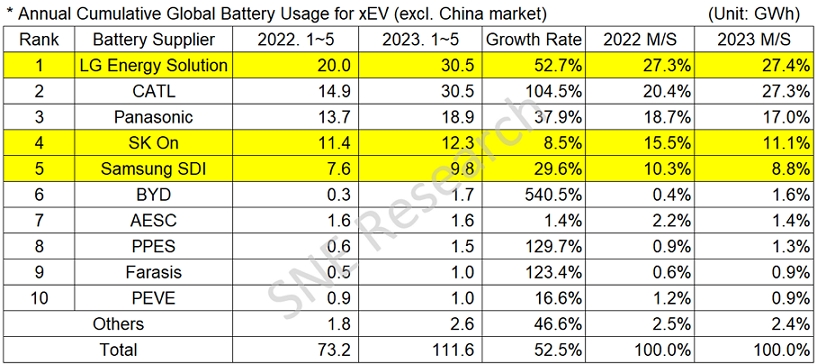

From Jan to May in 2023,

Non-Chinese Global

EV Battery Usage Posted 111.6GWh, a 52.5% YoY

Growth

- K-trio accounted for 47.3%

of the entire market, with LGES keeping No. 1 position

Battery

installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese

market sold from January to May 2023 was approximately 111.6GWh, a 52.5% YoY

growth.

(Source:

Global EV and Battery Monthly Tracker – June 2023,

SNE Research)

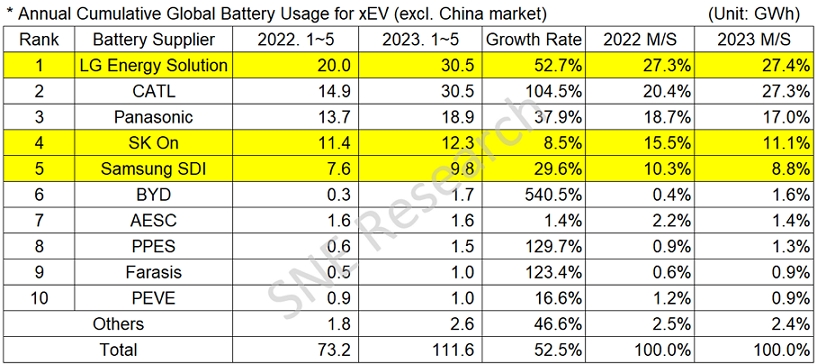

In the ranking of battery

usage for electric vehicles, the K-trio battery makers all entered the top 5 in

the ranking. LG Energy Solution kept the top position with a 52.7%(30.5GWh) YoY growth, while SK-On ranked 4th

with an 8.5%(12.3GWh) YoY growth and Samsung SDI ranked 5th

with a 29.6%(9.8GWh) YoY growth.

CATL closely followed LGES, recording a triple-digit growth rate of 104.5%(30.5GWh).

(Source: Global EV and Battery Monthly Tracker – June 2023, SNE Research)

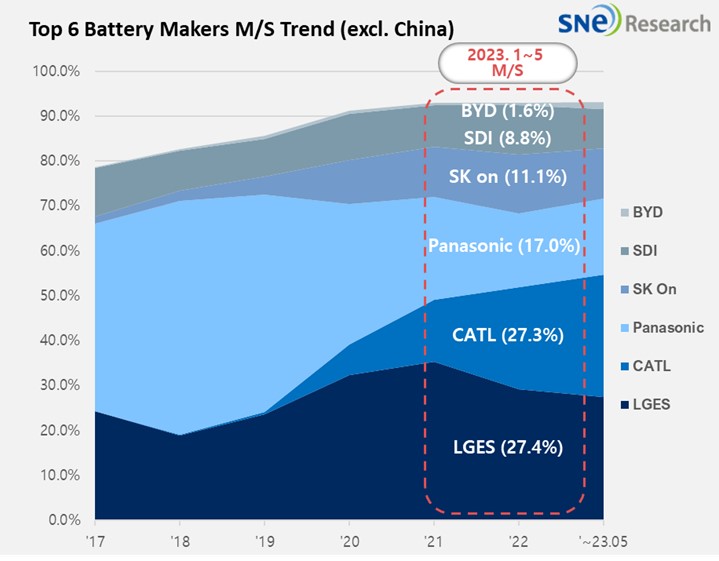

The combined

shares of K-trio recorded 47.3%, a 5.8%p decline from the same period of last

year. Their growth was mainly affected by strong

sales of electric vehicle models equipped with batteries of each company. LGES remained

in an upward trajectory based on the increasing sale of Tesla Model /Y, VW ID.

3/4, and Ford Mustang Mach-E. SK-On also saw a growth driven by the popularity

of Hyundai IONIQ 5/6 and KIA EV6 in the global market. Samsung SDI was also in

an upward trend thanks to the sale of Rivian’s pick-up truck R1T, BMW i4/X, and Fiat 500electric.

Panasonic

registered 18.9GWh of battery usage this year,

showing a 37.9% YoY

growth. As one of the major battery suppliers to Tesla, Panasonic saw such

double-digit growth thanks to the strong sale of Mazda CX-60 PHEV and Tesla

Model S/X/3/Y in the North American market.

Along

with CATL, some of the Chinese companies have boasted an explosive, triple-digit

growth even in the non-China market, gradually expanding their presence on the

global stage. CATL took the 2nd place in the non-China market due to

favorable sales of Tesla Model 3/Y

(made in China and exported to Europe, North America, and Asia), Volvo XC40 Recharge, Peugeot e-208,

KIA Niro, and MG-4. As it has been reported that CATL’s battery would be

installed to a new KONA model made by Hyundai, it is forecasted that CATL’s

share in the non-China market would further expand. BYD, showing the highest

growth among the top 10 companies, has drawn a great popularity in the Chinese

domestic market based on its

price competitiveness earned through vertical integration of SCM such as

in-house battery supply and vehicle manufacturing. Taking advantage of its

price competitiveness, targeting the Chinese domestic market, and product

quality, BYD is expected to see a rapid increase in its share in the markets of

Europe and Asia.

(Source: Global EV and Battery Monthly Tracker – June 2023, SNE Research)

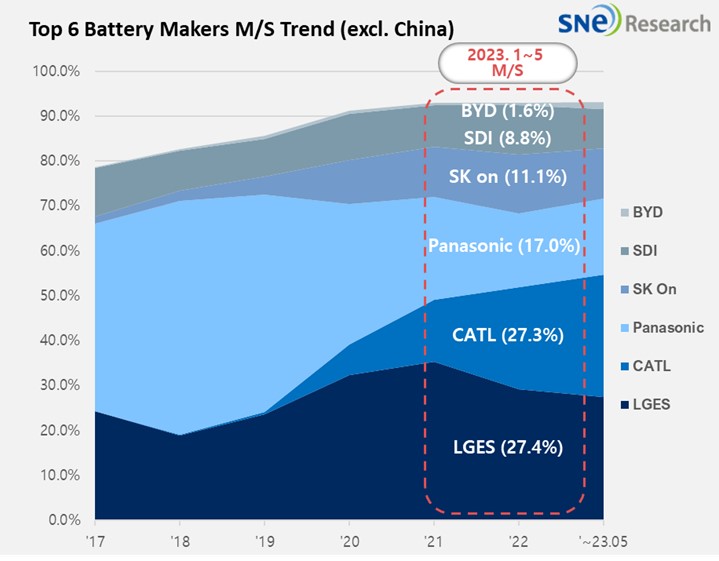

Although LGES has kept the No.1 position in

the non-China market in 2022 and the following year as well, CATL driven by

continuous high growth has become a continuous threat to LGES. The Chinese

companies are expected to start to target overseas markets by reducing their

product prices and go beyond the Chinese domestic one where excessive supply

has been already witnessed. The low-price competition initiated from Tela has

led OEMs to launch so-called price differentiation strategies. Under the

circumstances, the Chinese makers seem to take LFP battery as their key strategic

tool to target the overseas market. Specifically in Europe where the usage of

LFP battery is low, there may be a change in the market shares of Chinese

makers.

Based

on battery installation for xEV registered during the relevant period.