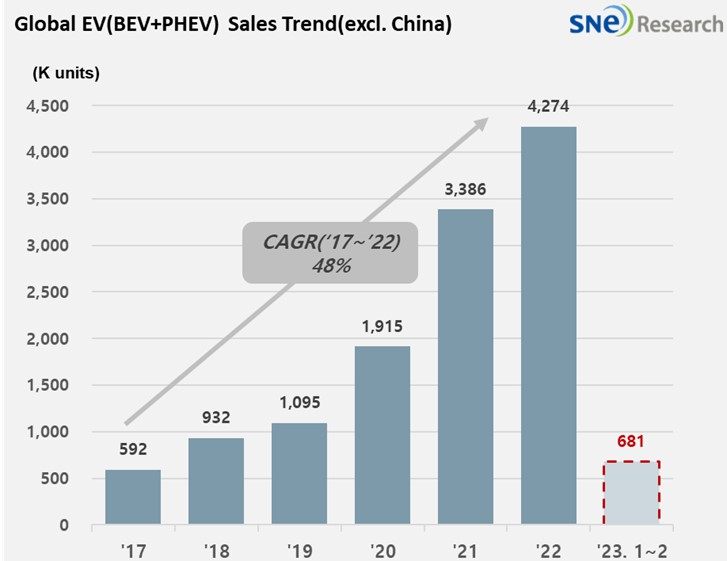

Non-China Global[1] Electric Vehicle Deliveries[2] from Jan to Feb 2023 Recorded 681,000 Units, a 33.2% YoY Growth

- Tesla far ahead of other players in

the non-China EV market, while Hyundai-KIA ranked 4th

The

total number of electric vehicles registered in countries around the world

except China from January to February 2023 was 681,000 units, posting 33.2% YoY

growth.

(Source: Global EV & Battery Monthly Tracker – March 2023, SNE Research)

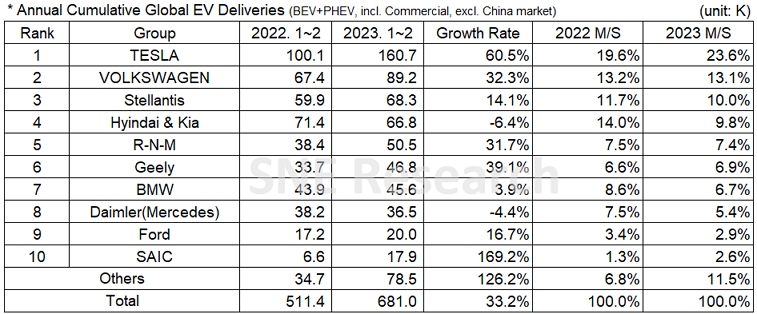

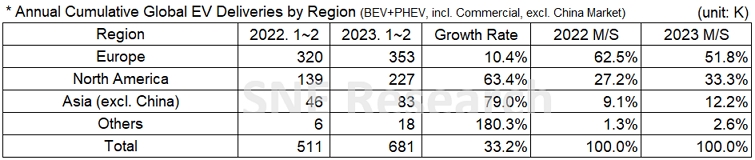

From Jan to Feb 2023, the sale of Tesla’s main models – Model 3 and Y – was a major driver behind the growth of Tesla who kept No.1 position with a 60.5% YoY growth. The Volkswagen group took the 2nd place, recording the growth of 32.3% compared to the same period of last year. The 3rd place on the list was taken by Stellantis group, where Peugeot, Jeep, and Fiat belong to, registering a 14.1% YoY growth. In particular, the favorable sale of Grand Cherokee 4xe and Wrangler 4xe by Jeep played a key role in achieving such a high growth during the period. Hyundai-KIA, who went down to the 5th place on the list last month, managed to recover to a level similar to that of last year and took the 4th place.

(Source: Global EV & Battery Monthly Tracker – March 2023, SNE Research)

Due to the reduction or termination of EV subsidy in Korea and Germany, Hyundai-KIA and the Daimler group were negatively affected and ended up recording a degrowth. SAIC Motor, which earned a high growth by successfully targeting the mini-EV market last year, posted a triple-digit growth again this month based on strong sales of MG-4, HS, and ZS in the UK and in Europe such as France and Germany.

(Source: Global EV & Battery Monthly Tracker – March 2023, SNE Research)

Except Tesla who seems to be invincible among the top 10 companies in the non-China market, most of other players saw their market shares maintained or declined. In addition, the market shares held by the top 10 companies increased by 4.7%p compared to the same period of last year, which was found to be influenced from strong sales of GM in North America and MAZDA and BYD in Asia (excl. China). In the non-China market, where China with a powerful domestic market is excluded, a so-called warlike period has just begun, drawing attentions to which auto groups in the top 10 would be able to secure their position in future.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.