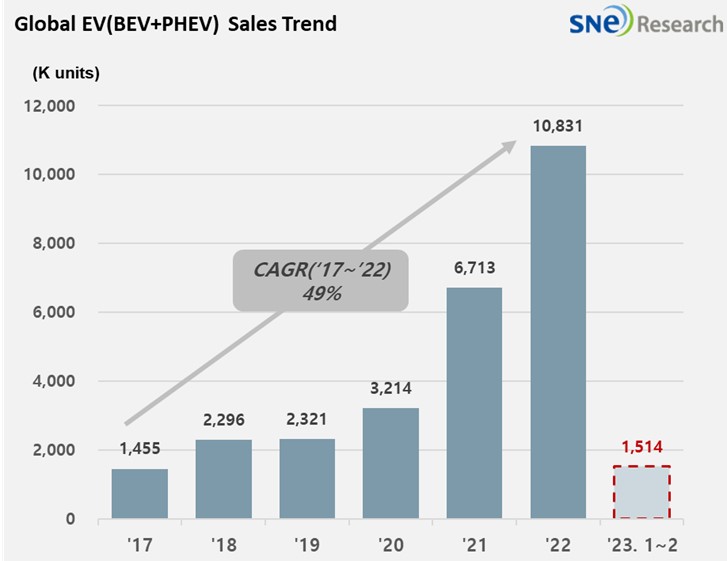

Global[1] Electric Vehicle Deliveries[2] Recorded 1.514 Mil Units from Jan to Feb 2023, a 25.6% YoY Growth

- While the EV market in China has been recovering in February, BYD ranked 1st and TESLA solidly maintained the 2nd position.

From

January to February 2023, the total number of electric vehicles registered in

countries around the world was approximately 1.514 million units, a 25.6% YoY

growth.

(Source: Global EV and Battery Monthly Tracker – March 2023, SNE Research)

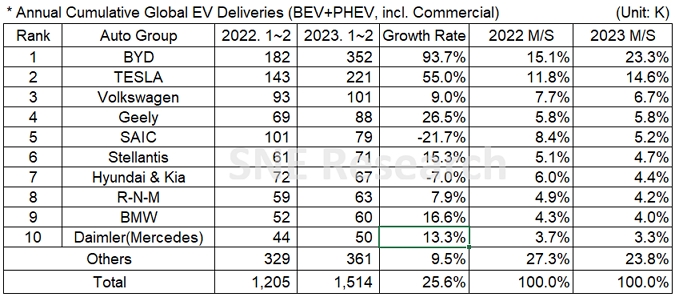

If we look at the EV sales from Jan to Feb 2023, BYD, who recorded over 200% of growth for two consecutive years, has successfully kept its explosive growth momentum. With a 93.7% YoY growth, BYD took No.1 position in the ranking. Tesla, who recorded a 55.0% growth, remained at the 2nd place as it was outpaced by BYD who is fully equipped with BEV and PHEV line-ups. Volkswagen, whose growth rate during the period was below the market average, managed to keep the 3rd place.

(Source: Global EV and Battery Monthly Tracker – March 2023, SNE Research)

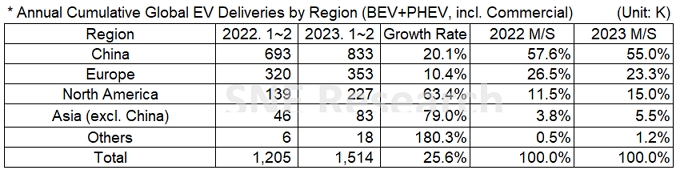

The Chinese market, which experienced a degrowth in Jan compared to the same period of last year, headed towards a recovery trend again, leading the growth of global EV market with BYD and Tesla at the forefront. Other auto groups, however, showed a growth rate below the market average. The North American and Asian regions posted a high growth of 63.4% and 79.0% respectively, while Europe only showed a growth of 10.4%.

(Source: Global EV and Battery Monthly Tracker – March 2023, SNE Research)

As various countries have decided to terminate or reduce subsidies for electric vehicles, it has become more important than ever for OEMs to find suitable price ranges and to achieve competitiveness in quality. In addition, with the US IRA and European CRMA implemented, the importance of vertical SCM integration has become greater than ever for OEM groups, too. While BYD and Tesla, who have been most active in building their in-house battery production capability, are currently leading the market in early 2023, it should be closely monitored how the entire EV market would respond to price competitions held between the two leaders.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.